Volatile week ends in green at PSX

Supreme Court’s GIDC verdict, political concerns keep investors wary

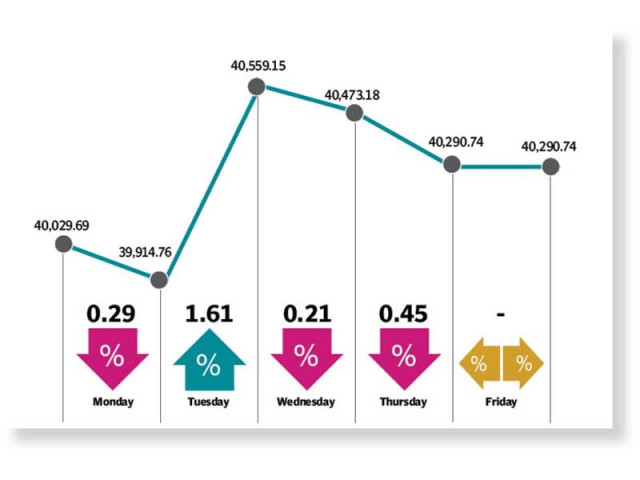

The short trading week at the Pakistan Stock Exchange (PSX) was marred by range-bound trading as the index rose 261 points for the eighth successive week of gains and ended the week at 40,291 points.

Selling pressure persisted throughout the week in index-heavy sectors as the unfolding political scenario in terms of relations with Saudi Arabia and the pending gas infrastructure development cess (GIDC) case made investors wary. The week kicked off on a bearish note as shares took a battering in the wake of political worries following remarks from foreign minister about the Organisation of Islamic Cooperation (OIC) and Kashmir.

Although investors cheered Moody’s rating agency’s stable outlook on Pakistan, the development failed to propel the index into the green zone. On Tuesday, however, the index rebounded and spiked to a six-month high on the back of increase in international crude oil prices and prospects of consensus between independent power producers and the government of Pakistan.

Pakistan’s request to Saudi Arabia and Islamic Development Bank’s Islamic Trade Finance Corporation to extend the facility of oil supply on deferred payments for another year also boosted investors’ confidence and fuelled a rally in oil-related sectors.

On the other hand, an increase in fertiliser prices also enhanced activity in the sector.

The positive momentum could not be sustained and stocks retreated in the following session with investors opting to book profits. Anticipation about a Supreme Court verdict on GIDC kept investors on the sidelines.

A few days after confirming Pakistan’s stable outlook, Moody’s reaffirmed Pakistani banks’ long-term local currency deposit rating with a stable outlook from the earlier stance of ratings under review for possible downgrade, meaning the government was capable of injecting money into its financial system, if required.

Though the news lent support to the index and spurred buying interest in banking stocks, the overall mood remained sombre.

The index continued its downward slide in the last trading session of the week on Thursday following the court’s ruling on GIDC, which triggered selling and pulled the benchmark index down by 182 points.

In its ruling, the Supreme Court dismissed all petitions against the GIDC levy and ruled in favour of the federal government, which would collect Rs420 billion from different companies. The fertiliser sector bore the brunt of the verdict and endured profit-booking as the sector now owed Rs110 billion in GIDC to the government. Average daily trading volumes and value for the outgoing week were down by 9% and 14% to 581 million shares and $125 million respectively.

Contribution to the upside was led by power generation and distribution firms (261 points), oil and gas exploration companies (97 points), oil and gas marketing companies (92 points), commercial banks (86 points) and textile composite firms (29 points).

Stock-wise, major gainers were Hubco (213 points), PPL (56 points), UBL (56 points), Kapco (39 points) and SNGPL (36 points).

On the other hand, Dawood Hercules (55 points), Engro (49 points), MCB (31 points), Engro Fertilisers (25 points) and Fauji Fertiliser Company (23 points) were major losers of the week.

Foreign buying continued during the week and stood at $8.7 million compared to net buying of $3.7 million last week. Buying was witnessed in cement companies ($4.3 million) and fertiliser firms ($2.7 million).

Among major news of the week were Moody’s reaffirming Pakistan’s stable outlook, K-Electric closing Rs25 billion fund raising via Sukuk, car sales declining 8% in July, large-scale manufacturing shrinking 10.2% in FY20 and govt restricting budget deficit to Rs3.4 trillion.

Published in The Express Tribune, August 15th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ