Current account deficit at $229m

Deficit came due to increase in food, industrial raw material imports

Pakistan recorded a current account deficit - higher foreign expenditures compared to income - for the second successive month in January at $229 million mainly due to increase in import of food items, industrial raw material and machinery.

The growth in imports - mainly of industrial goods and machinery - indicates expansion in businesses and growth in economic activities in the country as the economy largely depends on them. Receipt of higher remittances from overseas Pakistanis offset the impact of growth in import payments on the current account deficit.

The current account deficit was 55% lower in January compared to the same month of last year (January 2020) and 65% lower compared to the previous month of December 2020, the State Bank of Pakistan (SBP) reported on Monday.

Meanwhile, foreign direct investment (FDI) in different sectors of the economy like power and telecom, however, remained low at $192.7 million in January 2021 compared to $219.6 million in the same month of previous year.

Although FDI inflows stood low, they still contributed to narrowing the current account deficit in the month under review.

“The drop in current account deficit on a year-on-year basis and month-on-month basis in a growing economy is a welcome sign,” Pak-Kuwait Investment Company Head of Research Samiullah Tariq said while talking to The Express Tribune.

“The deficit of $229 million seems sustainable,” he said, hoping that the current account deficit would remain narrow in the range of $200-300 million per month in the remaining five months (February-June) of the current fiscal year.

The current account stood in surplus for a record five successive months (July-November) of current fiscal year. Accordingly, the overall current account remained in surplus during the seven-month (July-January) period despite the deficit in the past two months (December-January).

The current account remained in surplus at $912 million in the first seven months of fiscal year 2020-21 compared to a deficit of $2.54 billion in the same period of previous year, according to the central bank. The central bank has projected a current account deficit of 0.5-1.5% of gross domestic product (GDP) for FY21.

“Imports of wheat and sugar to address domestic shortages, and palm oil, were significantly higher,” the SBP said on its official Twitter handle in the backdrop of latest current account numbers. “Machinery imports continued to grow in double digits, reflecting economic recovery.”

Achieving a meaningful growth in exports, however, still remained a big challenge for economic managers. Growth in exports has remained moderate in the single month of January despite a notable depreciation of rupee against dollar and other major currencies of the world over the past two years coupled with incentives extended to export sectors - mainly textiles - by the incumbent government.

Growth in export earnings is a must to keep the current account deficit narrow or to turn it around into surplus in the longer-run.

The exports improved 2% to $2.09 billion in January 2021 compared to $2.05 billion in the same month of last year.

Cumulatively in the first seven months, the exports however slowed down almost 4% to $13.9 billion compared to $14.45 billion in the same period of last year. The drop in exports may be attributed to partial closure of the economies around the world under the recurring lockdowns imposed to confine Covid-19 pandemic.

The imports grew over 6% to $27.64 billion in the seven months compared to $26.04 billion in the same period last year. Workers’ remittances soared 24% to $16.48 billion in the period under review compared to $13.28 billion in the corresponding period of the last year.

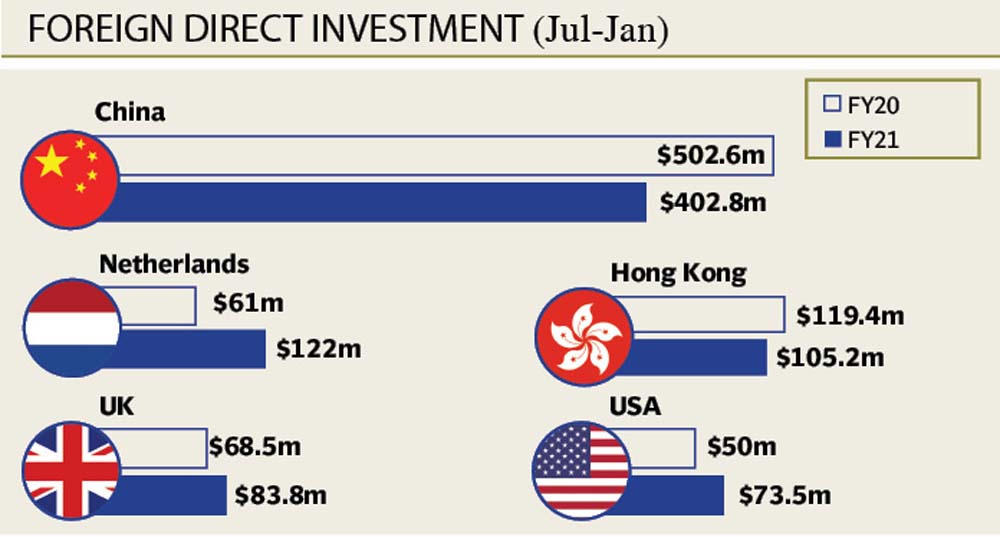

FDI slows down

The foreign direct investment (FDI) slowed down 27.4% to $1.14 billion in the seven month period (July-January) compared to $1.58 billion in the same period last year.

The slowdown in FDI may also be attributed to partial closure of the developed countries which invest in emerging economies around the world including Pakistan.

The foreign investment pattern in Pakistan suggests that they are just pouring capital into their ongoing projects like power, telecom, oil and gas exploration and financial businesses rather than initiating new projects due to uncertain global outlook under the Covid-19 pandemic.

“The pace of flow of FDI in Pakistan remained slow due to uncertain global outlook amid Covid-19 pandemic,” PKIC Head of Research Samiullah Tariq said adding that investors would initiate new projects in emerging economies after they come out of their own financial troubles.

Developed countries like UK and Germany have continued to report negative growth in their respective economies on a quarter on quarter basis since the outbreak of coronavirus in December 2019 in the mainland of China.

Published in The Express Tribune, February 23rd, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ