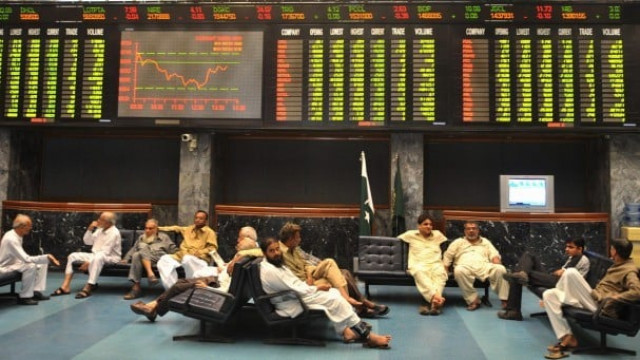

Market watch: Stocks breach 46,000-point mark

Benchmark KSE-100 index advances 169.92 points to settle at 46,091.96

It was a remarkable day for the Pakistan Stock Exchange (PSX) on Wednesday as the market, taking cue from bullish momentum in the previous session, advanced nearly 170 points and rose past the 46,000 mark after a hiatus of more than two and a half years.

The uptrend was driven by upbeat large industries’ output data released by the Pakistan Bureau of Statistics on Tuesday. The large-scale manufacturing (LSM) output grew 7.4% in the first five months of current fiscal year on the back of a sustained growth momentum for the third successive month.

Investors also rejoiced at the news of Moody’s ratings agency maintaining a stable outlook on Pakistan’s banking sector, which led bank stocks to perform better.

Moreover, steady crude oil prices in the international market, coupled with other positive macros, further strengthened investors’ sentiment.

The benchmark KSE-100 index started rising from the moment trading began and managed to power past the 46,000-point mark in the first hour of trading. Some gains were erased after midday, nevertheless, positive triggers helped the index close with modest gains.

At close, the KSE-100 index recorded an increase of 169.92 points, or 0.37%, to settle at 46,091.96 points.

Arif Habib Limited, in its report, stated that the market continued its uptrend from the previous session and added another 392 points during the day. Cement, exploration and production, and bank stocks contributed to the increase in the index.

“International crude prices supported the positive stance in the exploration and production sector, which was primarily on account of a consistent drawdown on the global floating storage of crude products,” it said.

On the other hand, the cement sector performed better due to anticipation of better corporate results for the just-ended quarter.

Towards the end of the session, Moody’s issued a positive statement related to Pakistan’s banks, which helped the banking sector fare relatively well.

Volumes increased from 825.8 million shares to 845.3 million shares (+2% day-on-day). Traded value increased 27% to $167.5 million against $131.8 million.

Sectors contributing to the performance included technology (+79 points), cement (+74 points), textile (+49 points), banking (+43 points) and engineering (+24 points).

Individually, stocks that contributed positively to the index included Systems Limited (+50 points), TRG Pakistan (+28 points), Pioneer Cement (+21 points), HBL (+21 points) and International Industries (+20 points).

Stocks that contributed negatively were UBL (-25 points), Pakistan Tobacco Company (-17 points), Dawood Hercules (-16 points), Millat Tractors (-16 points) and K-Electric (-15 points).

JS Global analyst Danish Ladhani said the KSE-100 stayed in the green all day, touching intraday high of +392 points and closing at 46,092, up 170 points.

Total traded volume was recorded at 845 million shares with major contribution coming from K-Electric (-5.1%), Pakistan International Bulk Terminal (+3.1%), Power Cement (+7%), Hum Network (-5.6%) and Fauji Foods (+4.4%).

Moreover, oil prices rose in the international market as crude stocks fell more than expected. Resultantly, Oil and Gas Development Company (+0.2%) and Pakistan Oilfields (+0.5%) remained in the green.

“According to reports, Byco Petroleum (+0.1%) has begun work on upgrading its plant to ensure environmental compliance,” he added. “During the session, it contributed 3% to the total traded volume with 24 million shares.”

The banking sector, however, remained eye catching where MCB (+1%), HBL (+0.8%), Bank AL Habib (+1.2%), NBP (+1.8%) and Askari Bank (+0.9%) closed in the positive zone.

“Moving forward, we recommend investors to see any downside opportunity to buy stocks,” the analyst said.

Overall, trading volumes surged to 845.3 million shares compared with Tuesday’s tally of 825.9 million. The value of shares traded during the day was Rs26.9 billion.

Shares of 437 companies were traded. At the end of the day, 237 stocks closed higher, 183 declined and 17 remained unchanged.

K-Electric was the volume leader with 110.6 million shares, losing Rs0.23 to close at Rs4.27. It was followed by Pakistan International Bulk Terminal with 79.6 million shares, gaining Rs0.4 to close at Rs13.18 and Power Cement with 45.1 million shares, gaining Rs0.81 to close at Rs11.03.

Foreign institutional investors were net sellers of Rs747.7 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ