Karachi and K-Electric - a flickering bond

Power utility unable to meet city’s energy needs as prolonged outages hamper economic progress

More than a decade has passed since K-Electric’s privatisation, but people of Karachi still endure prolonged load-shedding, which has also hampered trade and economic activities.

In the current scenario where the Covid-19 outbreak has dealt a blow to the economy, the blackouts have compounded the problem.

The sole purpose of privatising Karachi Electric Supply Company (KESC), now K-Electric, was to avoid prolonged power outages in the country’s financial capital in an attempt to give a boost to economic activities and allow people to spend their life in a normal way.

However, frequent interruptions in electricity supply have not gone, and the situation may have worsened in many cases.

Not only power tariffs have been enhanced significantly, the quality of services provided to consumers has also become unsatisfactory. At present, some areas are facing blackouts for 8-10 hours a day, including those industrial, commercial and residential consumers who pay bills on time.

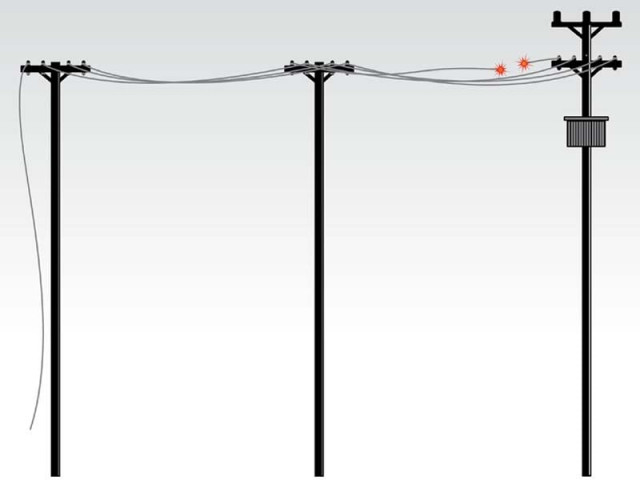

Inflated consumer bills with the economy still reeling from the coronavirus crisis and electrocution incidents during current rains have brought more misery. The power utility’s transmission and distribution system is so fragile that it cannot afford to supply the required 3,500-4,000 megawatts of electricity, which would end load-shedding, to over 2.5 million industrial, commercial and household consumers in the city and some parts of upper Sindh and Balochistan. This comes despite higher supply from the national grid.

However, credit goes to K-Electric for successfully managing to turn the company from a loss-making to a profitable concern, thanks to tariff hikes and fuel price adjustments. K-Electric shareholders may be happy with the development but citizens of Karachi are certainly not. Residents in different parts of the port city have staged protests against the persistent load-shedding. Industrial and commercial consumers, who pay comparatively higher tariffs and over 99% of them pay bills, have also demanded that the government take action to overcome the power crisis.

The utility insists that the power crisis partly stems from short supply of fuel (furnace oil and gas) and low output from wind-based power generators.

The crisis

Pakistan Electric Power Company’s (Pepco) former managing director and power sector expert Tariq Basharat Cheema was of the view that roots of the power crisis in Karachi could be found in K-Electric’s privatisation.

“They (the Abraaj Group) are here only for profit. They will invest in those projects which are highly profitable and will avoid less profitable and loss-making projects. So, the criticism from people and the government of K-Electric’s poor performance is illogical.”

He said, “To conserve electricity, once we switched off power to billboards and got shops closed at 8pm nationwide for energy management. K-Electric, however, did not let all this happen as it was selling power at the most expensive tariff of Rs21 per unit to billboards and at Rs12 to shops compared to Rs6 for domestic consumers.”

He said they failed to implement the electricity conservation plan, despite meetings with government officials at that time.

Talking about the problems, Cheema said a major reason for the power crisis in Karachi and other parts on K-Electric’s network was the lack of investment in infrastructure projects. “K-Electric did not invest in transmission and distribution networks as the return on investment was low (eg 12-12.5%) compared to a significantly high return on power generation projects,” he said.

K-Electric’s current management has tried to get rid of its transmission and distribution network and focus on power generation only. However, the government did not let it do so.

Power demand on K-Electric’s network has shot up to over 4,000 megawatts, including suppressed demand for 1,000-1,500 megawatts. For instance, there are buildings on two sides of the Super Highway towards Hyderabad but they do not have electricity connections.

K-Electric has introduced revenue-based load-shedding, meaning it is keeping supplies low to the areas where losses are high, theft is rampant and revenue recovery is low.

“It is a rough entity. It is in the control of no one, despite the government of Pakistan having 25% stake in K-Electric,” Cheema said. The National Electric Power Regulatory Authority’s (Nepra) State of Industry Report 2019, published in May 2020, said, “Historical record shows that K-Electric underutilised its power plants whereas it continued to carry out load-shedding.”

“In addition, power plants of K-Electric remained on standby mode for a significant period, during FY 2018-19, wasting the potential to generate significant amount of economical energy while adding to non-productive energy during the standby mode in the form of auxiliary power consumption, resulting in financial loss,” it said.

While analysing the available information, it is noted that the utility is subjecting its consumers to undue and unauthorised load-shedding by underutilising its own generation capacity.

Another main cause of underutilisation of efficient power plants could be the transmission system constraints existing in K-Electric’s transmission network, such as overloading of transmission lines, insufficient transmission capacity, outages of transmission lines due to tripping, faulty transformers, etc.

The number of consumers, who paid K-Electric’s bill, increased to 92.62% in FY19 compared to 91.05% in FY18.

A Nepra spokesperson said the authority had taken suo moto action and scheduled a public hearing on Friday (July 10) as there was huge hue and cry over K-Electric. The hearing would let Nepra know whether the power crisis in Karachi was due to shortage of furnace oil, whether K-Electric was maintaining the required stock of furnace oil, if all generation plants were functioning or not, what was the overbilling issue and how many complaints for overbilling were genuine.

Solutions

Pepco’s former MD said with the much-needed investment in infrastructure, the K-Electric transmission and distribution networks may help to overcome the power crisis.

Besides, Nepra findings suggest ending K-Electric policy of providing low supplies to low sales revenue generating areas and utilisation of all K-Electric power generators may reduce load-shedding. Thirdly, K-Electric will have to switch on generators on expensive fuels like furnace oil in case it faces shortage of gas, as it owns generators, which may function on both the fuels.

The government needs to negotiate well with the new potential investor - China’s Shanghai Electric Power (SEP) - in K-Electric, in terms of how the new management aims to fix the power crisis. The government should document all the future working with SEP.

Outlook

Nepra said in its May 2020 report, “K-Electric is not able to meet the expected demand at peak times and outage of a power plant may result in breakdown of the system. Even the surplus expected in 2023 would not be enough to operate K-Electric’s system with technically prudent margins.”

However, the change of K-Electric management from the Abraaj Group to SEP may change Nepra’s expected outlook to positive as the new investor has earlier announced plans to invest billions of dollars in K-Electric’s system.

The government is working at a fast pace to address challenges and remove constraints in the transfer of K-Electric management to SEP from Abraaj.

“The transfer of shares from Abraaj to SEP is expected to take place at a fast pace as everyone wants to get rid of K-Electric’s current management, which is not performing its duties. SEP, which is a huge and a world-class power company, may overcome the crisis,” Cheema added.

K-Electric’s version

“Since its privatisation, K-Electric has invested over $2.4 billion across the energy value chain. As a result, today over 70% of Karachi is load-shedding-free with 100% exemption for industries,” the K-Electric spokesperson claimed.

Before privatisation, only 23% of Karachi was exempt from load-shedding, she added.

With its intricate operating environment, business in Karachi comes with key challenges, which impact planned initiatives. Industrial and commercial activities in Karachi have increased with the ease in lockdown. At the same time, increase in temperatures has pushed the power demand above 3,450MW with average demand above 3,250MW.

However, a shortage of 300-400MW is being faced by K-Electric due to fuel supply constraints, low availability of wind power from NTDC’s 150MW wind corridor due to low wind pressure and shortage of supply from Kanupp power plant. “This shortfall necessitated load management to manage the demand,” she said. K-Electric had shared a demand for 120,000 MT of furnace oil back in January 2020 in anticipation of its June 2020 demand. This demand was in accordance with the fuel supply agreement (FSA) between K-Electric and Pakistan State Oil (PSO). However, so far this demand has not been completely fulfilled.

“K-Electric is grateful to the Ministry of Energy and various stakeholders for their support in allowing furnace oil imports as a means to regularising the fuel supply chain in the best interests of the people of Karachi.”

K-Electric’s forward-looking initiatives are focused on capacity additions, technological advancements and improved service levels. Around $2 billion will be invested in the power value chain of the city under a robust three-year investment plan. Safety is also a key priority, underpinned by the removal of unlawful wires encroaching on the K-Electric network, conversion to Aerial Bundled Cables and large-scale efforts against power theft, she added.

Published in The Express Tribune, July 10th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ