K-P presents 1.1tr ‘balanced budget’

Allocates a record Rs371 billion for annual development programme

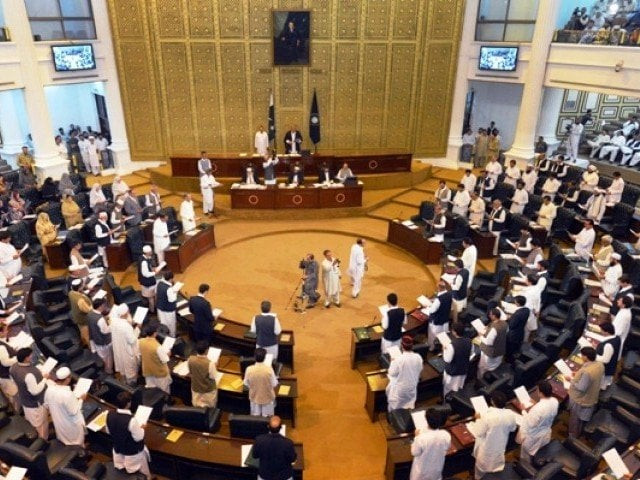

The PTI led Khyber Pakhtunkhwa (K-P) government on Friday presented Rs1,118.3 billion “balanced budget” for financial year 2021-22, with a record allocation of Rs371 billion for annual development programme (ADP) and Rs747.3 billion for current budget expenditures.

The KP government announced a record 37% increase in salaries of all those employees who do not take special allowances from government.

Presenting the budget in the K-P Assembly, Minister for Finance Taimur Salim Jhagra said out of the total budget allocations, Rs919 billion have been earmarked for the province’s settled districts and Rs199.3 billion for development of the tribal districts.

Out of total Rs371 billion ADP, the K-P government has earmarked Rs270.7 billion for settled districts and Rs100.3 billion for the tribal districts. Rs648.3 billion have been earmarked for the settled districts and Rs99 billion for the tribal districts for current budget expenditure.

He said the budget is based on five main pillars including a record increase in salaries of government employees, development budget, introduction of devoted services, increase in the K-P's own resource revenue and introduction of goal oriented reforms and innovation in the overall governance system.

He said two innovative approaches “development plus budget” and “service delivery budget” are being introduced under which the government will spent Rs500 billion on former focusing on mega projects like Sehat Plus Cards, provision of furniture to schools and increase in medicines budget for hospitals.

“Rs424 billion out of Rs747 billion would be spent on the latter with priorities to payment of salaries of doctors, nurses, and teachers besides provision of medicines to hospitals and fuels to Rescue1122 ambulances. “

The minister said Rs1,018 billion revenues and income target has been set for the fiscal year (FY) 2021-22 and that this target will be achieved from different financial resources, duties and taxes.

He said Rs475.6 billion would be collected through federal taxes; Rs57.2 billion through federal divisible pool of 1% share under terrorism affected province; Rs26.5 billion under gas and oil royalty and surcharge (direct transfer) and Rs74.7 billion under hydel new profit and arrears.

“Rs75billion would be collected from provincial tax and non-tax revenue, Rs85.8 billion through foreign development assistance (for settled areas) and Rs3.3 billion foreign development assistance (for tribal districts), Rs187.7billion under special assistance grant for the tribal districts and Rs132.5billion from other revenue resources.”

Read: PTI lawmakers trade barbs over strategy for budget passage

The minister said a total of Rs374 billion would be spent on salaries with Rs60billion in tribal districts and Rs314 billion in settled districts. Similarly Rs92.1 billion would be utilized for payment of pension including Rs0.1billion for tribal districts and Rs92billion for settled districts.

Besides salaries, Rs203.9billion would be spent for operation and maintenance expenditures, emergencies and district expenses.

Rs244.6billion have been allocated for expenditures under Provincial Development Programme including Integrated Implementation Programme (AIP) for tribal districts, he said.

Rs17.4billion have been allocated for the ADP including Rs2.4billion for tribal districts and Rs85.8billion for settled districts while a record Rs19.9billion will be obtained from federal government Public Sector Development Programme (PSDP).

The salaries of all government employees except those who didn't get special allowances are being increased to 37%. There is going to be a 20% increase in functional or sectorial allowance, 10% increase in ad-hoc relief allowance and 7% in house rent for employees who don't use official accommodation.

Jhagra said 100% increase in pension expenditure has been witnessed in the last couple of years and share of pensions, which was only 1% in 2003-04 has jumped to 13.8% of the total budget in 2021-22.

To overcome pension expenses, he said, two proposals are under consideration. “We may set the retirement age at 55 years or retire officials who have completed 25 years of service. This would help us save Rs12billion per year.”

Similarly, Rs1 billion per year would be saved from change in the pension rules under which a widow, children and parents of deceased employees would be entitled for pension benefits. The minister announced that minimum wages of labourers and daily wagers were being increased to Rs21,000.

The government has increased science and technology budget by 137%, allocating Rs2.5 billion with major projects including establishment of citizens facilitation centers, early age childhoods programme, and construction of model science laboratories and schools.

Similarly, Rs48.2 billion would be spent on construction of 3,000km roads including Peshawar-DI Khan motorway, Swat Motorway Phase II, Haripur Bypass and Peshawar-Torkham Motorway in FY2021-22.

Rs13.2 billion have been allocated for agriculture sector. Major projects include project for promotion of olive cultivation; establishment of trout fish villages in Malakand and Hazara divisions and Rs800 million for Prime Minister's Industrial Emergency Program.

The government has decided to revive Torkham Safari Train Service to promote tourism. Rs1billion have been earmarked for development and welfare of women with a project for revival of the Women Commission with allocation of Rs100million budget.

The money will also be used in establishment of a cadet college for girls in Mardan, allocation of 5% quota for women in SIDP “Akhowat” Programme and provision of interest-free loan to all register women entrepreneurs.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ