Volatile week at PSX ends in green

Improving economic indicators boost investor sentiment

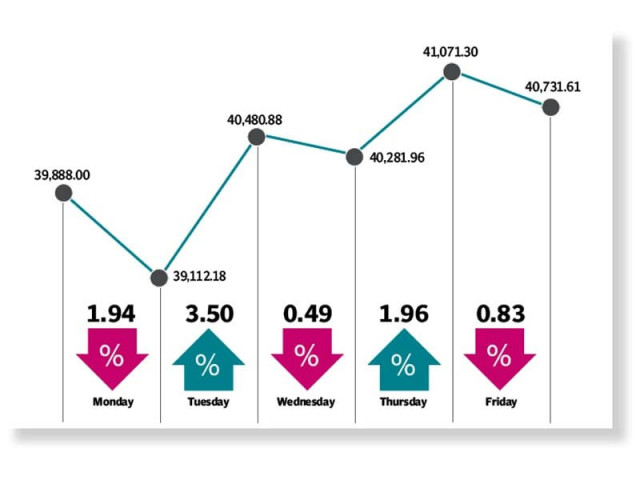

Volatility marred the outgoing week at the Pakistan stock market as sharp ups and downs punctuated the daily trading sessions amid concerns over the rising Covid-19 cases and uncertainty stemming from the US presidential elections. The KSE-100 finished the week up 843.61 points or 2% to close at 40,731.61 points.

Taking cue from last week’s close, trading kicked off on a negative note on Monday as fears over outcome of the second wave of the Covid pandemic dented sentiments. Expectations of another round of restrictions and lockdowns kept investors wary.

However, bears took a break from the Pakistan Stock Exchange (PSX) as the index staged a remarkable comeback on Tuesday on back of encouraging inflation reading. The Consumer Price Index (CPI) clocked-in at 8.91% for October 2020, which was far below market expectations. Moreover, recovery in international equity markets and global oil prices also helped snap a four-session losing streak.

Unfortunately, by mid-week sentiments turned soar again and investors started offloading stocks, which dragged the market down. The upbeat cement and petroleum product sales, announced during the week, failed to garner much excitement as the overall mood remained sombre on Wednesday.

Monthly cement sales touched a record high in October 2020 as mills dispatched 5.735 million tons to consumers. While the sales of petroleum oil products in Pakistan hit two-year high level of 1.7 million tons in October. The mounting number of coronavirus cases locally and globally continued to fan fears of a second lockdown and uncertainty over US elections (on November 3) also weighed on participants in the domestic market.

Fortunately, the anxiety was temporary as a steep rally was witnessed on Thursday as bull tossed the index above the 41,000-point mark. Participants shed their nervousness over the US presidential election as market had a spillover impact of the uptick in global and regional equities after Joe Biden gained the lead over incumbent President Donald Trump in the election.

Moreover, the government’s efforts to resolve the circular debt issue - which has soared past Rs2,300 billion - also helped the index remain in the green zone.

Nonetheless, on the last trading day, stampede was observed as participants took cues from a plunge in global oil prices coupled with lack of clarity over the US presidential elections. Participation crawled down as average volumes arrived at 368 million shares (down 21% week-on-week) while average value traded settled at $79 million (down 20% week-on-week).

In terms of sectors, positive contributions came from commercial banks (203 points), oil and gas exploration companies (149 points), technology and communication (97 points), cement (74 points), and fertiliser (57 points). Scrip-wise, major gainers were Pakistan Oilfields (90 points), TRG Pakistan (83 points), MEBL (61 points), BAFL (35 points) and HMB (33 points).

Whereas, major losers included HBL (38 points), Fauji Fertilizer (14 points), Pakistan Tobacco Company (13 points) Murree Brewery (6 points) and Attock Petroleum (6 points).

Foreign selling continued this week clocking-in at $21.34 million compared to a net sell of $5.5 million last week. Selling was witnessed in commercial banks ($3.46 million) and exploration and production ($1.86 million). On the domestic front, major buying was reported by individuals ($5.37 million) and insurance companies ($3.63 million).

Other developments during the week were; government reduced prices of petrol, diesel by up to Rs1.57, World Bank projected 9% growth in remittances, Supreme Court dismissed petitions of GIDC judgment, and ADB planned to give Pakistan $10 billion in fresh aid to Pakistan.

Published in The Express Tribune, November 8th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ