Business review: A look back at top picks in 12 months

If 2018 was shrouded in uncertainty, 2019 brought much-needed clarity.

A Reuters illustration.

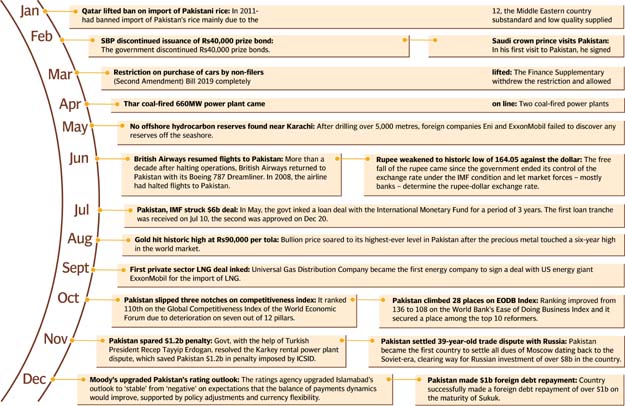

January

Qatar lifted ban on import of Pakistani rice: In 2011-12, the Middle Eastern country had banned import of Pakistan’s rice mainly due to the substandard and low quality supplied by exporters. However, following PM Imran’s visit to Doha, the Qatari government agreed to lift the ban.

February

SBP discontinued issuance of Rs40,000 prize bond: The government discontinued Rs40,000 prize bonds. However, bondholders can encash their bonds till Mar 31, 2020.

Saudi crown prince visits Pakistan: In his first visit to Pakistan, he signed investment agreements worth $20b.

March

Restriction on purchase of cars by non-filers lifted: The Finance Supplementary (Second Amendment) Bill 2019 completely withdrew the restriction and allowed non-filers to buy new vehicles of any engine capacity.

April

Thar coal-fired 660MW power plant came on line: Two coal-fired power plants of 330MW each were inaugurated in the desert district.

May

No offshore hydrocarbon reserves found near Karachi: After drilling over 5,000 metres, foreign companies Eni and ExxonMobil failed to discover any reserves off the seashore.

June

British Airways resumed flights to Pakistan: More than a decade after halting operations, British Airways returned to Pakistan with its Boeing 787 Dreamliner. In 2008, the airline had halted flights to Pakistan.

Rupee weakened to historic low of 164.05 against the dollar: The free fall of the rupee came since the government ended its control of the exchange rate under the IMF condition and let market forces – mostly banks – determine the rupee-dollar exchange rate.

July

Pakistan, IMF struck $6b deal: In May, the govt inked a loan deal with the International Monetary Fund for a period of 3 years. The first loan tranche was received on Jul 10, the second was approved on Dec 20.

August

Gold hit historic high at Rs90,000 per tola: Bullion price soared to its highest-ever level in Pakistan after the precious metal touched a six-year high in the world market.

September

First private sector LNG deal inked: Universal Gas Distribution Company became the first energy company to sign a deal with US energy giant ExxonMobil for the import of LNG.

October

Pakistan slipped three notches on competitiveness index: It ranked 110th on the Global Competitiveness Index of the World Economic Forum due to deterioration on seven out of 12 pillars.

Pakistan climbed 28 places on EODB Index: Ranking improved from 136 to 108 on the World Bank’s Ease of Doing Business Index and it secured a place among the top 10 reformers.

November

Pakistan spared $1.2b penalty: Govt, with the help of Turkish President Recep Tayyip Erdogan, resolved the Karkey rental power plant dispute, which saved Pakistan $1.2b in penalty imposed by ICSID.

Pakistan settled 39-year-old trade dispute with Russia: Pakistan became the first country to settle all dues of Moscow dating back to the Soviet-era, clearing way for Russian investment of over $8b in the country.

December

Moody’s upgraded Pakistan’s rating outlook: The ratings agency upgraded Islamabad’s outlook to ‘stable’ from ‘negative’ on expectations that the balance of payments dynamics would improve, supported by policy adjustments and currency flexibility.

Pakistan made $1b foreign debt repayment: Country successfully made a foreign debt repayment of over $1b on the maturity of Sukuk.

Published in The Express Tribune, January 1st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ