The Pakistan Stock Exchange witnessed a phenomenal rally in the outgoing week despite rising number of coronavirus cases that jolted investors briefly.

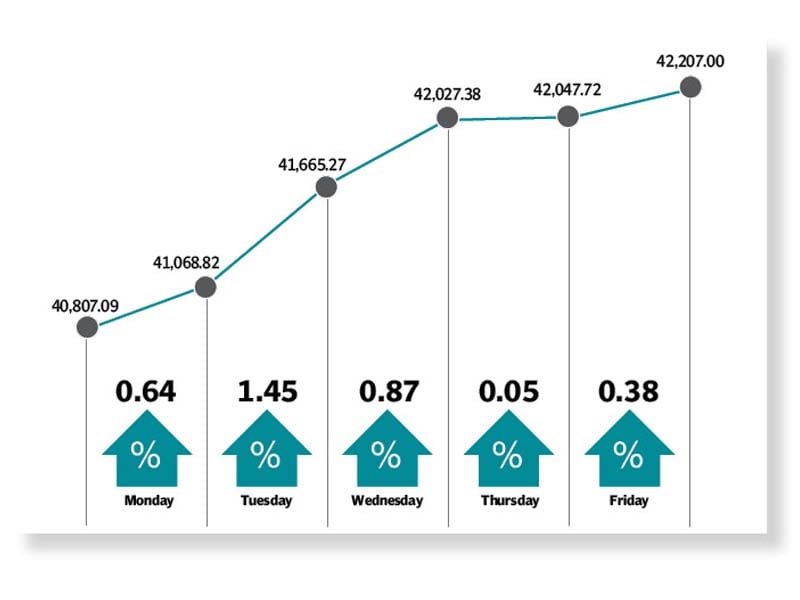

The benchmark KSE-100 index managed to sustain its winning streak for the second successive week as it advanced 1,399.91 points or 3.4% and managed to power past the 42,000-mark.

The index maintained a healthy momentum on back of coronavirus vaccine hopes and declining monthly inflation. Additionally, sector-specific developments also spurred buying interest in select stocks, which fuelled the rally. The market finished all five sessions in the green to settle at 42,207 points.

Monday witnessed volatile trading as investors remained jittery over the circular debt crisis, anticipating that the government would take steps to provide relief to the exploration and production sector. Additionally, reports of changes in Morgan Stanley Capital International (MSCI) semi-annual index coming into effect on November 30, 2020, also drove sentiments particularly in the banking sector.

The bullish rally continued to grip the stock market on Tuesday as members of the Organisation of the Petroleum Exporting Countries and allies, called OPEC+, dropped signals that there might be consensus on extension in the current supply cuts well into 2021, due to which oil-related sectors closed the session entirely in the green, and helped the index surpass the 41,000-mark.

The uptrend became stronger as the Federal Board of Revenue (FBR) announced that it would collect capital gains tax (CGT) on stock trading once a year instead of collecting the tax every month. The index extended gains on Wednesday as investors’ cheered low inflation reading, which eased to 8.3% in November, and the benchmark KSE-100 index powered past 42,000-point mark. Furthermore, news of increase in cement prices in the northern region, acted as a catalyst and spurred interest in cement stocks.

Despite, absence of positive triggers, sentiments remained bullish on Thursday owing to stability in international crude oil prices. Moreover, hefty buying by foreign institutional investors lent modest support to the market as purchases from foreign investors soared past Rs1 billion during the session.

The winning spree continued for the fifth successive session on the last trading day of the week as the benchmark index gradually marched upwards and gained nearly 160 points mainly in line with the bull-run in global equities and oil markets.

Uptick in global oil prices, as major producers agreed on a compromise to increase output slightly from January but continue the bulk of existing supply curbs to cope with the coronavirus-hit demand, impacted the exploration and production sector positively as the index-heavy sector managed to close in the green.

During the week, the average traded volume stood at 476 million shares, while the average value stood at Rs20.39 billion, according to an Aba Ali Habib report.

In terms of sectors, contributions came from telecom (20%), cement (13%), vanaspati (11%), fertiliser (8%) and oil and gas marketing companies (7%).

Scrip-wise, positive contributions were led by BAHL (42 points), TRG (41 points), MTL (40 points), HUBC (24 points) and LUCK (23 points).

Among market participants’ foreigners remained net sellers during the week amounting to $30.02 million, primarily contributed by corporates amounting to $36.06 million. On the other hand, local investors remained net buyers amounting to $30.02 million, mainly contributed individuals ($20.79 million), mutual funds ($5.37 million) and insurance ($7.79 million). While the brokers remained net buyers with the amount of $8.07 million.

Other key news during the week were State Bank of Pakistan reported significant growth in digital payment transactions in 1QFY21, foreign exchange reserves held by the central bank fell $305 million to $13.1 billion and oil sales increased by 10% year-on-year to 8.16 million tons in 5MFY21.

Published in The Express Tribune, December 6th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730379446-0/WhatsApp-Image-2024-10-31-at-17-56-13-(1)1730379446-0-270x192.webp)

1735025557-0/Untitled-(96)1735025557-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ