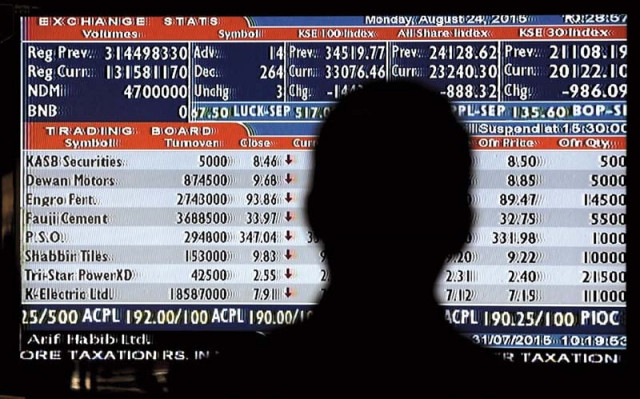

Market watch: KSE-100 extends gains with 97-point rise

Benchmark index advances 0.22% to settle at 44,587.85

The stock market extended gains on Wednesday on the back of a host of positive triggers and the benchmark KSE-100 index gained nearly 100 points.

Pakistan on Tuesday received the third loan tranche of nearly $500 million from the International Monetary Fund (IMF), which sparked positive momentum at the Pakistan Stock Exchange (PSX).

Moreover, reports about Pakistan floating $2.5 billion worth of Eurobonds to build its foreign currency reserves, coupled with encouraging news about resumption of trade with India, fostered optimism at the bourse.

Earlier, trading kicked off with a spike with the index surpassing the 45,000-point mark in first hour of the session.

However, gloomy scenario on the back of rising coronavirus cases and World Bank’s projection of Pakistan’s public debt surging to 94% of gross domestic product (GDP) in the current fiscal year shook investor confidence. The index dived by the end of the session.

At close, the benchmark KSE-100 index recorded an increase of 96.82 points, or 0.22%, to settle at 44,587.85 points.

Arif Habib Limited, in its report, stated that Pakistan’s launch of Eurobonds to raise funds from the international market was warmly greeted by the PSX.

Exploration and production, cement, oil and gas marketing and steel sectors performed well whereas refinery and tech sectors were volatile, where stocks hit the lower circuit after trading at high levels.

A hint of opening up trade with India also boosted investor confidence as among listed sectors cement was anticipated to be a key beneficiary of export to the neighbouring country.

Sectors contributing to the performance included fertiliser (+24 points), cement (+24 points), exploration and production (+22 points), banks (+19 points), technology (-35 points) and textile (-17 points).

Individually, stocks that contributed positively to the index included Engro (+31 points), UBL (+28 points), Pakistan Oilfields (+20 points), Systems Limited (+20 points) and Services Industries (+17 points).

Stocks that contributed negatively were TRG Pakistan (-52 points), HBL (-30 points), Colgate-Palmolive (-20 points), Hubco (-11 points) and Fauji Fertiliser Company (-10 points).

JS Global analyst Maaz Mulla said a rollercoaster ride continued at the PSX, where the index touched an intra-day high of +642 points. It closed the session at 44,588, up 97 points.

Total traded volume was recorded at 444 million shares where top contributors were Byco Petroleum (-1.6%), Pakistan Refinery (-1.3%), Unity Foods (-0.2%), TRG Pakistan (-3.1%) and Ghani Glass (+7.4%).

Steel and auto sectors gained ground on the back of recovery of Pakistani rupee against the US dollar.

Mughal Iron and Steel Industries (+4.7%), International Industries (+2.2%), Aisha Steel Mills (+2.5%), International Steels (+1.5%), Agha Steel Mills (+2.3%), Pak Suzuki Motor Company (+6.7%), Honda Atlas Cars (+2.7%), Indus Motor (-0.7%) and Ghandhara Industries (+3.5%) were the major movers.

Selling pressure was witnessed in refinery and tech stocks, among which Attock Refinery (-1.2%), National Refinery (-0.6%), Pakistan Refinery (-1.3%), NetSol (-7.5%) and TRG Pakistan (-3.1%) shed value.

“We expect the market to remain volatile amid increasing corona cases and recommend investors to book profit on the higher side and wait for any sharp dips to accumulate value stocks,” the analyst said.

Overall trading volumes rose to 443.9 million shares compared with Tuesday’s tally of 339.1 million. The value of shares traded during the day was Rs25.9 billion.

Shares of 403 companies were traded. At the end of the day, 244 stocks closed higher, 150 declined and 9 remained unchanged.

Byco Petroleum was the volume leader with 74 million shares, losing Rs0.17 to close at Rs10.46. It was followed by TRG Pakistan with 39.2 million shares, losing Rs4.8 to close at Rs150.21 and Pakistan Refinery with 31.2 million shares, losing Rs0.35 to close at Rs26.09.

Foreign institutional investors were net sellers of Rs428.9 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ