Current account deficit shrinks 75%

Current account deficit shrinks 75%

Pakistan’s current account deficit - the difference between the country’s foreign expenditures and income - stood at a nominal $50 million in February 2021, according to the central bank.

The deficit narrowed following a growth in foreign income rather than a reduction in expenditures. The income surged with the much-needed increase in export earnings while the inflow of worker remittances has already remained strong since June 2020.

The modest deficit paved the way for giving a boost to economic activities in the country. However, the worsening third wave of Covid-19 pandemic and a spike in prices of commodities, including food and energy, remained some of the immediate challenges.

The deficit was almost 75% lower in February 2021 compared to the same month of last year. It fell 76% compared to the previous month of January, the State Bank of Pakistan (SBP) reported on Sunday. February was the third consecutive month that recorded a deficit in the current account balance, which earlier stood in surplus for five successive months (Jul-Nov) of the current fiscal year.

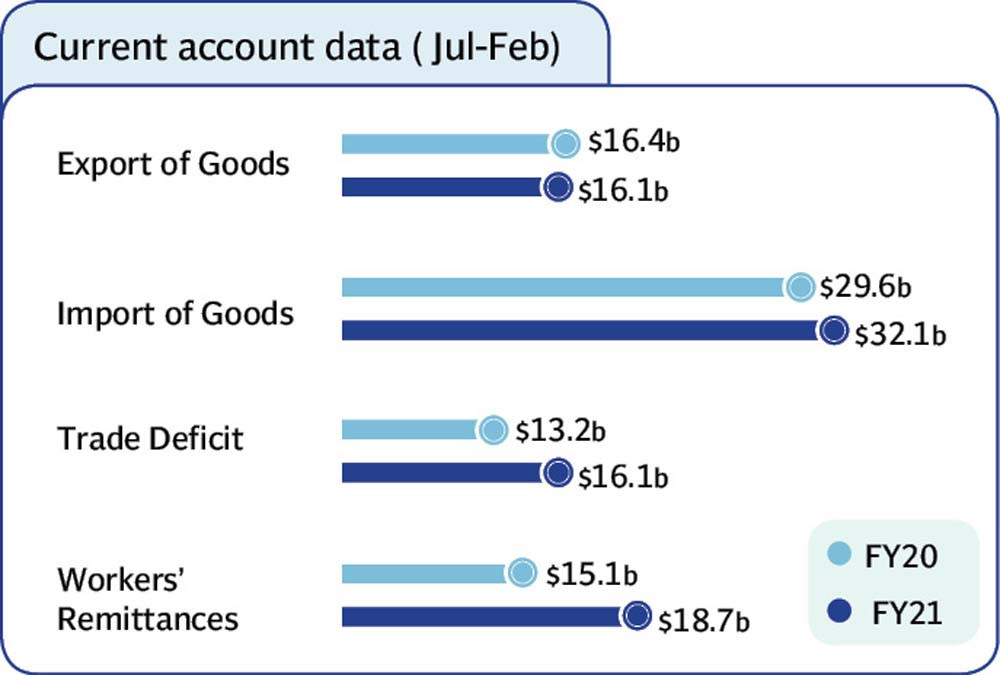

Cumulatively, in the first eight months (Jul-Feb) of FY21, the current account balance stood in surplus at $881 million compared to a deficit of $2.74 billion in the same period of last year.

Exports of goods grew almost 9% to $2.16 billion in February 2021 compared to $1.99 billion in the same month of last year. They improved 3% compared to the previous month of January 2021. The growth in exports and worker remittances encouraged industrialists to increase imports.

Earlier, the government had managed to restrict the current account deficit by making imports expensive to fix the faltering economy. Liberalising imports is a must to accelerate economic growth as the economy and exports both remain largely dependent on imported raw material.

The central bank said as the economy recovered, the trade deficit was widening somewhat on the back of imports of capital goods and industrial materials as well as food, together with rising international commodity prices.

“Nevertheless, the current account deficit in FY21 is expected to remain below 1% of GDP given the out-turn to date, continued strong prospects for remittances - which have remained above $2 billion for the last nine months - and the ongoing pickup in exports, especially high value-added textiles,” the SBP said last Friday (Mar 19).

Arif Habib Limited Head of Research Tahir Abbas said in a commentary that in addition to the increase in export of goods, the export of services also picked up significantly in February.

“It partly helped the current account deficit to improve in the month whereas the contribution of technology exports also played a pivotal role in improving services export in the first eight months of FY21, cumulatively.”

He said, “During February 2021, export of services was up 69%, which shows some significant improvement made by the country. During eight months of FY21, technology recorded exports of $1.29 billion, contributing 34% to the overall services export and marking a 41% year-on-year jump.”

Overall exports in the first eight months of FY21, however, dropped 2.27% to $16.07 billion compared to $16.44 billion in the same period of last year, according to the central bank.

JS Research analyst Ahmed Lakhani said that the main reason for the contraction in current account deficit was the reduction in outflow of primary income by $158 million to $230 million in February compared to $388 million in January. Simultaneously, there was some relief for the financial account, where there was no central bank repayment in February compared to $536 million in the preceding month, he added.

Import of goods increased 27% to $4.51 billion in February alone compared to $3.56 billion in the same month of the last year. The imports grew by almost 2% in the month compared to the previous month of January. Cumulatively during Jul-Feb FY21, imports surged almost 9% to $32.15 billion compared to $29.60 billion in the same period of the last year.

Meanwhile, workers’ remittances soared 24% to $18.74 billion in the eight-month period compared to $15.10 billion in the corresponding period of the previous year.

The strong growth in remittances inflow has remained the single largest source to the country’s foreign income this fiscal year so far. The inflows have eased making international payments mainly for imports and repayment of foreign debts.

The ongoing revival in international petroleum oil prices is seen risky for economic growth, as they carry the potential to increase energy import bill of Pakistan and slightly widen the current account deficit. At the same time, the growth in the international oil price remains a positive development for growth in workers’ remittances as majority (around 70%) of Pakistani expatriates are living in Middle Eastern oil exporting countries at present.

Published in The Express Tribune, March 23rd, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ