Pakistan's FDI falls to 11-month low level

Pakistan clocks-in at $114.3m in July against $174.8m in June

The flow of foreign investment into different sectors of Pakistan’s economy, such as power plants, oil and gas exploration and IT and telecommunication, slowed down to an 11-month low of $114.3 million in July 2020.

“Foreign direct investment (FDI) numbers are not impressive. They will grow gradually along with normalisation of economic activities globally,” Topline Securities Director Research Syed Atif Zafar said while talking to The Express Tribune.

The FDI is 35% lower compared to $174.8 million received in the previous month of June 2020. The number, however, surged over 60% against $71.1 million recorded a year ago in July 2019, the State Bank of Pakistan reported on Thursday. The surge in investment over the one-year period is seen due to massively low FDI in July 2019.

Many economies around the world, particularly the developed ones, which pour in investment in developing countries like Pakistan, have yet to fully recover from Covid-19 impact and lockdown. UK - which was the second largest foreign investor in Pakistan in the recent past - reported in mid-June that its economy shrunk by a record 20% in April 2020.

“The FDI is higher on a year-on-year basis, but still lower compared to the average of $250-300 million during the pre-Covid-19 period,” Zafar said. Pakistan has reopened its economy from the lockdown. Majority of the sectors in manufacturing and almost entire agriculture sector are operational now.

“The thing is that FDI comes from abroad. So we have to wait for other countries to open up accordingly as well,” he said. Covid-19 has badly hit financial health of people and businesses globally in the last four to six months.

“They (foreign investors/multinational firms) will take more time to stabilise financially and then shift their focus towards making new investment in developing countries like Pakistan,” he added.

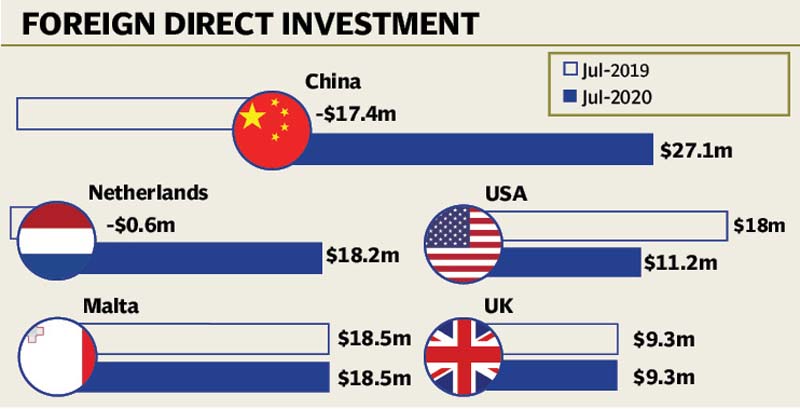

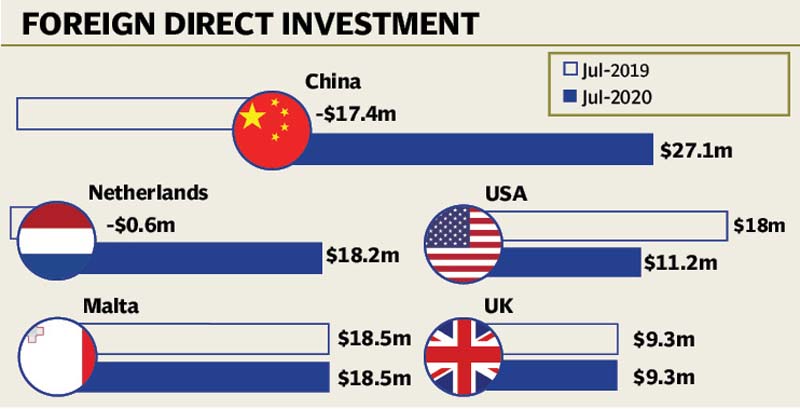

Country-wise FDI

Country-wise FDI

China remained the single largest investor with net FDI of $27 million during July 2020 compared with net outflow of $17 million during the same month of the last year, the central bank reported.

China has remained the single largest investor in Pakistan over the last couple of years. It has been mainly investing in power projects under its flagship and multi-billion dollar China-Pakistan Economic Corridor (CPEC) projects.

“The Chinese investment reflects in FDI,” Zafar said.

Malta appeared as the second largest investor with net FDI of $18.5 million during July 2020. The country had invested the same amount in July 2019 as well.

“It (Malta) is a tax haven. Connect recently announced real estate amnesty with improved flows from such tax havens,” Alpha Beta Core (ABC) CEO Khurram Schehzad said in a short comment.

Netherlands and UK invested $18.2 million and $11.2 million, respectively, in July 2020.

Sector-wise FDI

Electrical machinery attracted the single largest investment of $29.4 million in July 2020 compared to no investment in the same month of last year.

Financial business attracted $23.8 million in the month compared to net outflow of $2.3 million in July 2019.

Communication sector received investment of $21.5 million compared to $26.1 million. Oil and gas exploration sector invited $17 million compared to $15 million. Power sector attracted $12.2 million in July 2020 compared to an outflow of $3.3 million in July 2019.

Published in The Express Tribune, August 21st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ