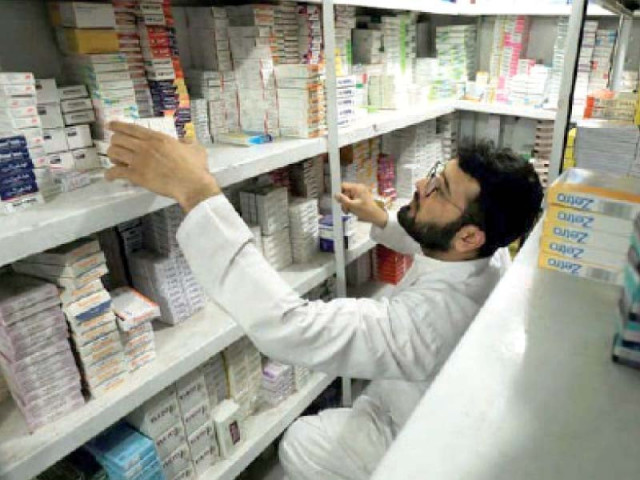

Pharma sector faces import hurdles

Port authorities take 3-4 months to clear raw material coming from India

The pharmaceutical sector is facing bureaucratic hurdles in getting clearance for the raw material needed for several lifesaving drugs as the goods are imported from India because no other country produces them.

It has been facing shortage of raw material used in manufacturing lifesaving drugs for snakebites, tuberculosis and cancer since Islamabad and New Delhi suspended trade ties over one year ago owing to flare-up of political tensions.

“Pakistan has a policy to import essential goods from India despite the ongoing tensions, which include APIs (active pharmaceutical ingredients) for medicines,” said Pharma Bureau Executive Director Ayesha Tammy Haq while talking to a group of journalists in an online meeting on Saturday.

“However, local ports take three to four months to clear them, which is causing shortage of medicines in the market,” she said.

“They (port authorities) clear APIs imported from other countries the very next day, hence, they should clear those imported from India within a day as well.”

The imported raw material was lost several times due to mistreatment at ports and pharmaceutical firms had to import the same APIs from India again. APIs have a limited shelf life and the delay in clearance can significantly impact their lifespan.

She said India was the only country which produced APIs to treat TB and snakebites and the industry had no option but to import them from the neighbour. The industry can import raw material for cancer medicines from other countries but this will cost them 1,000% more. She highlighted that cancer medicines were already very costly and the import of pricey raw material would make them out of the reach of patients.

“The industry imports raw material from India according to the given rules,” Haq said. “We open LC (letter of credit) through the State Bank of Pakistan (SBP) for import, pay through banking channels and import raw material via proper channels.”

She asked why the port authorities needed such a long time to clear the cargo despite fulfillment of all legal obligations.

“The condition to acquire a no-objection certificate from the Drug Regulatory Authority of Pakistan (DRAP) to get imported APIs cleared from ports should be withdrawn by the government,” she said.

The industry has also outlined these issues in meetings with high-ranking government officials, who have assured it of addressing them.

Apart from that, the government officials have asked the industry to start manufacturing APIs for lifesaving drugs within Pakistan to promote import substitution in the country. They have also urged the industry to invest in the manufacturing of raw material.

“This is, however, a long-term plan and may take five to seven years to materialise,” she said. “Industrialists need to make new investment of millions of dollars after the government comes up with a policy.”

Besides, the government should allow an increase in prices of other lifesaving drugs so that they were available in the market, she said.

“The government has allowed the industry to increase prices of 94 drugs very recently. There are 100 more lifesaving drugs whose prices need to be rationalised,” she said.

The industry stops manufacturing such medicines once their cost of production jumps above prices, which results in shortage of drugs in the market. The cost of manufacturing rises with depreciation of the rupee because most of the medicines are made with the help of imported APIs.

Last time, the government increased medicine prices when the US dollar was available at Rs105. Now, the rupee has depreciated by over Rs60 to Rs168 against the US dollar, she said.

The number of multinational companies in the pharmaceutical sector has gone down to 24 from 40 a few years ago. There are around 700 pharmaceutical companies manufacturing and marketing 7,000 drugs in Pakistan.

Published in The Express Tribune, September 27th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ