KSE-100 ends all sessions in red

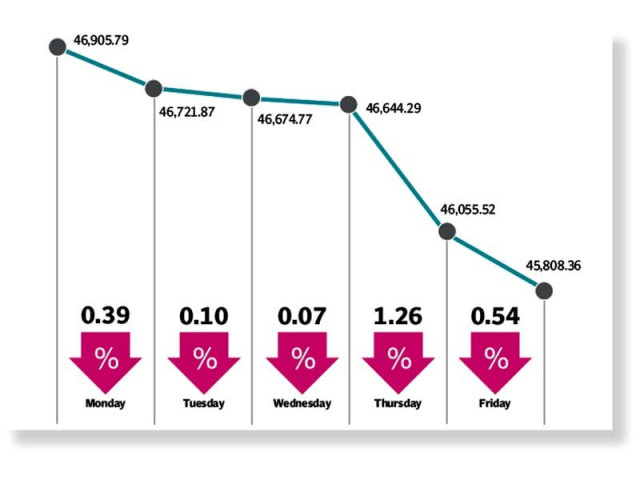

Benchmark index falls over 1,097 points as selling pressure persists

Bears dominated the Pakistan Stock Exchange during the outgoing week as the KSE-100 finished all sessions in the red owing to rampant selling pressure.

During the week, volumes shot up and the market witnessed the largest ever single-day volume of 1,125 million shares.

“The market finally underwent a much-awaited correction during the week, shedding 1,097 points to close at 45,808 levels,” said JS Global analyst Ahmed Lakhani.

Trading on Monday kicked off with a dip and investors paid no heed to the agreement between the government and independent power producers (IPPs) regarding electricity tariff and resorted to offload their holdings. In addition, absence of positive triggers to provide a direction to the market sparked volatility, which continued till the end of the week.

The market seemed to shrug off prevalent pessimism during the next two trading sessions as the downward trajectory flattened, however, political tensions weighed on investors mind and the index closed slightly lower.

Things fared no better during the remaining sessions and the index fell over 800 points on back of aggressive selling by investors who assumed cautious positions in wait for positive developments.

Exploration and production sector had remained under the limelight during the week on back of a rally in international oil market. However, the uptrend was corrected in the final sessions after investors shifted interest from oil sector scrips.

While most of the corporate results announced during the week were encouraging, they failed to turn the tide of the market towards the green zone.

“We expect the market to turn positive in the coming week given healthy earnings expectations in the ongoing result season,” stated a report from Arif Habib Limited.

Average daily traded volume spiked 32% week-on-week to 734 million shares while average traded value came in at $169 million, down 1.5% on a week-on-week basis.

In terms of sectors, negative contributions came from commercial banks (448 points), fertiliser (267 points), oil and gas exploration companies (175 points) and power generation and distribution (113 points).

On the flip side, positively contribution was led by cements (318 points), technology and communication (16 points) and refinery (16 points).

Scrip-wise, negative contributors were UBL (105 points), HBL (100 points), and Engro (99 points) while positive contributors included Lucky Cement (144 points), DG Khan Cement (63 points), and Kohat Cement (36 points).

Foreign selling continued this week clocking-in at $3.2 million compared to a net sell of $2.7 million last week. Selling was witnessed in commercial banks ($4.3 million) and exploration and production ($0.4 million). On the domestic front, major buying was reported by individuals ($12.7 million) and companies ($8.4 million).

Among other major news of the week was; bank deposits surged 16% in January, car sales jumped 44% to 14,543 units in Jan, Ogra allowed SNGPL to raise average price of gas and income tax on debt profit through Roshan Digital Accounts was waived.

Published in The Express Tribune, February 14th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ