PSX gains 1,435 points on renewed confidence

Positive triggers help index power past 41,000-point during the week

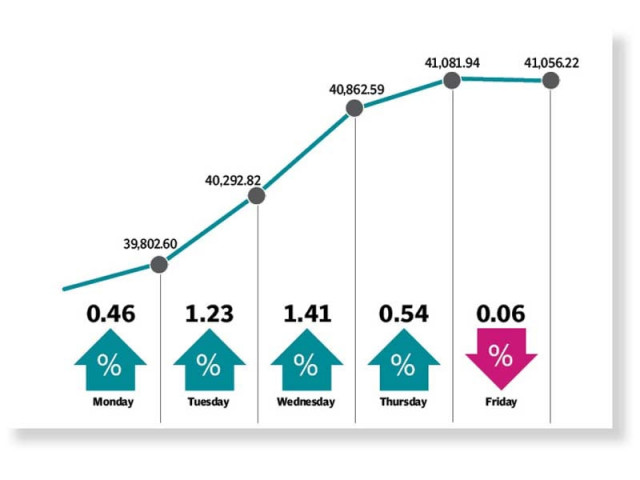

Following a week of correction, the stock market resumed its upward march in the outgoing week as investor confidence revived on back of encouraging newsflows and host of positive triggers. The KSE-100 surged 1,435 points or 3.6% during the past week to close at 41,056 levels.

“The market received an adrenaline rush after confidence expressed by local and global fund managers over the outlook of the local bourse in electronic media,” said JS Global analyst Amreen Soorani.

Trading kicked off on a positive note as investor sentiments turned optimistic on Monday buoyed by encouraging current account data, prompting participants to assume fresh positions.

According to the State Bank of Pakistan, the current account once again recorded a surplus of $424 million in July 2020. The upbeat economic data acted as a much-needed catalyst and helped lift the market upwards.

Meanwhile, exploration and production sector remained under pressure throughout the week on back of expected privatisation of Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL), which triggered a selloff in oil sector scrips.

However, market projections of a swift economic recovery in the next few months lent further support to the rally and painted a positive picture, which encouraged market participants to pour money into the bourse.

Additionally, investors cheered Sindh Assembly’s move of abolishing 3% capital value tax (CVT) on immoveable property in the Finance Bill, which fuelled the rally further.

Throughout the week, investors remained optimistic for a lower inflation reading for the month of August 2020 and the subsequent monetary policy announcement, which helped spur buying activity.

The bullish momentum continued and the index managed to power past the 41,000-point barrier on Wednesday. The finance ministry forecasted 1% recovery of the economy during the first quarter of the ongoing fiscal year, which propelled the index upward.

Unfortunately, the rally could not be sustained as the market snapped its four-day winning streak. The KSE-100 retreated on the last trading day of the week after the financial hub of the country was hit by record breaking torrential rains leading to urban flooding and halt in business activities. At this point, investor sentiments weakened owing to an economic standstill and the subsequent decline in exports anticipated by Adviser to Prime Minister on Commerce Abdul Razak Dawood.

During the outgoing week, average daily trading volumes settled at 440 million shares (down 0.3% week-on-week) while average value traded clocked-in at $102 million (down 5% week-on-week).

Contribution to the upside was led by power generation and distribution (up 4.8% week-on-week), oil and gas marketing companies (5.0%) and textile composite (6.8%) sectors.

Scrip-wise, major gainers were Colgate Palmolive (33.3%), TRG Pakistan (24.4%), Shell (23.5%), Systems Limited (18.6%) and Bannu Woollen Mills (17%).

Stocks that registered losses were Indus Dyeing and Manufacturing Company (-7.4%), Bank Al Falah (-6.5%), Bank of Punjab (-3.2%), Unity Foods (-3%) and Standard Chartered (-2.5%)

Among major news of the week was; public offerings of OGDC and PPL shares have been approved, current account posted $424 million surplus in July 2020 and refineries to face penalty for not producing petroleum products on Euro-V specifications.

Published in The Express Tribune, August 30th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ