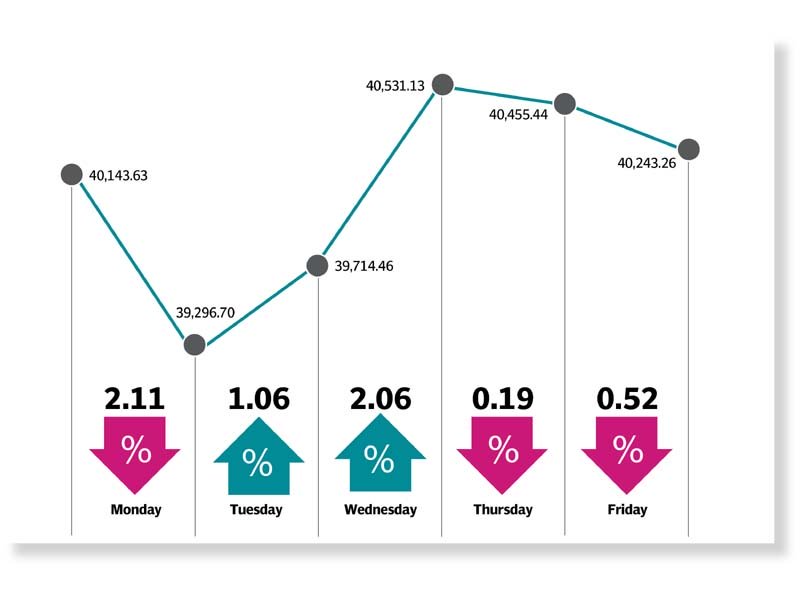

The KSE-100 index managed to gain 100 points to close the week at 40,243 points. “This is not surprising after a 7% decline in the index over the past four weeks,” stated JS Global analyst Ahmed Lakhani.

Concerns over the rising inflation and 12-month T-bill yield coupled with turmoil in global markets also wreaked havoc during the week. Trading kicked off on a bearish note as the index plummeted below 40,000 following fears of investors about impact of Chinese coronavirus outbreak on the global economy.

However, the tables turned in the following session as the index managed to post a handsome recovery on back of improved investor sentiments in global markets due to news of fewer fresh cases of corona virus being reported.

Meanwhile, on the domestic front the prime minister’s announcement of a relief package to tackle inflation and the Federal Board of Revenue Chairman Shabbar Zaidi’s statement denying rumours of his resignation also fuelled the rally at the Pakistan Stock Exchange.

This upbeat mood continued as investors opted to buy stocks in sectors across the board amid growing institutional interest ahead of announcement of major financial results. On the other hand, bullish global equities and surging crude prices also lent support to the index.

Unfortunately, the positive momentum could not be sustained as the index retreated into the red zone in the last two sessions of the week. Investors remained subdued as talks between the IMF and the government continued with no major break-through. Participants took position on the sidelines as they anticipated imposition of further tariffs and taxes.

Participation remained stable with volumes at 168 million, while average value traded dipped 11% week-on-week clocking-in at $40 million.

In terms of sectors, positive contribution was led by commercial banks (123 points), cement (63 points), power generation and distribution (55 points), tobacco (24 points) and insurance (-12 points). Scrip-wise, positive contributions were led by HBL (92 points), Hubco (83 points), Lucky Cement (45 points), MCB (39 points) and Pakistan Tobacco Company (24 points).

Foreign selling continued this week and clocked-in at $11.2 million compared to a net selling of $14.2 million. Selling was witnessed in commercial banks ($3.6 million) and exploration and production ($3.1 million). On the domestic front, major buying was reported by insurance companies ($8.8 million) and other organisations ($5.6 million).

Other major news of the week included; OGDC’s announcement of beginning commercial production from Dhok Hussain Gas Field, remittances grew to $13.3 billion in July-January and foreign currency reserves held by the SBP increased $157 million at $12,430.8 million.

Published in The Express Tribune, February 16th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1725030039-0/Untitled-design-(2)1725030039-0-165x106.webp)

1732084432-0/Untitled-design-(63)1732084432-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ