Current account gap at $632m

Deficit widens in May due to slowdown in remittances, drop in exports

Pakistan’s current account deficit - the gap between foreign expenditure and income - hit a 17-month high of $632 million in May 2021 mainly due to slowdown in workers’ remittances from overseas Pakistanis and a drop in export earnings compared to the previous month of April.

“Current account deficit rose to $632 million in May from $188 million in April as exports fell due to partial lockdowns (imposed during the third wave of Covid-19) and long Eid holidays, and remittances moderated as usual post-Eid,” said the central bank on Twitter.

The lofty deficit may trigger depreciation of the rupee against the US dollar and erode the country’s foreign currency reserves.

“The current account deficit is much higher than market expectations,” a leading analyst said on condition of anonymity while talking to The Express Tribune.

“We were expecting a deficit of around $300 million in the month (May 2021) with strong anticipation that the current account would end up with a moderate surplus in full fiscal year 2020-21.”

The high level of deficit in May has reduced the current account surplus to $153 million in the first 11 months (July-May) of the ongoing fiscal year compared to a surplus of around $750 million in the first 10 months.

To recall, the country had recorded a surplus in the current account balance for the first five months (Jul-Nov) of current fiscal year. However, it witnessed a deficit in the remaining six months (Dec-May).

The current account balance had stood in surplus at $329 million in May 2020, according to the State Bank of Pakistan (SBP).

The analyst said that May 2021 was the second consecutive month in which the import volume remained notably high at $5.95 billion. “High imports are unsustainable as the overall size of export earnings has remained less than half of the import volume,” he said.

“A higher inflow of workers’ remittances has enabled the country to pay for higher imports and repay foreign debt,” he said.

BMA Capital Executive Director Saad Hashmi, however, argued that the current account balance would improve during the last month of the outgoing fiscal year, ie June 2021.

“Remittances may once again show an uptick in June ahead of Eidul Azha (falling in the second half of July) as overseas Pakistanis traditionally send higher remittances ahead of Eid,” he said.

Secondly, export earnings should also pick up during June keeping in view the higher number of working days in the month compared to May, he said.

More importantly, non-resident Pakistanis were also sending additional remittances through the Roshan Digital Account (RDA). They sent over $1.3 billion in nine months since the RDA was launched in September 2020, he said.

The credit for the current account surplus in the first 11 months of FY21 should go to the RDA. This would extend much-needed support to keep the balance in surplus in the full fiscal year ending June 30, he said.

“Rough estimates suggest that the country will record a moderate current account deficit of $100-200 million in June with the uptick in remittances, acceleration in exports and stagnant imports,” he said.

“The current account will show a nominal surplus for the full year at the end of June.”

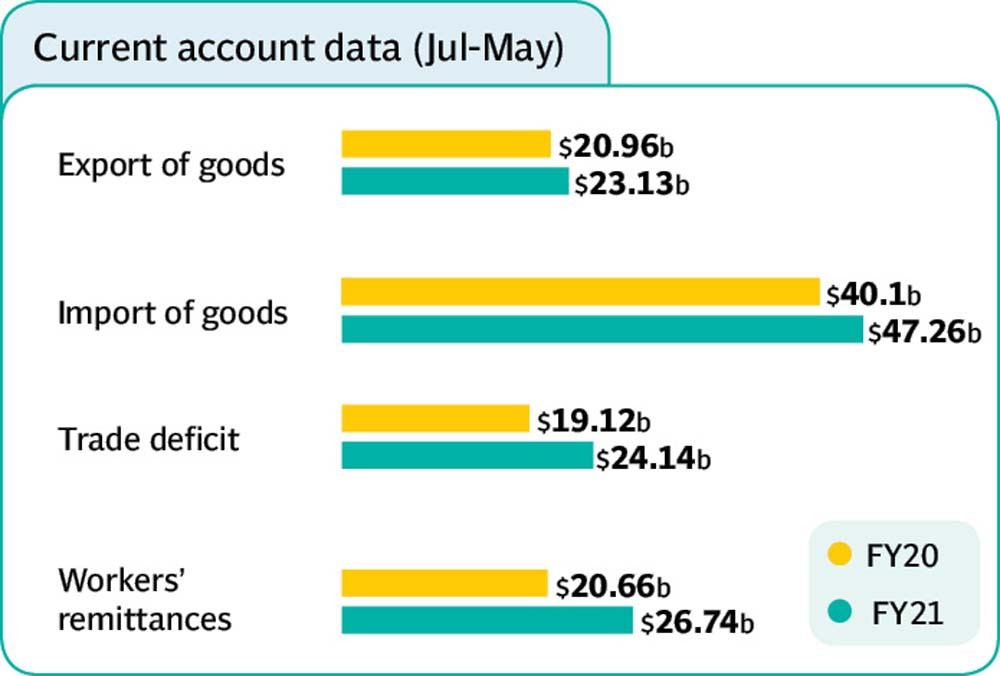

Cumulatively, in the first 11 months of FY21, workers’ remittances soared 29% to a record high of $26.73 billion compared to $20.65 billion in the same period of last year, according to the SBP.

Imports of goods surged 18% to $47.26 billion in the 11 months under review compared to $40.08 billion in the same period of previous year.

Exports of goods increased 10% to $23.12 billion in the 11-month period compared to $20.96 billion in the corresponding period of last year.

Imports of services, however, dropped 15% to $6.89 billion during July-May FY21 compared to $8.1 billion in the corresponding period of last year.

Imports of services remained low due to full or partial suspension of international travel including for religious purposes like Hajj and Umrah as people spent hefty amounts on international tourism.

The drop in imports of services supported the national economy to keep the current account in surplus in the first 11 months of ongoing fiscal year.

Besides, exports of services improved 6.4% to $5.38 billion in the 11 months under review compared to $5.06 billion in the same period of last year.

Published in The Express Tribune, June 26th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ