PSX reels from corona and oil shock

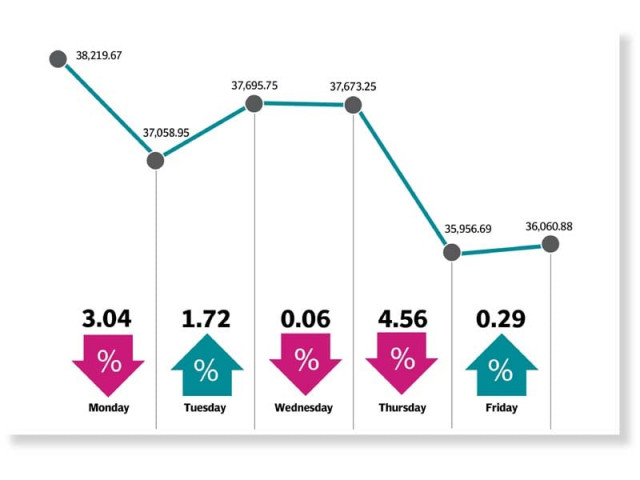

KSE-100 dives 2,159 points or 5.65% to finish at 36,061

PSX reels from corona and oil shock

However, this chaos was felt in financial markets across the globe as they were rocked by looming repercussions of the virus and the crash in oil prices. Prices for crude oil tumbled as much as 23% after Saudi Arabia launched a price war with Russia, sending already jittery investors fleeing for the safety of bonds and the yen.

Saudi Arabia had stunned markets with plans to raise its production significantly after the collapse of OPEC’s supply cut agreement with Russia - a grab for market share reminiscent of a drive in 2014 that sent prices down by about two-thirds.

Reacting to the tumble in global stocks and crude prices, trading at the PSX kicked off on a bearish note on Monday as stocks witnessed a bloodbath in what was a historic rout for the market. Stocks had come in for heavy battering as the benchmark KSE-100 index crashed by nearly 6% during intra-day trading, recording the largest daily slump in history. This was also the first time that a trading halt had been triggered due to the sharp decline.

Despite heavy losses, the index took a dramatic turn and rebounded to finish over 600 points in the green, taking cues from the bull-run in global equities and a rise in international crude oil prices. Investors were also cautiously optimistic over expectations of a cut in interest rate, keeping in view decline in inflation.

Unfortunately, the rally was short-lived as depreciation of the rupee against the US dollar and volatility in global markets dragged the index into red. The trend continued and stocks once again came under the hammer following a travel ban by the US on most European countries. The development elicited a strong response from world markets, which witnessed a meltdown following confirmation of the World Health Organization (WHO) of the classifying the virus as a pandemic.

Fears of further disruption in global supply chains and the threat of a looming recession sent the markets into freefall. Meanwhile, the last trading session of the week endured a rather interesting session, with the index recovering from a slump of over 1,600 points to finish on a positive note.

Participation ticked up as average volumes increased 9% week-on-week to 264 million while average value traded jumped 25% to $81 million.

In terms of sectors, negative contributions came from commercial banks (706 points), oil & gas exploration companies (650 points) and fertilisers (317 points). Positive contributions came from pharmaceuticals (35 points).

Scrip-wise, negative contributions were led by PPL (262 points), HBL (177 points), and ENGRO (167 points) while positive contributions were led by SEARL (30 points), and INDU (20 points).

Foreign selling continued this week clocking-in at $23 million compared to a net sell of $16.7 million last week. Selling was witnessed in cements ($8.2 million) and exploration & production ($6.2 million).

On the domestic front, major buying was reported by insurance companies ($25.2 million) and banks/DFIS ($6 million).

Published in The Express Tribune, March 15th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ