FDI rises 88% to $2.56b

China emerged as largest foreign investor in FY20 with injection of $844m

Long-term foreign investors poured much higher fresh capital into advanced mobile internet 3G/4G, a telecom-led microfinance bank, hydel power projects and oil and gas exploration in Pakistan in fiscal year ended June 30, 2020.

The foreign direct investment (FDI) rose 88% to $2.56 billion in the country in the previous fiscal year (FY20) compared to $1.36 billion in FY19, the State Bank of Pakistan (SBP) reported on Friday.

In June alone, the foreign investment surged 70.53% to $174.8 million compared to $102.5 million in the same month of last year.

China once again emerged as the largest foreign investor in FY20 as it injected a net $844 million, mainly into power projects such as thermal, hydel and coal-based power plants, an expert said.

Norway turned out to be the second largest foreign investor with a net investment of $402 million. It injected equity mainly to renew the 3G/4G mobile internet licence and into a telecom-led microfinance bank, he added.

Commenting on the FDI received in FY20, Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem said “this is an encouraging number ($2.56 billion) considering the challenging circumstances. However, this is also below the country’s true potential.”

The circumstances were challenging even before the Covid-19 outbreak in late February in Pakistan. The emergence of the global health crisis worsened business sentiment.

“The required improvement in the regulatory environment and streamlining of business policies may help Pakistan attract FDI as per its potential,” Aleem said.

FDI stood at around 1% of gross domestic product (GDP). It should increase to 3%, he said. FDI was calculated at 6% of GDP in Vietnam, he said while drawing a comparison.

Sector-wise FDI

The power sector received the largest investment of a net $764.3 million in FY20 compared to outflow of $323.9 million in fiscal year 2018-19.

The communication sector attracted the second largest foreign investment of $663.9 million in FY20 compared to outflow of $55.7 million in FY19.

The oil and gas exploration sector attracted $311.4 million compared to $349.8 million in FY19. The finance business sector received $273.8 million compared to $286.5 million.

Electrical machinery received investment of $153.4 million in FY20 compared to $164.3 million in FY19.

In June alone, telecom, power, oil and gas exploration and financial business sectors emerged as major recipients of foreign investment.

Country-wise FDI

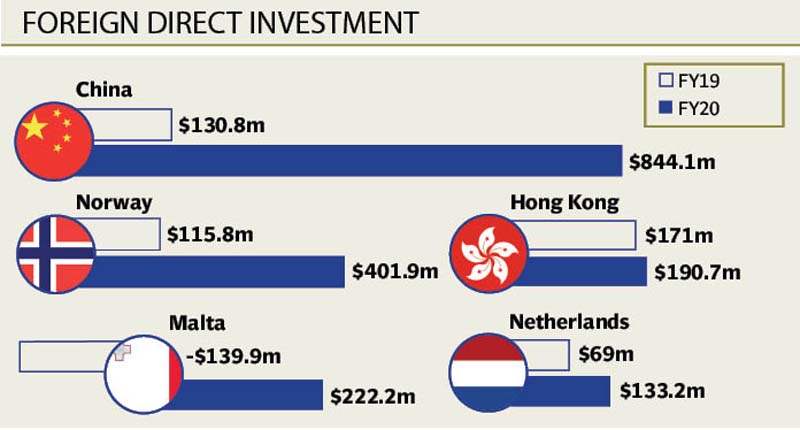

After a gap of one year, China once again emerged as the largest foreign direct investor in Pakistan in FY20. It poured a net $844 million compared to $130.8 million in FY19.

China is apparently ramping up investment in power projects under its multibillion-dollar China-Pakistan Economic Corridor (CPEC). Its investment in flagship projects slowed down in FY19.

Norway emerged as the second largest investor with $402 million in FY20 compared to $115.8 million in FY19.

Malta invested $222.2 million compared to outflow of $140 million in FY19. Hong Kong invested $190.7 million compared to $171 million.

The Netherlands, United Kingdom and United States were also prominent investors in the previous fiscal year.

In June, Norway, Hong Kong, South Korea and Malta invested modestly in Pakistan.

PSX outflow

The sale of shares by foreign investors slowed down at the Pakistan Stock Exchange (PSX). They sold shares worth $281.7 million in FY20 compared to $415.5 million in FY19.

This was, however, the fifth consecutive year in which the foreign investors remained net sellers of shares at the PSX.

Published in The Express Tribune, July 18th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ