PSX ends historic week in green

Posts record high volumes in two successive sessions on back of positive developments

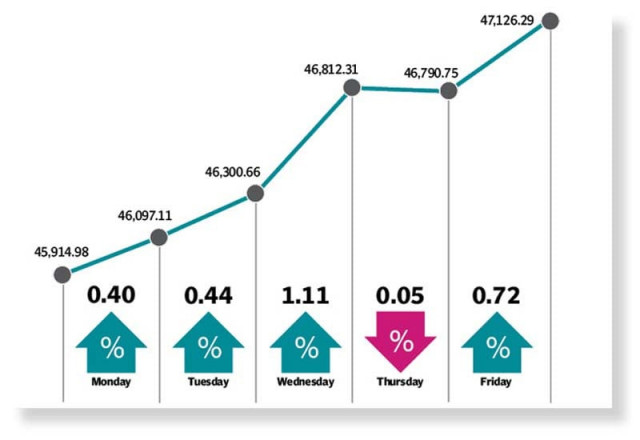

The Pakistan Stock Exchange made new records in what was a historic week as trading volumes hit all-time high levels in two successive sessions during the outgoing week. The overall bullish trend helped the KSE-100 post impressive gains of 1,211 points or 2.64% to close at 47,126.29 points.

Developments on the economic front fuelled optimism among investors who resorted to buying stocks in droves. Participants cheered the upward revision in projected growth rate for the ongoing fiscal year. In addition, the MSCI rebalancing and current account data also acted as a positive catalyst for the market

“The positive sentiment in the market may have been backed by expectations built around a growth-oriented FY22 federal budget, which is scheduled to be announced on June 11,” said JS Global analyst Ali Zaidi.

The week kicked positively and the KSE-100 index reported gains during the first three sessions primarily due to National Accounts Committee (NAC)’s provisional estimate of 3.94% economic growth during the current fiscal year, which gave a boost to investors’ spirits.

A contraction of $200 million in the current account surplus in April 2021 failed to break the upward momentum of the market as participants remained undeterred and assumed fresh positions.

Cumulatively, in the first 10 months (July-April) of current fiscal year 2020-21, the current account balance remained in surplus at $773 million compared to a deficit of $4.65 billion in the same period of last fiscal year.

On Wednesday, trading volumes soared to a historic high of 1.56 billion shares only to climb to a fresh peak in the following session with 2.2 billion trading volume. Despite a record breaking session, the stock market witnessed a decline on Thursday.

Monetary policy announcement weighed on investor’s mind throughout the week and they pinned hopes of a status quo in interest rate. Market expectations proved to be true as the central bank maintained policy rate at 7% on Friday.

The final session saw the market witness a turnaround and breach 47,000 points barrier after four years as improving macroeconomic cues revived confidence of market participants on the economy.

Market talk of a business-friendly budget announcement on June 11 kept the bullish momentum persisting for most part of the week. In addition, Finance Minister Shaukat Tarin’s prediction of 5% economic growth for the next fiscal year also kept investor interest alive.

“Going forward, we expect the market to remain bullish in the upcoming week amid expectation of relief in upcoming budget and reduction in duties on imported raw material for construction sector,” stated AHL report.

Average daily traded volume surged 103% week-on-week to 1.24 billion shares while average daily traded value increased 30% week-on-week to $178 million.

In terms of sectors, positive contributions came from commercial banks (456 points) oil and gas exploration companies (163 points), cement (131 points), technology and communication (120 points) and fertiliser (89 points).

Meanwhile, the sectors that contributed negatively included tobacco (26 points) and chemical (17 points).

Scrip-wise, positive contributors were HBL (174 points), Bank Al Falah (103 points), Pakistan Petroleum (101 points), Systems Limited (92 points), and Oil and Gas Development Company (82 points).

Foreign buying was witnessed this week arriving at $2.1 million against a net sell of $49.3 million last week. Buying was witnessed in cement ($23.9 million) and technology and communication ($9.2 million). On the domestic front, major selling was reported by individuals ($10.2 million) and mutual funds ($7.4 million).

Among other major news of the week; divestment of OGDC, PPL shelved over ‘low share price’, FDI dropped 32.5% to $1.55 billion in July-April FY21, current account posted $773 million surplus in 10MFY21, circular debt swelled Rs260 billion in 10 months.

Published in The Express Tribune, May 30th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ