KSE-100 dives 2.7% as Covid cases rise

Stocks battered as fears of lockdown and impact on economy intensify

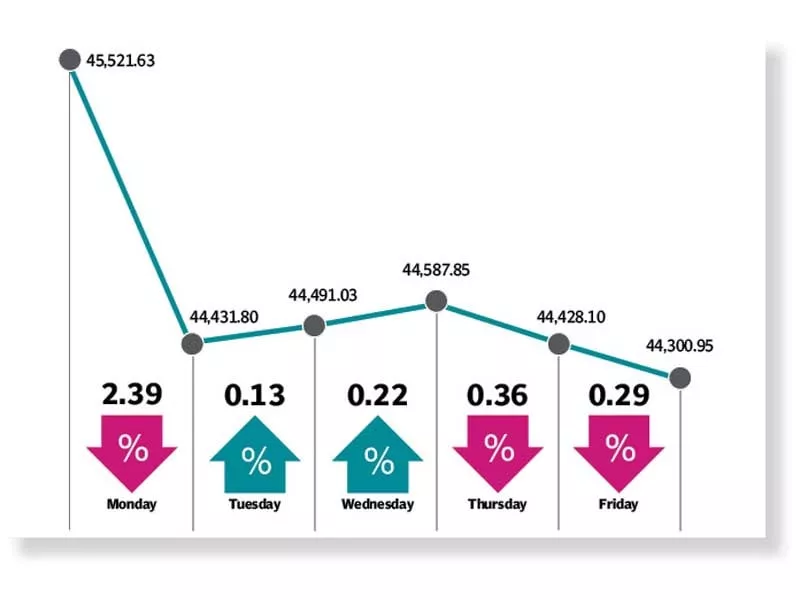

KARACHI:The euphoria of the past two weeks subsided as the Pakistan Stock Exchange felt the brunt of rising coronavirus infections across the country. The spike in Covid cases, coupled with developments on the political front mounted selling pressure, pushing the index 1,221 points or 2.7% in the red to end at 44,301 points.

Bears took control on Monday as the market plunged over 1,000 points on back of surging Covid-19 cases, particularly in Punjab, due to which the government also imposed a smart lockdown in various districts.

In addition to this, market players struggled to anticipate the impact of stringent measures being taken by the government in the wake of resumption of the International Monetary Fund (IMF) loan programme.

The tables turned in the following session as the benchmark KSE-100 index bounced back into green territory following major reshuffling in the cabinet. In a surprise move, the prime minister removed Abdul Hafeez Shaikh from the post of finance minister and appointed Hammad Azhar. Similarly, Tabish Gauhar was given the additional portfolio of Special Assistant to Prime Minister on Petroleum, which was previously held by Nadeem Babar.

Read: KSE-100 extends gains with 97-point rise

The somewhat positive momentum prevailed as the State Bank of Pakistan (SBP) confirmed receipt of third loan tranche worth nearly $500 million from the IMF.

Moreover, reports about Pakistan floating $2.5 billion worth of Eurobonds, coupled with encouraging news about resumption of trade with India also fostered optimism at the bourse on Wednesday.

However, the uptrend did not last and the remaining two sessions saw the index retreat into the red zone as cabinet’s refusal to resume trade with India dented sentiment.

In view of shortage of sugar and cotton, the Economic Coordination Committee on Wednesday gave the go-ahead to import the commodities from the neighbouring country. However, the cabinet did not endorse the summary.

In addition, rising Covid-19 cases across the country further dented investor spirits as fears of a nationwide lockdown mounted.

The downtrend continued on Friday as the ballooning trade deficit and soaring inflation weighed on investors’ sentiments.

Pakistan’s trade deficit widened almost 100% to $3 billion in March 2021 whereas the nine-month (Jul-Mar) trade deficit widened over $20.5 billion, according to figures released by Adviser to Prime Minister on Commerce Abdul Razak Dawood on Thursday.

Moreover, the Pakistan Bureau of Statistics (PBS) reported that inflation rose 9.1% in March - the highest pace in nine months.

“The market is expected to portray range-bound behaviour next week,” stated an Arif Habib Limited report. “While consolidating macroeconomic fundamentals led by strengthening rupee-dollar parity and building up of forex reserves pose upside risks, we highlight the ongoing third wave of Covid-19 to be a major risk to investors’ confidence.”

Average daily traded volume declined 18% week-on-week to 377 million shares while average daily traded value was down 16% week-on-week to $133 million.

In terms of sectors, negative contribution came from technology and communication (341 points), commercial banks (164 points), oil and gas exploration companies (147 points), cement (144 points) and power generation and distribution (117 points).

Read more: KSE-100 creeps up amid cabinet reshuffle

On the other hand, positive contribution was led by fertiliser (91 points) and automobile assembler (24 points).

Scrip-wise, negative contributors were TRG Pakistan (328 points), Hubco (71 points), Lucky Cement (61 points), Pakistan Petroleum (58 points) and Pakistan State Oil (51 points). Meanwhile, positive contributors included Engro Corporation (120 points), Fauji Cement Company (22 points) and Services Industries (20 points).

Foreigners remained sellers this week as they off-loaded shares worth $4.9 million compared to a net sell of $0.1 million last week. Selling was witnessed in technology and communication ($6 million) and power generation ($1.4 million). On the domestic front, major buying was reported by insurance companies ($6.8 million) and individuals ($5.4 million).

Among other major news of the week; petroleum product prices slashed up to 2.5%, banks were directed to apply reduced withholding tax on sugar imports, World Bank projected 1.3% growth for Pakistan by end-June, foreign exchange reserves held by SBP increased $378 million, Pakistani rupee emerged as the best-performing global currency over past three months and exports touched decade high of $2.3 billion during March 2021.

Published in The Express Tribune, April 4th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ