Despite pandemic, Pakistan's FDI soars 32% in April

In 10 months of FY20, foreign firms injected capital worth $2.28b

A Reuters file photo.

Foreign direct investment (FDI) rose 32% to $133.2 million in April 2020 compared to $100.8 million in the same month of the previous year, the State Bank of Pakistan (SBP) reported on Monday.

Although the volume of investment stood at an eight-month low in April, “what is encouraging is that investors have continued to pour fresh capital into ongoing projects in Pakistan despite the global economic recession under Covid-19,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary-General M Abdul Aleem remarked while talking to The Express Tribune.

Moreover, the nature of investment stands diversified. Companies from multiple countries have poured new investment, unlike Chinese firms which have been the only major investors in Pakistan in recent times.

FDI should improve in the months to come as countries are slowly lifting lockdowns in a bid to revive economic activities around the globe. Accelerating the activities, however, may remain a challenge in the absence of a coronavirus vaccine and medicines.

Cumulatively, in the first 10 months (July-April) of the current fiscal year, foreign firms injected FDI worth $2.28 billion, which was more than double the investment of around $1 billion in the same period of the previous year, according to the central bank.

Before the outbreak of Covid-19 late in February in Pakistan, foreign investors seemed poised to initiate new projects in the country. They, however, have put the projects on hold in response to the virus.

“In the recent past, some foreign companies made a new investment in food, energy, and telecom sectors in Pakistan,” Aleem said.

Country-wise FDI

Hong Kong emerged as the largest investor with net FDI of $28.4 million in April 2020, followed by the Netherlands that injected $24.5 million, the US $22.5 million, Malta $18.5 million, and the UK $10.5 million.

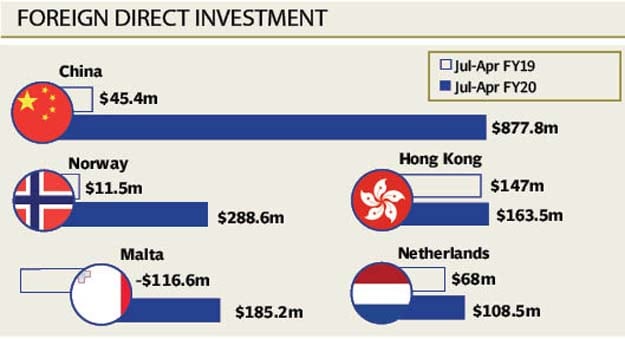

Cumulatively, in the first 10 months of FY20, China was the biggest investor, with FDI worth $877.8 million compared to $45.5 million in the same period of last year.

Norway stood second with $288.6 million, followed by Malta that injected $185.2 million in July-April FY20.

However, in the same period of the previous year, the UAE was the largest investor with a net investment of $159.7 million, followed by Hong Kong at $147 million, while Japan invested $95.8 million.

Sector-wise FDI

The oil and gas exploration sector attracted the largest foreign investment of $39.1 million in April 2020, followed by the financial sector that got an investment of $30.8 million, the communication sector $20 million, power sector $18.4 million, and chemical sector $14.9 million.

Cumulatively, in 10 months, power, communication, and oil and gas exploration sectors were the top three sectors that attracted significant investment.

Investment in stock market

Although foreign investors continued to remain net sellers at the Pakistan Stock Exchange (PSX) in the first 10 months of FY20, they slowed down selling compared to the same period of last year.

They offloaded stocks worth $182.7 million in July-April FY20 compared to $408.1 million in the same period of last year, according to the central bank.

Published in The Express Tribune, May 19th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ