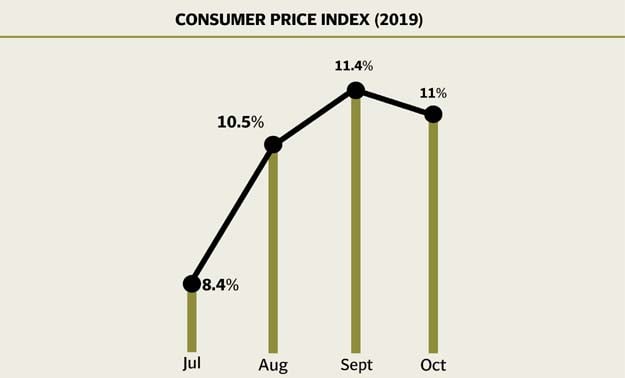

In Pakistan, inflation drops slightly to 11% in Oct

Chances for monetary easing remain remote due to second round of inflationary pressure

A shopping cart is pushed down the aisle in this REUTERS photo illustration.

For the third consecutive month, the headline inflation, called the Consumer Price Index (CPI), remained in double digits and stood at 11% in October 2019 compared to the same month of previous fiscal year, reported the Pakistan Bureau of Statistics (PBS) on Wednesday.

The inflation reading for October, which came after a delay of about one week, was slightly lower than September’s figure of 11.4%. Similarly, the core inflation, calculated after excluding energy and food prices, slowed down to 7.7% in October compared to 8.4% in the preceding month, it added.

The key reason behind the double-digit inflation for the third consecutive month was the spike in prices of food, energy and transport charges, showed the PBS bulletin.

Federal authorities expect the inflation rate to hit 12% in November even if prices of perishable food items come down due to the low base effect. Core inflation decelerated for the second consecutive month to 7.7% in urban areas and remained at 8.6% in rural areas in October. It is unlikely that the central bank will change its tight monetary policy despite a 5.55% difference between the core inflation and key policy rate of 13.25%. High interest rates have affected industrial expansion, hurting prospects for economic growth.

As against earlier policy of the central bank to set the monetary policy while keeping in view the core inflation, the State Bank of Pakistan has now shifted to the headline inflation projection for determining the policy rate. It has projected the headline inflation will remain within a range of 11-12% and has set the interest rate at 13.25%.

Average inflation in first four months of the current fiscal year came in at 10.31% compared to 6.2% in the same period of previous year, according to the PBS. Food inflation in both urban and rural areas stood high at 13.7% and 14.6% respectively on a year-on-year basis. Non-food inflation was in single digit at 9.3% in urban areas and 8.7% in rural areas, according to the PBS.

The central bank’s tight monetary policy has had no effect on prices of food items, which are increasing because of supply shocks, increase in sales tax and monopoly of a few businesses. Overall, prices in the non-perishable food item group increased 15% while prices of perishable food increased almost 11.4% in October over a year ago. Inflation reading for the alcoholic beverages and tobacco group surged 35.2% and clothing and footwear by 20.4% due to the Pakistan Tehreek-e-Insaf (PTI) government’s move to impose 17% sales tax on the sale of clothing items.

Inflation rate in the transport group surged 16.5% on the back of increase in motor fuel and high-speed diesel prices. The highest increase was recorded in onion prices, which surged 131% in urban areas, followed by a 55% increase in gas prices, 46% in pulse moong, 45% in potatoes, nearly 40% in fresh vegetables and 34.6% in sugar.

Motor fuel prices rose almost 21% while vehicles became expensive by 15.6% in October over a year ago. Prices of motor vehicle accessories increased almost 18% due to the imposition of sales tax.

Cooking oil rates increased 18.4% and vegetable ghee prices rose 17.8% due to the government’s decision to impose sales tax on the industry.

Published in The Express Tribune, November 7th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ