Corrective measures jolt Pakistan's manufacturing sector

LSM records decline of 5.4% in Jul-Mar FY20, auto worst impacted sector that contracts 36.5%

A Reuters file image.

The much-needed corrective measures taken to fix the faltering economy; rupee depreciation, hike in interest rate, raising electricity prices, and lately the lockdown, have badly hit the large-scale manufacturing (LSM) sector with major contraction in automobile, textile, petroleum, wood and electronic production in the ongoing fiscal year.

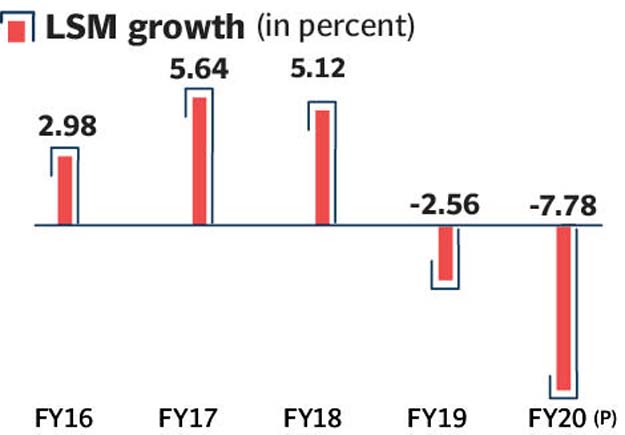

The policy measures added fuel to drive LSM downwards for the second consecutive year. The sector declined by 5.4% in the first nine months (July-March) FY20 compared to decrease of 2.34% in the same period last year, according to Pakistan Economic Survey FY2019-20 launched on Thursday.

The last three months of the current fiscal year ending June 30 were projected to create havoc in the sector and sub-sectors; as lockdown imposed to contain the coronavirus toned down demand next to nil for goods like cars, petrol, cement, steel and electronics. In addition to the policy measures, the expensive industrial inputs, implementation of stabilisation and revenue measures like increase in the rate of taxes on imports and lower domestic demand remained the key reasons behind the subdued performance.

Furthermore, instability of rupee against the US dollar fuelled the already gloomy performance. Rupee depreciated by 3.9%, while the benchmark interest rate stood at an eight-year high of 13.25% during July-March FY20.

“When slight improvement was started to be seen in export-oriented sectors and construction allied industries ie cement, thus a gradual economic recovery was expected but unforeseen Covid-19 crisis brought economic activity to a near-halt, both domestically and globally,” the survey said.

“Textile and apparel, a heavyweight sector, was highly exposed to this crisis due to its labour-intensity. Still, uncertainty regarding pandemic, global economic downturn and dismal domestic demand has escalated the downside risks for the manufacturing sector. Nevertheless, the government measures taken to boost the economy are expected to bring a positive impact on the manufacturing sector,” it stated.

LSM has a 78% share in manufacturing and contributes 9.5% to GDP. Comprehensively, the manufacturing sector is the driver of economic growth due to its forward and backward linkages with other sectors of the economy. “This (manufacturing) sector provides employment opportunities to about 16.1% of the total labour force while its share in GDP is around 13-14%,” the survey said. Automobile appeared to be the worst impacted sector as it contracted by 36.50%, followed by wood products which shrunk 22.11%, coke and petroleum products negative 17.46%, electronics 13.54%, engineering products 7.05% while the textile sector, which holds the highest weight of almost 21% in LSM contracted 2.57% in July-March FY20.

Some of the LSM sub-sectors under the lead of fertiliser, however, played positively on the economic horizon and offset some of the losses in the broader economy which is projected to contract by 0.4% in FY20. Such a massive recession is seen after a gap of 68 years in Pakistan. The other sub-sector exhibited upward trends; including leather products, paper and board and non-metallic mineral products.

Automobile

The automobile is the worst-hit sub-sector in LSM. It contracted 36.5% in July-March FY20 compared to downtick of 7.56% in the same period of the last year. A major contributor to this decline was the passenger car segment due to its weight in LSM index. During the period under review, car production shrunk 47.9%.

“The factors which impacted this sector were currency depreciation, policy rate hikes, increase in FED (federal excise duty) from 2.5% to 7.5% against different vehicle categories and additional customs duty (ACD) from 2% to 4% and 7% against tariff lines of 16% and 20% and above, respectively,” the survey documented reported.

Iron and steel

The pace of contraction of iron and steel production slowed down during July-March FY20 as it declined by negative 7.96% compared to negative 11% in the same period last year.

The decline was more visible in billets and ingots which fell by negative 13.04% indicating the gloomy construction activities mainly due to high financing cost. Hot and cold roll sheets, strips, coils and plates having the highest weight in iron and steel products declined by negative 4.15%.

According to the survey, “Low automobile production, an upward adjustment in electricity prices, lower housing investment by the public and private sector and rupee depreciation further dampened steel industry.”

Electronics

Electronics exhibited lacklustre performance during Jul-Mar FY20 and plunged by negative 13.54% compared to 39.9% growth to the corresponding period. Electric motors, bearing the highest weight in this segment, have so far been responsible for overall electronics growth. During the period under review, electric motors dived by 13.42% and dragged down the whole electronics industry.

“The slowdown in electric motor segments can be attributed to subdued demand for the water extraction pumps. Increased electricity tariffs and rupee depreciation adversely affected production. The high cost of borrowing further dampened the consumer demand for durables,” it stated.

Fertilisers

Fertilisers recorded a growth of 5.81% during the first nine months of FY20 mainly on account of nitrogenous fertilisers, which recorded a growth of 6.7%. “The impetus came from small as well as large urea producers, who scaled up their operations,” the report added.

Cement

Pakistan’s cement industry has posted healthy growth during July to March in FY20. It was backed by the increased exports mainly of clinker which went up by 100% during the period.

Domestic demand for cement has picked up pace as the government increased development expenditures and improved remittances inflow further uplifted private construction activities. However, Covid-19, as expected, had an impact on domestic consumption of cement industry, which declined by 16.7% in March 2020 alone.

Published in The Express Tribune, June 12th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ