People living in Sindh will pay more in taxes to the provincial government for consuming electricity, buying and running vehicles, owning houses, using local infrastructure and for outing and entertainment, according to the budget documents.

The provincial government has targeted hefty revenue collection from real estate and properties ahead of expected acceleration in construction activities.

The federal government has announced a relief package for construction and 40-70 allied industries in a bid to revive economic activities and create job opportunities, especially for daily-wage earners, to better fight the coronavirus pandemic.

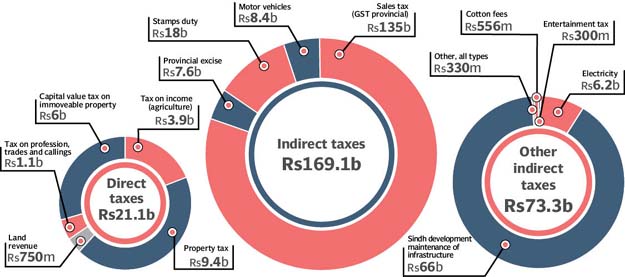

The Sindh government will continue to heavily rely on indirect taxes, which are considered a burden on poor people, while the wealthy will continue to pay less on account of direct taxes.

Budget documents suggested that the government would collect a massive 89% of revenue from indirect taxes and a mere 11% from direct taxes in the next fiscal year starting July 1, 2020.

Sindh Chief Minister Syed Murad Ali Shah, who also keeps the portfolio of finance minister, while unveiling the Sindh Budget for 2020-21 in the Sindh Assembly on Wednesday, said the province had targeted to collect tax revenue worth Rs313.39 billion in the next fiscal year.

The targeted collection is almost 50% higher than the estimated collection of Rs210 billion in the coronavirus-hit outgoing fiscal year ending June 30. This is, however, 9% higher compared to the original tax collection target of Rs288.71 billion for FY20.

“Total provincial receipts for the (outgoing) financial year 2019-20 were fixed at Rs288.7 billion. The Covid-19 situation deeply affected provincial receipts. The actual collection is expected to be Rs210 billion, which is only 8% higher than last year’s (FY19) actual collection of Rs194.9 billion,” Shah said.

He announced the budget outlay of Rs1.21 trillion with fiscal deficit of Rs18.83 billion for FY21.

The Sindh government is targeting to collect higher taxes at a time when the national economy is under stress due to Covid-19 and locust attack on agricultural crops. At the same time, the increase in the collection of taxes is a must to support poor people in these testing times.

The government’s huge reliance on indirect taxes, rather than direct taxes, is against its efforts to support poor segments of society.

The provincial government has targeted to collect 413% higher tax revenue on electricity at Rs6.16 billion in FY21 compared to expected collection of Rs1.12 billion in the outgoing year.

It is estimated to collect Rs9.37 billion in property tax in FY21 compared to Rs8 billion to be collected in FY20. It is estimated to collect Rs6 billion in capital value tax (CVT) on immovable property (real estate) in FY21 compared to Rs4.5 billion in FY20.

The government has targeted to collect Rs3.87 billion in tax on income from agriculture compared to Rs1.2 billion. The government has targeted to collect the same amount in taxes in FY21 on the head of sales tax (general sales tax/GST) which it was estimated to collect Rs135 billion in FY20.

It is aimed at collecting Rs66 billion on Sindh development maintenance on infrastructure next year compared to Rs56.86 billion in the outgoing year.

The government has targeted to collect taxes from entertainment at Rs300 million compared to Rs60 million in FY20.

It is estimated to collect Rs8.45 billion from motor vehicles in FY21 compared to Rs7.8 billion in FY20.

It has targeted to collect Rs18 billion from stamp duty compared to Rs13 billion.

“To achieve the provincial target in receipts (Rs313.39 billion), the Revenue Collecting Agencies are being strengthened with increased emphasis on automation. Moreover, monitoring mechanisms will also be developed to monitor provincial receipts,” Shah said while addressing provincial budget for the next fiscal year 2020-21 in assembly on Wednesday.

“The receipt of the province are seriously affected by post-Covid-19 economic challenges, therefore for FY 2020-21, it is limited to Rs1.22 trillion with a nominal increase of 0.4% over the current fiscal year,” according to the budget at a glance.

Federal transfers

The Rs1.22 trillion includes federal transfers worth Rs774.71 billion and provincial collection of Rs313.39 billion targeted to be collected in FY21.

Breakdown of the federal transfers suggests that the Sindh government will receive Rs679.68 billion on the head of the revenue assignment, Rs62.34 billion on straight transfers, Rs14.41 billion on development grant (PSDP and foreign) and Rs18.27 billion in other grants, according to the budget document.

Published in The Express Tribune, June 18th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1734511806-0/Untitled-design-(5)1734511806-0-270x192.webp)

1734587529-0/Express-Tribune-(1)1734587529-0-270x192.webp)

1734468458-0/Copy-of-Untitled-(50)1734468458-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ