Macroeconomic concerns rattle PSX

Investors expect worsening of economic cues, inflationary pressure

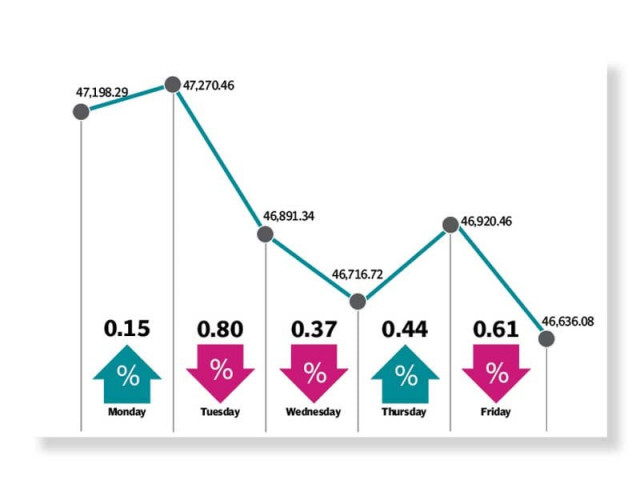

The Pakistan Stock Exchange (PSX) witnessed a jittery trading week as dismal data coupled with weakening of local currency dampened investor sentiments. Resultantly, the KSE-100 witnessed a roller coaster ride and closed the week at 46,636.08 points after a loss of 562 points or 1.2%.

“Market remained cautious over rising import bill and lack of clarity on the macroeconomic front,” said JS Global analyst Waqas Ghani. “International commodity prices continued to rise this week as well.”

Volatility shrouded the KSE-100 index on Monday, however, robust remittances data and clarity over the cantonment board election revived investor sentiment and bolstered the index in posting gains.

The next two sessions witnessed modest profit-taking primarily because rupee dropped to an all-time low level of Rs169.12 against the US dollar. The decline signalled a spike in inflation in future on account of increase in import payments and freight cost, which dimmed the spirits of market participants.

Besides, uncertainty over the new refinery policy, which attracted criticism from the Cabinet Committee on Energy, further contributed to the slide. Steep increase in petrol price of Rs5 per litre renewed fears of inflationary pressure and triggered sell-off at the bourse.

Temporary suspension of gas supply to general industries owing to maintenance work at the liquefied natural gas (LNG) terminal at Karachi port painted a gloomy image of the manufacturing sector and encouraged divestment at the stock market.

The market reversed its trend on Thursday after the State Bank of Pakistan seemingly intervened and arrested rupee depreciation and the large-scale manufacturing (LSM) sector reported steady growth.

The final session of the week saw the market dip once again on the back of dismal macroeconomic data. Figures released by the central bank showed nearly two-fold increase in current account deficit to $1.5 billion in August while the foreign direct investment experienced a 10% drop in August 2021 on a year-on-year basis.

Investors also booked profits ahead of the monetary policy announcement by the central bank on Monday to safeguard their holdings in case of a surprise change in the interest rate.

Read PSX may be reclassified to FM index

“Going forward, we expect the market to remain positive in the upcoming week attributable to talks with the International Monetary Fund for sixth tranche scheduled to begin at the end of the current month,” stated a report from Arif Habib Limited. “However, current macroeconomic concerns such as rising imports, higher inflation due to increasing petroleum prices and pressure on currency could deteriorate investors’ sentiment.”

Average daily traded volume contracted 7% week-on-week to 400 million shares while average daily traded value rose 3% week-on-week to settle at $90 million.

In terms of sectors, negative contributions was led by cement (287 points), refinery (55 points), oil and gas marketing companies (54 points), food and personal care products (51 points) and technology and communication (44 points).

On the flip side, sectors which contributed positively included commercial banks (130 points), tobacco (6 points) and synthetic and rayon (5 points).

Scrip-wise, negative contributors were Lucky Cement (131 points), Meezan Bank (102 points), Systems Limited (70 points), Maple Leaf Cement (43 points) and DG Khan Cement (41 points). Meanwhile, scrip-wise positive contribution came from UBL (73 points), HBL (56 points) and Fauji Fertiliser (50 points).

Foreigners offloaded stocks worth of $10.9 million compared to a net sell of $18.6 million last week. Major selling was witnessed in commercial banks ($12.7 million) and all other sectors ($2.2 million). On the local front, buying was reported by individuals ($16.8 million) followed by banks/ development finance institutions ($7.3 million).

Published in The Express Tribune, September 19th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ