Pakistan's current account deficit soars to $572m

Widens 64 times from $9 million in March due to coronavirus impact

A Reuters file photo.

The current account deficit soared 64-fold in April compared to $9 million in the previous month of March, the State Bank of Pakistan (SBP) reported.

The reason for comparing the numbers month-on-month rather than on a year-on-year basis “is to check the impact of coronavirus pandemic on the economy”, BMA Capital Executive Director Saad Hashmi said while talking to The Express Tribune.

“The impact of Covid-19 will determine the direction of the national economy, particularly in relation to exports and workers’ remittances, going forward,” he said.

Cause of spike

Arif Habib Limited (AHL) Director Ahsan Mehanti said a significant drop in exports mainly caused the widening of the current account deficit in April. Exports of goods dropped one-fourth to $1.39 billion in April compared to $1.82 billion in March, according to the central bank.

Besides, a 5% slowdown in remittances also contributed to the widening of the external deficit. However, a nominal decrease in imports helped contain the deficit, Mehanti said.

Deficit manageable

Hashmi said April’s deficit was close to market expectations and it was at an affordable level. “Deficit in the range of $500-600 million a month remains bearable,” he said.

Cumulatively, in the first 10 months (Jul-Apr) of the current fiscal year ending June 30, the current account deficit stood at $3.34 billion compared to the International Monetary Fund’s revised estimate of $4.5 billion for the full year (Jul-Jun), he said.

The IMF projection seemed achievable if the deficit continued to remain around $500-600 million a month in the last two months of the outgoing fiscal year, he said.

If the deficit remained within the projected limit, it should keep the rupee-dollar parity stable at around the current level of Rs160 to a dollar, he said.

The recent improvement in the country’s foreign currency reserves above $12 billion will help to manage the current account deficit. The improvement came after the IMF last month provided an emergency loan of around $1.5 billion to fight the Covid-19.

The reserves have remained stable considering the G20 countries may defer foreign debt repayments for the period May to December 2020 due to the global crisis. The Paris Club is also considering the same relief for economically weak countries.

Deficit improves on a yearly basis

On a year-on-year basis, the deficit narrowed down 51% to $572 million in April 2020 compared to $1.17 billion in the same month of last year.

Cumulatively, in the first 10 months of FY20, the deficit plunged 71% to $3.34 billion compared to $11.45 billion in the same period of last year, the central bank said. A contraction in imports mainly helped to contain the deficit.

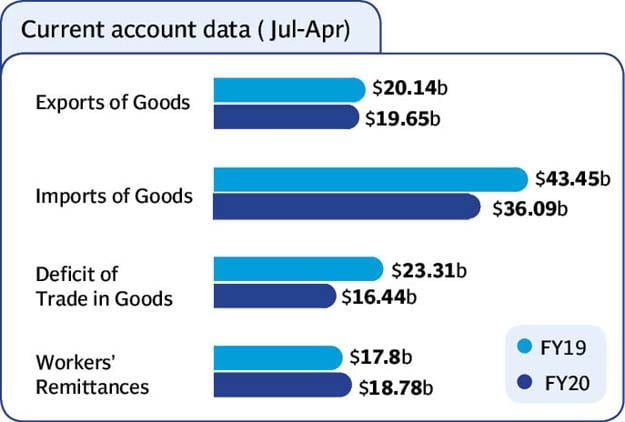

Imports of goods shrank 17% to $36.09 billion in the first 10 months of FY20 compared to $43.47 billion in the same period of last year.

Unfortunately, the export of goods decreased by 2.38% to $19.65 billion compared to $20.13 billion.

Luckily, workers’ remittances improved by 5.5% to $18.78 billion compared to $17.80 billion.

Outlook

Hashmi said an improvement in export earnings and workers’ remittances remains a must, but simultaneously remains challenging keeping in view the recession in the global economy due to the health crisis which is yet to see its end.

The overall aggregated demand has dropped and massive job cuts are seen in the global economy.

However, Pakistan’s single largest export earnings sector; the textile is reporting receipt of new export orders. The orders are including for protective suits for doctors and paramedical staff and other hospital-related stuff. “This is perhaps the result of the ongoing US-China trade war,” he added.

The orders may not be sufficient to offset the full impact of Covid-19 on the domestic economy.

The export order for textiles and other commodities may further improve if “we manage to efficiently control Covid-19 in Pakistan,” he said.

The IMF has projected the current account deficit at $6.6 billion for the next fiscal year starting July 1.

Published in The Express Tribune, May 22nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ