PSX reports loss on FATF concerns

Index sees range-bound trading due to host of negative triggers

Bears maintained hold on the Pakistan Stock Exchange (PSX) in the outgoing week as a host of negative triggers, particularly concerns over the Financial Action Task Force (FATF) review of Pakistan, motivated investors to stay on the sidelines.

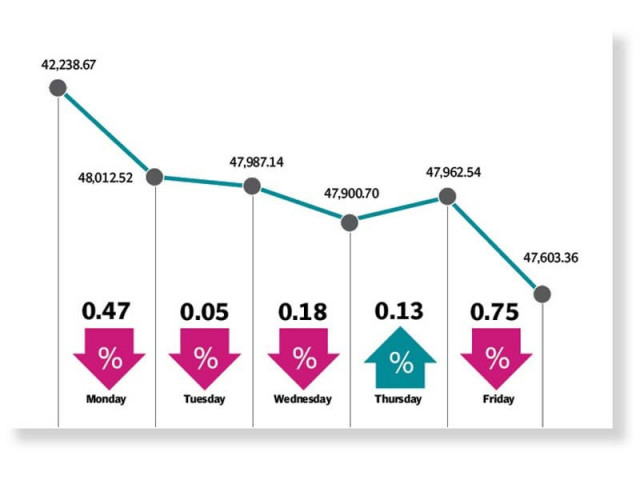

Resultantly, the KSE-100 index traded range-bound last week and closed at 47,603 level, having lost 635 points or 1.3%.

“On the economic front, talks between Pakistan and the International Monetary Fund (IMF) are still underway and both parties seem hopeful of reaching an agreement soon,” said JS Global analyst Ali Zaidi.

The KSE-100 dipped on Monday as market participants weighed sentiments on the start of the four-day FATF meeting. Uncertainty over the global watchdog’s review of the country marred trading throughout the week as investors assumed cautious stance and resorted to offload securities to safeguard their investments.

The market followed a downward trajectory during the first three days owing to across the board profit-taking by participants. Fuelling the drop further, persistent depreciation of rupee against the US dollar reignited inflationary concerns and dampened sentiments.

The bourse turned bullish on Thursday as market participants cherry-picked stocks at attractive valuations. A nation-wide strike by oil transporters and suspension of fuel supply to filling stations failed to dissuade investors and they assumed fresh positions.

MSCI dropped a surprise for Pakistan’s capital markets on the final day of the week after it proposed to downgrade Pakistan Stock Exchange (PSX) to its Frontier Markets Index in November 2021 from the Emerging Markets Index, which dented investors’ interest. This announcement, coupled with anxiety over FATF’s verdict and projected oil shortage, once again dragged the index to the red zone and it closed the week with a loss.

Concluding its review after closure of the market, the FATF on Friday retained Pakistan in the grey list and demanded implementation of a new six-point action plan.

“Going forward, we expect the market to depict a mixed to positive trend in the upcoming week attributable to FATF’s announcement to keep Pakistan on grey list and sectors that got major relief in the budget will remain in the limelight,” stated AHL Research in a report.

Average daily traded volume dropped 34% week-on-week to 694 million shares while average daily traded value declined 35% week-on-week to settle at $112 million.

In terms of sectors, negative contributions came from cements (212 points), commercial banks (178 points), oil and gas exploration companies (58 points), pharmaceuticals (53 points) and oil and gas marketing companies (51 points). Scrip-wise, negative contributors were Lucky Cement (118 points), TRG Pakistan (62 points), MCB (60 points), PSO (45 points) and HBL (44 points). On the flip side, major gainers were Systems Limited (67 points), FrieslandCampina Engro (43 points), Hubco (38 points), Azgard Nine (34 points) and Millat Tractors (21 points).

Foreign selling continued this week clocking-in at $7.88 million compared to a net sell of $6.76 million last week. Major selling was witnessed in all other sectors ($7.42 million) and commercial banks ($1.94 million). On the local front, buying was reported by individuals ($13.71 million) followed by banks ($12.86 million).

Among other major news of the week; government mulled tax relief to make cars up to 1,000cc affordable, SSGC suspended gas supply to non-export industries, steel units planned shutdown against FED removal plan and steel bar prices crossed Rs150,000 per tonne.

Published in The Express Tribune, June 27th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ