Weekly review: Budget pessimism drags stock market lower

Benchmark KSE-100 index decreases 3.4% as investors express dismay

Weekly review: Budget pessimism drags stock market lower

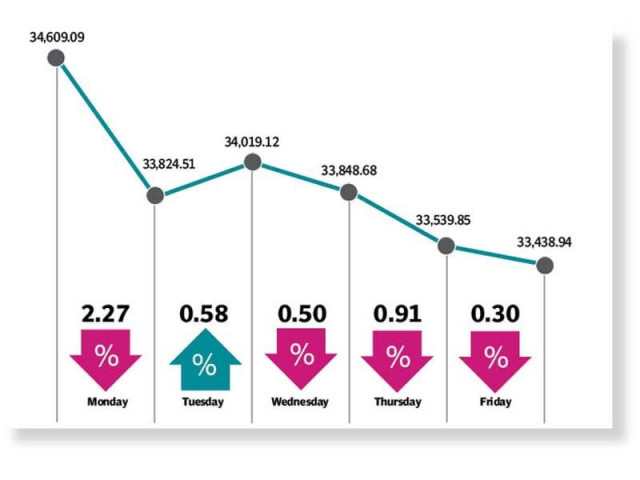

Pessimism prevailed at the bourse for most of the week as participants remained concerned regarding the ambitious tax target set by the government for the next financial year, beginning in July. As a result, the KSE-100 index witnessed a correction of 3.4% or 1,172 points on a week-on-week basis, closing at 33,439 levels this week.

The week kicked off with a plunge of nearly 800 points as investors’ dismay over the budget announcement triggered a sell-off at the bourse. Investors had hoped of gaining a handful of tax incentives coupled with further relief from the “corona budget”. However, expectations were shattered and participants resorted to divest from the stock market.

The fall in global stock markets in the wake of fresh coronavirus cases reported in countries including China raised fears of an approaching second wave of the pandemic, which further battered sentiments. The trend reversed on Tuesday as disappointment over the budget faded and investors assumed fresh position in the domestic market. Meanwhile, recovery in oil prices lent further support and fuelled bullish trading in exploration and production and oil marketing companies’ scrips.

The optimism did not last as the index retreated to the red zone for the next three sessions amid a handful of negative triggers. Growing political noise after Balochistan National Party-Mengal announced its withdrawal from the Pakistan Tehreek-e-Insaf-led alliance took a toll on investors’ mind and reflected in the selling spree at the bourse. Unfortunately, matters did not improve as political upheaval persisted for the outgoing week.

Investor sentiments took a further hit following imposition of a fresh lockdown in areas of Sindh and Punjab and trading remained under selling pressure. The news of another lockdown was unwelcoming for participants who feared further worsening of macroeconomic indicators The news regarding breakthrough in discovery of drug for treating Covid-19 patients also failed to excite the market. On the other hand, consistent depreciation of rupee against the US dollar and dismal data of large scale manufacturing released by the Pakistan Bureau of Statistics further restrained the market from posting any gains. Amidst this, the rising cases of coronavirus in Pakistan continued to impact trading negatively.

Participation barely crawled up as average daily volumes rose 1% to 229 million shares, while traded value for the outgoing week decreased 16% to $42 million.

Contribution to the downside was led by commercial banks (293 points), fertiliser (226 points) and cement (183 points).

Whereas, scrip-wise major losers were UBL (94 points), LUCK (92 points), ENGRO (74 points), FFC (68 points) and HUBC (65 points).

Foreigners offloaded stocks worth $4.8 million compared to net selling of $7.73 million last week. Major selling was witnessed in fertiliser ($2.4 million) and commercial banks ($1.9 million). On the domestic front, major buying was reported by individuals ($12.3 million) and broker proprietary trading ($0.5 million).

Among major news of the week was; textile exports surged 86% in May as lockdown eased, public debt swelled to Rs34.3 trillion in July-April, reserves held by the central bank rose $11 million to $10.1 billion.

Published in The Express Tribune, June 21st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ