Current account makes new record

Remains in surplus for fifth successive month at $447 million

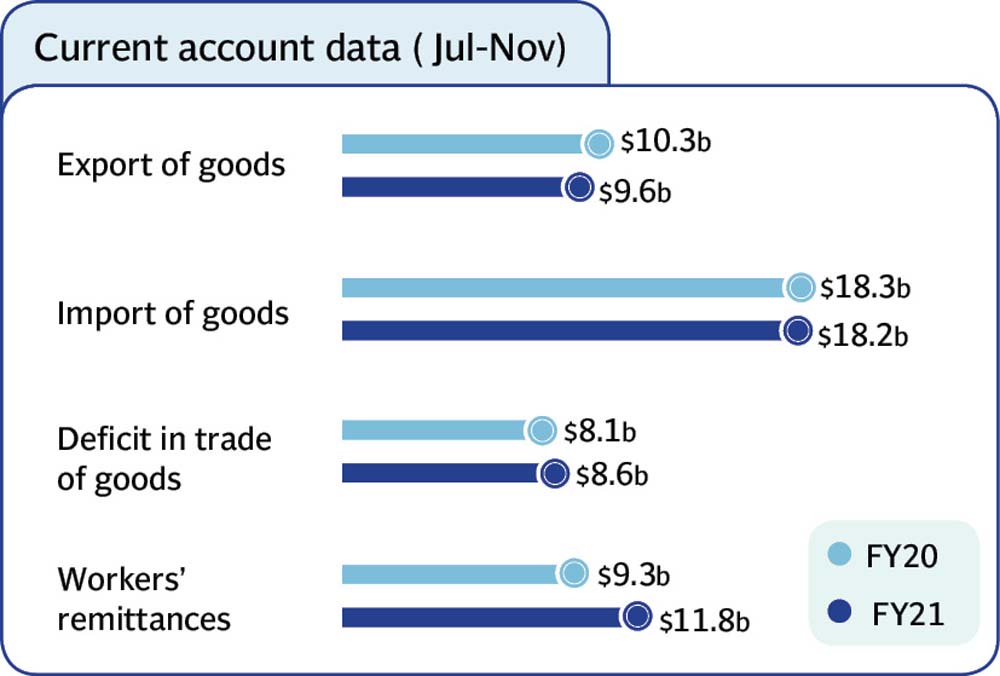

Pakistan’s economy has continued to make and break historic records during the Covid-19 pandemic. Its current account balance stayed in surplus - meaning government’s foreign income exceeds its expenditures - for the fifth successive month in November at $447 million.

The development partially helped the country’s foreign currency reserves stay near a three-year high above $13 billion.

“Despite Covid-19, great news on economy - remarkable turnaround. Current account surplus again in November: $447 million. For fiscal year so far, surplus is $1.6 billion as opposed to deficit of $1.7 billion in same period last year,” Prime Minister Imran Khan said on his official Twitter handle on Tuesday.

“State Bank of Pakistan’s (SBP) foreign exchange reserves have risen to about $13 billion, highest in three years.” “Yes, it is a record. Pakistan has never before seen its current account balance in surplus for five successive months,” Pak-Kuwait Investment Company (PKIC) Head of Research Samiullah Tariq said while talking to The Express Tribune.

“Pakistan seems to sustain the positive trend (current account balance in surplus), going forward,” he said, adding that the national economy was now in a position to afford an increase in imports of $200-400 million a month.

He said the Covid-19 pandemic had opened new opportunities on the economic horizon for the country. In addition to strong inflows of workers’ remittances and continuous recovery in export earnings, Pakistan’s IT and software exports have also maintained the momentum during the crisis times.

“Our IT (information technology) exports have spiked 51% to $168 million in the month. An additional inflow of $50 million during the crisis times is meaningful for us.”

Exports of the IT sector have grown especially after the government allowed IT freelancers to bring their export earnings in the form of workers’ remittances and keep up to 35% of their income in their foreign accounts. Earlier, they used to hold their earnings mostly in foreign accounts and spend abroad due to hardships faced in bringing the money home.

“Government’s incentives have encouraged freelancers to bring their foreign earnings into the country,” he said. Besides, overseas Pakistanis have been opening digital accounts in local banks in good numbers and depositing their savings into the accounts for the past three months. This is also adding to the country’s foreign currency reserves.

Textile exports - particularly the value-added ones like readymade garments and knitwear - had continued to grow and were estimated to grow 10% in current fiscal year, he said.

Secondly, the import of services has remained low largely due to limited international flights between Pakistan and other countries. “This has kept foreign expenditures on the lower side,” he said.

“Such developments suggest…Pakistan’s current account balance is likely to remain at around zero for the full current fiscal year,” Tariq said. He said the country had recorded current account surplus of $1.6 billion in the first five months (Jul-Nov) of current fiscal year. “If it witnesses a deficit of around $1.5-1.6 billion in the remaining seven months (Dec-June), the balance for the full fiscal year is likely to fall to zero.” BMA Capital Executive Director Saad Hashmi, however, believed that the economy had yet to come out of the challenging times. “A strong growth in receipt of workers’ remittances and recovery in export earnings seem unsustainable.”

He said the economy would return to the pre-Covid challenging times once the world reopened after the second and third wave of the pandemic. “Imports will be up…and remittances and exports may be in trouble again as they were in pre-Covid times,” he said.

The time is not far when the world will open again. The availability of vaccines will help in doing so. On the flip side, this will push up international oil and liquefied natural gas (LNG) prices. “An increase of $10-20 per barrel in international oil prices will shatter the national economy, as we heavily rely on imported energy,” he said.

Published in The Express Tribune, December 23rd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ