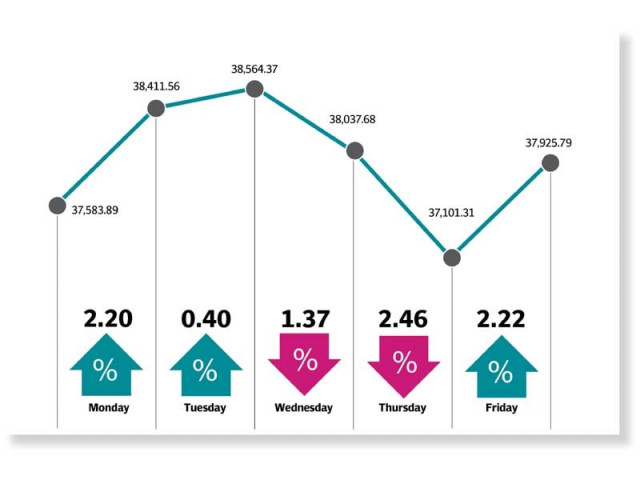

Weekly review: KSE-100 advances amid roller-coaster week

Improving economic indicators boost investors’ confidence

Trading kicked off on an upbeat note as bulls dominated the local bourse on back of Lahore High Court’s decision to remove former prime minister Nawaz Sharif’s name from the Exit Control List (ECL), which permitted him to travel abroad for medical treatment. The decision acted as a catalyst for investors who took to buying stocks in droves, thus pushing the benchmark index above the 38,000 mark at a seven-month high.

The confidence in business climate and approval from the International Monetary Fund (IMF) to issue sovereign guarantees worth Rs250 billion for tackling circular debt helped the bullish trade continue. However, the long bull-run came to an end mid-week as bears rushed in amid profit-taking, implementation of axle load policy and higher inflationary readings causing concerns over delay in central bank’s policy rate cut.

Stocks received further battering on Thursday as the index nosedived over 900 points in a correction phase following a prolonged rally and in the wake of expectations that the central bank would maintain status quo in the monetary policy. During the week, investors opted to book profits, which kept equities under pressure, coupled with rising T-bill yields in three month and 12 month paper led index to two consecutive negative sessions, depleting 1,463 points cumulatively.

Fortunately, the fear was temporary as a steep rally was witnessed in the last trading session of the week. Participants shed their nervousness over the monetary policy announcement following State Bank of Pakistan Governor Reza Baqir’s comments hinting at maintaining the status quo in the monetary policy. This provided much-needed clarity and helped the bourse trade in the green zone.

The improved sentiment was seen due to the view that the economy is finally reaching stabilisation after painful consolidation measures. Another positive for the equity market was the current account finally eking out a surplus after a lengthy period of 3.5 years.

Activity crawled up as average volumes improved 6% week-on-week to 331 million, while average value traded jumped 15% week-on-week at $74 million.

In terms of sectors, positive contributions came from power generation and distribution (up 140 points), fertiliser (102 points), and oil and gas marketing companies (66 points). On the other hand, commercial banks (down 74 points), transport (15 points), and refinery (11 points) dragged the index lower.

Scrip-wise, positive contributions were led by HUBC (132 points), FFC (94 points), PSO (40 points), LUCK (32 points) and NATF (29 points).

Foreigners remained net buyers of $8.5 million compared to a net buy of $4.2 million last week. Buying was witnessed in commercial banks ($6.7 million) and fertiliser ($3.6 million). On the domestic front, major selling was reported by banks/DFIs ($15.2 million) and insurance companies ($2.6 million).

Other major news; PIA acquired two A320 aircraft on dry lease, Ufone, PTCL announced joint major restructuring, govt engaged OGDC, PPL, MPCL to explore four blocks, Chinese company to invest $250 million in Service Industries, and D G Khan Cement planned expansion.

Published in The Express Tribune, November 24th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ