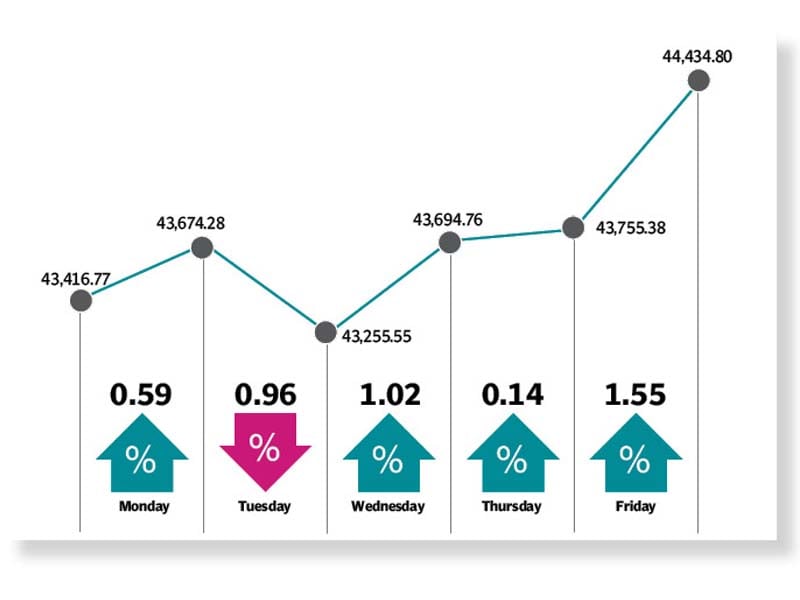

The stock market resumed its upward drive, following a brief correction in the previous week as the benchmark KSE-100 index shot up by 1,018 points or 2.34% and surpassed the 44,000-point barrier during the week ended January 1.

The week started off slowly with the performance remaining sombre for the first two trading sessions. However, things changed with the turn of the year and the KSE-100 index jumped nearly 1,000 points during intra-day trading in the last session of the week to close at 44,343.80. Investor sentiment saw an improvement on the first trading session of 2021 following improvements in the country’s macroeconomic conditions and upbeat economic data, which aided the index in its bullish momentum.

The KSE-100 index inched upwards on Monday on back of a bullish spell in global equity markets coupled with rising international oil prices. Unfortunately, the discovery of three cases of the new variant of coronavirus in Pakistan recently detected in the United Kingdom, among returnees from the European nation on Tuesday dented investors’ sentiment and failed to prevent a downturn as the benchmark KSE-100 index fell 392 points.

In a dramatic turnaround, the following three sessions witnessed an impressive rally as the investors pinned hopes on the new year and welcomed 2021 in high spirits. On Wednesday, a bull-run managed to erase all losses from the previous day’s selloff as interest was revived over anticipation of policy announcements for textile manufacturers, banks and oil and gas marketing companies.

The final trading session of 2020 - Thursday - despite being marred by volatile activity maintained the positive momentum and the index closed the year with a slim gain of 61 points. The uptrend was supported by Prime Minister Imran Khan’s announcement of extension in the fixed tax regime and for the disclosure of source of income by investors along with further incentives for the construction sector on Thursday. The statement triggered a rally in cement and steel sectors and helped major stocks of the two sectors closed in the green.

In an encouraging development during the week, inflation figures for December 2020 clocked-in at 8%, highlighting a slowdown in the pace of inflation. Further impetus was provided by news of a meeting held between government officials and independent power producers (IPPs) where the former offered a package to the IPPs for clearing circular debt worth Rs450 billion. This coupled with reports of growing exports, lent further support to the bullish momentum.

According to a tweet from Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood, exports grew 18.3% to $2.357 billion in December 2020 as compared to $1.993 billion in December 2019.

That said, investor participation improved as average daily volumes rose 4% to 528 million shares, while average daily traded value was up 3% to $142 million.

In terms of sectors, contribution to the upside was led by banks (342 points), fertilisers (231 points), and oil and gas exploration (202 points). On the flip side power generation and distribution declined 37 points.

Stock-wise, major gainers were Oil and Gas Development Companies (112 points), Fauji Fertilizer (95 points), Meezan Bank (68 points), Engro Corporation (64 points) and Pakistan State Oil (63 points). On the other hand, Hubco (43 points) and Kohat Cement Company (15 points) emerged as major losers.

Foreigners were net sellers during the week under review as they offloaded shares worth $46.22 million compared to net selling of $20.44 million in the previous week. Major selling was witnessed in all other sector ($46.14 million) and technology ($0.95 million). On the local front, buying was reported by companies ($41.09 million), followed by individuals ($20.04 million).

Among other major news of the week was; assurance of 1mn vaccine doses from a Chinese firm, expectations of a mini-budget ahead of talks with International Monetary Fund, government jacked up the prices of petrol, diesel, Wapda allowed to issue $500 million eurobonds, and foreign exchange reserves held by SBP fell $65 million to $13.15 billion.

Published in The Express Tribune, January 3rd, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732090022-0/Elmo-and-Amelia-(1)1732090022-0-165x106.webp)

1725523665-0/Minecraft-Movie-(1)1725523665-0-165x106.webp)

1732089759-0/BeFunky-collage-(75)1732089759-0-165x106.webp)

1732084432-0/Untitled-design-(63)1732084432-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ