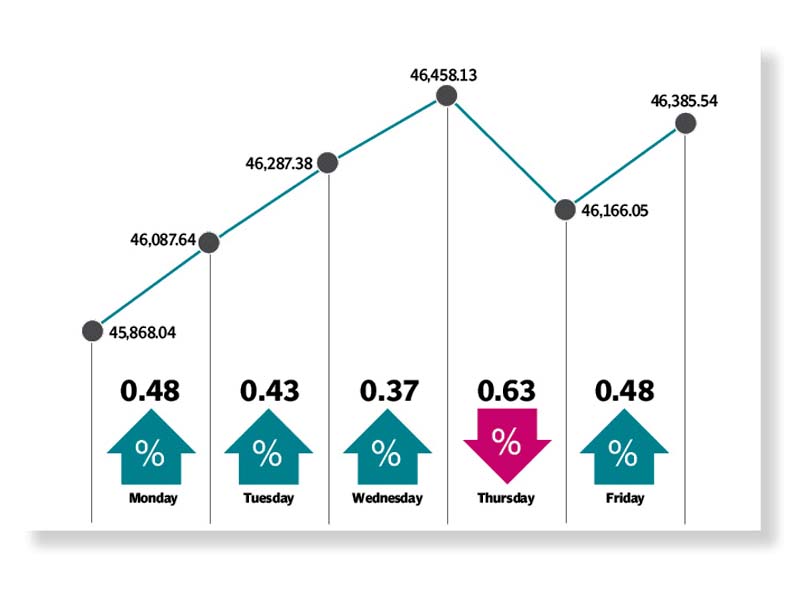

Bulls staged a comeback at the Pakistan Stock Exchange (PSX) following a week of bearish trade as the KSE-100 powered past the 46,000-point mark. The index posted gains of 518 points or 1.1% in the outgoing week to settle at 46,385.54 points.

Interest in all-season sector stocks kept the market buoyant as investor participation remained strong. The index maintained an upward momentum on the back of status quo in monetary policy and impressive earnings season. Additionally, sector-specific developments also spurred buying interest in select stocks, which further fuelled the rally. The market finished four out of the five sessions in green.

The Pakistan Stock Exchange - second best performing regional market - opened on an upbeat note with investors welcoming the decision taken by the State Bank of Pakistan (SBP) to leave the benchmark interest rate unchanged at 7% for the next two months.

Moreover, comments from SBP Governor Reza Baqir, which signalled that the policy rate may remain at the same level in the next monetary policy announcement, in March, also helped the index shoot past the 46,000-point mark on Monday. Rising oil prices in the international market coupled with expectations of better financial results in different sectors aided the optimistic outlook.

In addition, the economic growth forecast of 1.5% for Pakistan in the ongoing fiscal year by the International Monetary Fund (IMF) in its World Economic Outlook Update 2021, released on Tuesday, also impacted activity at the bourse.

After posting gains for three successive sessions, the stock market reversed its trend on Thursday as investor optimism faded and the index retreated to the red zone. A continued rally over the past few sessions encouraged investors to offload their stockholdings, consequently, index-heavy oil, automobile and fertiliser sectors succumbed to selling pressure and closed with substantial losses. Fortunately, the tables turned and the index rallied in the last trading session of the roll-over week. Participants shed their nervousness over encouraging financial results. This provided much-needed clarity and helped the bourse trade in the green zone.

Read: KSE-100 ends week on positive note

The overall improved sentiment was seen due to an uptick in international crude prices in earlier part of the week as well as hike in cement prices in the north, which kept sectors like exploration and production, oil marketing companies and cements under the limelight.

“We expect the market to remain in the green amid the ongoing result season, whereby corporate profitability appears strong,” said a report by AHL. “In addition, improved liquidity in the market (translating in augmented volumes/value), will also keep the index trajectory positive.”

Activity crawled up as average daily traded volume increased 33% week-on-week to 674 million shares while value traded clocked-in at $169 million, up 44% on a weekly basis.

In terms of sectors, positive contributions came from cement (326 points), technology and communication (201 points), pharmaceuticals (70 points) and power generation and distribution (60 points). On the flip side, commercial banks (166 points), oil and gas exploration companies (81 points) and fertiliser (54 points) contributed negatively.

Scrip-wise, major gainers included TRG Pakistan (216 points), Lucky Cement (84 points) and Fauji Cement Company (59 points).

Foreigners remained net sellers of $9.1 million compared to a net buy of $5.5 million last week. Selling was witnessed in commercial banks ($2.7 million) and technology ($2.6 million). On the domestic front, major buying was reported by individuals ($8.7 million and companies ($8.1 million).

Among other major news of the week was; Pakistan dropped four spots to 124 in corruption index, Asian Development Bank approved five year loan programme worth $10 billion for Pakistan, government and Independent Power Producers inked initial agreement and Pakistan received the Geographical Indication (GI) tag for its Basmati rice.

Published in The Express Tribune, January 31st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732519298-0/BeFunky-collage-(85)1732519298-0-165x106.webp)

1732611352-0/lamar-(5)1732611352-0-165x106.webp)

1732610018-0/BeFunky-collage-(91)1732610018-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ