Large-scale manufacturing contracts 6% in Jul-Aug

It signals deeper economic slowdown that will increase unemployment

Representational image. PHOTO: REUTERS

Large-scale manufacturing (LSM) output decreased 6.04% in July-August of the current fiscal year compared to the same period of the previous year, the Pakistan Bureau of Statistics (PBS) reported on Wednesday.

The pace of contraction almost doubled in one month as big industries had recorded negative growth of 3.3% in July. Owing to the poor output, the share of LSM in the total national output plunged to a 19-year low at 10.1%.

Out of 15 major industries, 10 recorded negative growth while the textile sector had less than 1% growth in output, according to PBS. The slowdown was steeper in August as the LSM sector contracted 7.1% over the same month of the previous year, according to the PBS.

The continued slump in large industries, which heavily contribute to the government’s revenue collection, job creation, and poverty reduction efforts, has affirmed the apprehension that the country is going to pass through a prolonged economic slowdown.

In order to bring the widening current account deficit and budget deficit at manageable levels, the government has been implementing economic stabilisation policies.

A recent report of the International Monetary Fund (IMF) has projected a slight increase in the unemployment rate in Pakistan in the current fiscal year. In a separate report, the World Bank has warned that for the first time in the past 18 years, poverty reduction has stalled in Pakistan.

The international financial institutions have projected 2.4% gross domestic product (GDP) growth rate for the current fiscal year, which is equal to the population growth rate and less than the pace in the last fiscal year. Low growth means there will be an increase in unemployment and poverty.

Prime Minister Imran Khan won the July 2018 elections on the promise of creating 10 million new jobs and constructing five million houses at affordable prices - a dream shattered at the end of the first year of the Pakistan Tehreek-e-Insaf (PTI) government.

A large number of businesses - mainly those belonging to energy and agriculture sectors - have stopped paying off debt to banks due to economic slowdown amid a massive hike of 7.5% in the benchmark interest rate since January 2018 to an eight-year high at 13.25% at present, according to a report published in The Express Tribune on Tuesday.

Non-performing loans (NPLs) increased 13% to Rs768 billion in the first half of the current calendar year ended June 30, 2019, the State Bank of Pakistan (SBP) said in the Mid-Year Performance Review of the Banking Sector (January-June 2019).

A one-percentage-point increase in the interest rate reduces investment by 0.7%, according to Dr Ayesha Ghaus Pasha, Pakistan Muslim League-Nawaz’s (PML-N) member of the National Assembly and former finance minister of Punjab.

At present, the real interest rate is positive by 5.05%, which is far above the core inflation rate of 8.2%.

Of the 15 major LSM sectors, five registered some growth and 10 saw a contraction in the July-August period, according to data released by the national statistics agency.

Data collected by the Oil Companies Advisory Committee (OCAC) showed that 11 types of industries registered on average 1.2% negative growth in the first two months of the current fiscal year.

The Ministry of Industries, which monitors 15 industries, reported a 3.9% decline in the growth of these industries. Similarly, the provincial bureaus reported about 1% contraction in 11 industries.

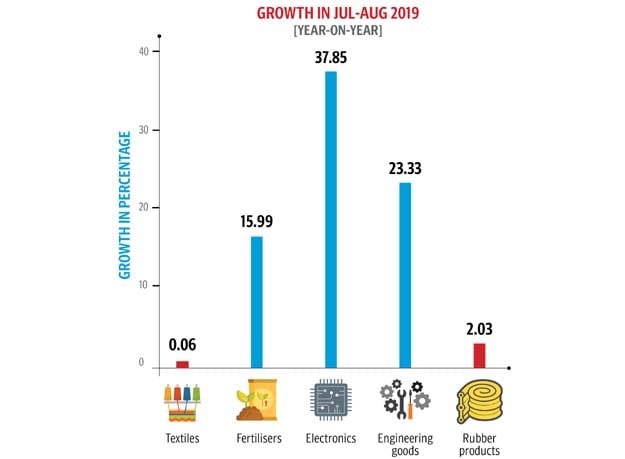

Sectors that posted growth on an annual basis included textile which grew just 0.06%, fertiliser which exhibited 16% growth and electronic goods which recorded 37.8% growth in the first two months of the current fiscal year. Manufacturing of engineering products increased 23.3% and rubber products 2% during the July-August period.

Industries that were producing 10 major types of goods recorded a dip in their manufacturing in July-August 2019. The production of food, beverages, and tobacco went down 12.6%, coke and petroleum products 17.7%, pharmaceuticals 14.4% and chemicals 8.3%.

Non-metallic mineral products saw a dip of 4.3% and the automobile sector registered a reduction of over 30% due to almost 50% increase in prices by local assemblers, which kept their vehicles out of the reach of consumers. The production of iron and steel products dropped 16.5% and paper and board by almost 1%. The output of the wood producing sector went down 33%, indicating a massive slowdown.

Published in The Express Tribune, October 24th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ