The government of Punjab has imposed no new taxes in the budget for next fiscal year 2021-22 and kept the number of taxed services unchanged at 73.

The entertainment industry, which includes cinemas and theaters, will be exempted from taxes in 2021-22, a step which can give a little bit breathing space to this industry.

Furthermore, economic managers have proposed a reduction in the tax rates applicable to 10 additional services from 16% to 5%. These services include beauty parlors, fashion designers, home chefs, architects, laundries, dry cleaners, supply of machinery, warehouses, dress designers and rental builders.

The tax relief measures announced by the provincial government for 25 services during the current fiscal year will continue in the next fiscal year as well.

While presenting the budget, the government of Punjab claimed that the tax relief measures undertaken by the provincial managers to combat the fallout of Covid-19 had boosted tax revenue of the province.

The provincial government collected a total of Rs359 billion in tax and non-tax revenues during the ongoing fiscal year, which was 13.1% higher than the original estimate of Rs317 billion, showed the budget document.

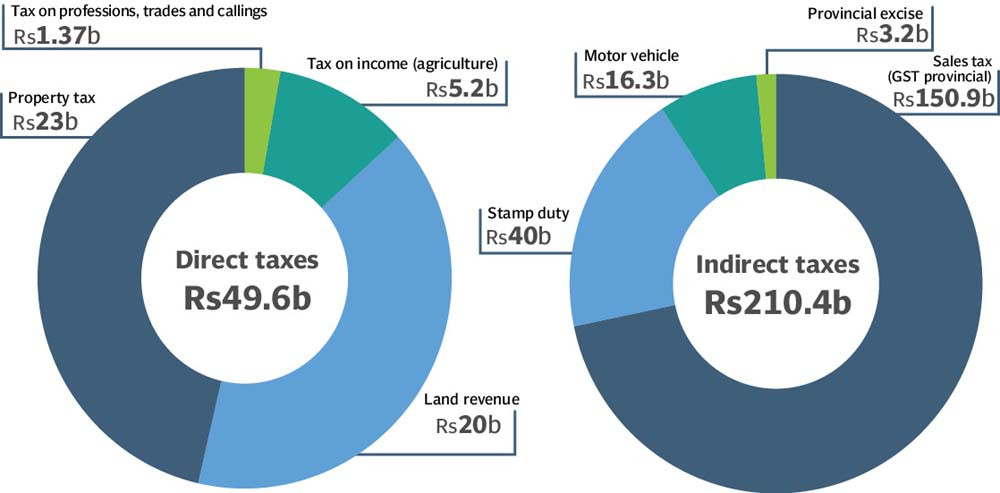

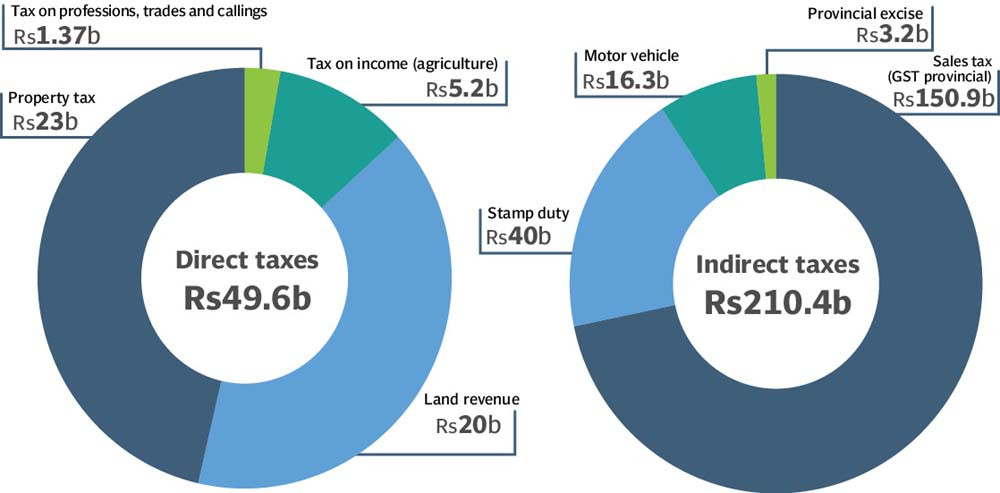

Giving the breakdown, the document revealed that Rs228.7 billion was collected on account of tax revenue while Rs129.91 billion was received under the head of non-tax revenue.

“The government of Punjab gave a tax relief package of Rs56 billion in fiscal year 2020-21 to steer ease of doing business,” said Punjab Finance Minister Makhdoom Hashim Jawan Bakht while delivering the budget speech on Monday.

“Next year, the leadership is offering a tax relief package of Rs51 billion with the hope that tax collection will increase further in fiscal year 2021-22.”

The provincial government increased the target of revenue collection by 28% to Rs405 billion for the next fiscal year against Rs317 billion for the ongoing fiscal year.

Out of the target for FY22, the province envisages to collect Rs272.6 billion under the head of tax revenue and Rs132 billion in non-tax revenue.

During the ongoing fiscal year, the provincial government received Rs1,354.17 billion released by Islamabad from the federal divisible pool. For the next fiscal year, Punjab expects to secure Rs1,683.69 billion from the same source.

The Punjab Revenue Authority (PRA) managed to collect Rs141.15 billion in 2020-21 while the provincial Board of Revenue registered collection of Rs56.2 billion, Excise Taxation and Narcotics Control Department reported revenue of Rs30.5 billion and transport and energy sectors showed earnings of Rs0.6 billion and Rs0.2 billion respectively.

For the next fiscal year, the government has targeted to collect Rs155.9 billion through the PRA, Rs65.95 billion through the Board of Revenue, Rs42.8 billion by the Excise Taxation and Narcotics Control Department, Rs0.7 billion and Rs7.25 billion by the transport and energy sectors respectively.

The Finance Bill 2021 proposed the withdrawal of relief granted in motor vehicles tax on old vehicles to discourage the use of such vehicles in a bid to keep pollution in check.

Similarly, it proposed a discounted rate of motor vehicle tax for electric vehicles to promote the purchase of such cars. The document showed that 50% waiver in registration and 75% discount in token fee was recommended by the authorities.

In case of e-payment of urban immovable property tax and motor vehicle tax, a discount of 5% has been proposed during the Covid-19 pandemic. Besides, surcharges and penalties for property tax and motor vehicle tax have also been rationalised.

In view of the proposal to assign the subject of entertainment duty to the PRA, the leadership will repeal the Punjab Entertainment Duty Act 1958 and amend the Punjab Sales Tax on Services Act 2012 for this purpose.

Furthermore, a penalty of Rs10,000 per invoice has been suggested for persons who charge tax at a rate higher than the rate provided under the 2012 Act.

The relief measures brought through the Finance Act 2020 in the shape of reduction in rates for various service sectors would continue and sales tax rates for 10 service sectors would be reduced to 5%, the bill stated.

“In view of the success of the proposal to charge sales tax at the reduced rate of 5% from restaurants, expansion of this segment by introducing payments through mobile wallets and QR scanning has also been proposed,” it said.

In order to ensure ease of doing business, a recommendation has been made to exempt all the goods from the Punjab Infrastructure Development Cess, which are exempted from federal duties and taxes on imports.

Currently, a taxpayer has to apply for exemption with the government of Punjab after obtaining exemption from the federal government.

Published in The Express Tribune, June 15h, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1731916090-0/sabrina-(3)1731916090-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ