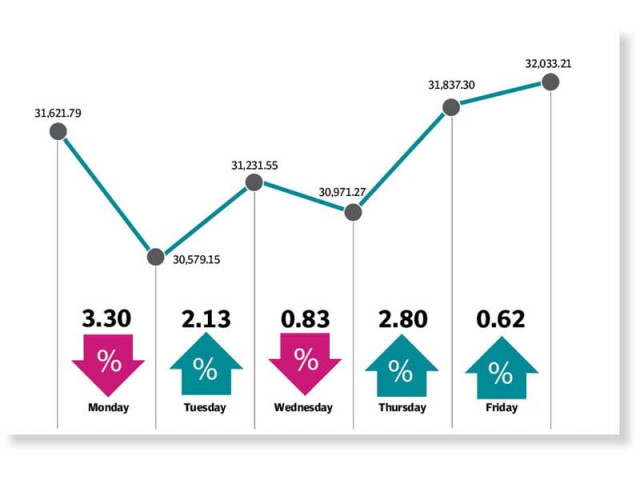

Weekly review: Bulls maintain control as KSE-100 rises 1.3%

Multiple international, local developments help benchmark index post gains

Trading during the week remained volatile as market participants reacted to positive and negative developments. The tally of COVID-19 cases crossed 1.5 million globally with more than 94,000 casualties; however, the sentimental impact of the virus on capital markets seemed to fade as the rate of increase in new cases diminished.

Trading began on a positive note on Monday morning as market participants lauded the announcement of a relief package worth Rs100 billion for the construction sector by Prime Minister Imran Khan at close of the previous week. However, the momentum could not be sustained and the sentiment quickly turned negative owing to a downward revision of Pakistan’s projected GDP growth by the World Bank and the Asian Development Bank, which caused the market to nosedive over 1,000 points.

KSE-100 falls 1,487 points on inflation fears

The market recovered partially during the next session after crude oil prices soared in hopes of an agreement of significant cut in oil production by OPEC+ followed by possibility of an energy sukuk issuance. A recovery in the international stock markets also fuelled investor sentiments.

The bourse turned bearish mid-week as news emerged that the third tranche of International Monetary Fund (IMF) $6 billion bailout package worth $450 million may be delayed.

Aiding the decline at the bourse, Mexico expressed disagreement over reduction in oil production by OPEC+ which caused oil prices to crash impacting the oil scrips.

During the next two days, the stock market rallied as IMF announced commitment to lend $1.4 billion to Pakistan in the coming week under the Rapid Financing Instrument to help improve the country’s financial condition and aid in combating the economic impact of the coronavirus.

Furthermore, the Financial Action Task Force (FATF) granted a five-month grace period to Pakistan to submit its performance report on the remaining benchmarks. In addition to this, oil price crash in the world markets lent support as investors anticipated a cut in the prices of oil products.

The outgoing week also saw the exploration and production sector outperform the benchmark index by 2.2% as it rose on anticipation of positive results from the meeting of major oil producing nations. The government also granted permission to key export-oriented industries to reopen from April 14 onward which provided the much needed clarity for investors.

Following prime minister’s announcement, the cement sector saw a positive movement which persisted for the rest of the week. “We expect the market to remain positive in the upcoming week as the government prepares to ease off lockdown in the country,” stated a report from Arif Habib Limited.

Investor participation remained subdued as traded volume declined by 18% week-on-week to 186 million shares while value traded per day declined by 8% week-on-week to $42 million.

Market watch: Bulls hold ground as KSE-100 crosses 32,000 mark

Sector-wise positive contributions came from oil and gas exploration companies (132 points), cement (78 points), fertiliser (71 points), insurance (70 points) and power generation and distribution (37 points). Meanwhile, sector-wise negative contribution came from automobile parts and accessories (20 points), tobacco (13 points) and textile composite (13 points).

In terms of scrips, positive contributions were led by Oil and Gas Development Company (127 points), Bank Al Falah (51 points), Hubco (49 points), Fauji Fertiliser (42 points) and DG Khan Cement (40 points).

Foreign selling continued this week clocking-in at $16.2 million compared to a net sell of $36.1 million last week.

Selling was witnessed in commercial banks ($5.9 million) and cement ($2.1 million). On the domestic front, major buying was reported by individuals ($9.4 million) and insurance companies ($5 million).

Published in The Express Tribune, April 12th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ