Pakistan's current account deficit narrows to 41-month low

Deficit contracts 80% to $259m in September, but at cost of economic growth

PHOTO: FILE

The deficit stood at $1.27 billion in the same month of last year, the State Bank of Pakistan (SBP) reported on Friday.

The measures taken by the central bank to aggressively cut unwanted imports through a significant hike in the benchmark interest rate and attempts to revive exports and earn higher remittances through rupee depreciation helped bring down the current account deficit. The measures, however, have adverely impacted the growth of gross domestic product (GDP) at the same time.

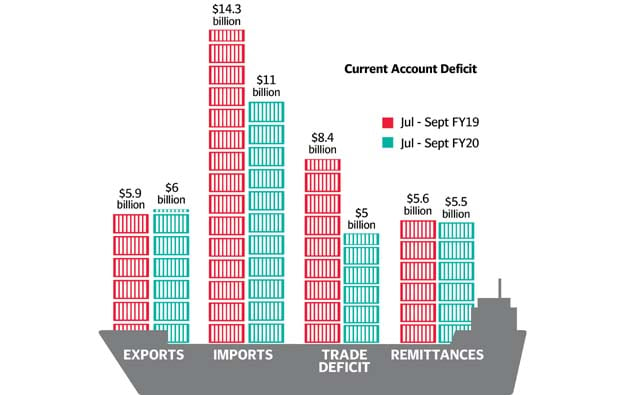

In the first quarter (July-September) of the current fiscal year 2020, the current account deficit fell by 64% to $1.54 billion compared to $4.28 billion in the same quarter last year.

Alpha Beta Core CEO Khurram Schehzad said that the current account deficit has been reduced with a massive cut in imports through the rate hike. The hike has also led to improvement in foreign currency reserves. However, this is one side of the achievement.

Traders, businessmen must remain apolitical for Pak-Afghan trade to flourish

"The measures (rate hike and rupee depreciation) are now hurting economic growth in the absence of import substitutes," he said.

"The government needs to create an enabling environment to attract investment (both local and foreign) in import substitution and human resource capacity building to let the economic growth accelerate. Otherwise, the current account deficit would again widen to unsustainable level when the authorities concerned soften interest rate to let some economic growth happen in the future," he said.

Over 75% of all imports are essentials. They are raw material for export industries and their domestic substitutes remain absent. "Such imports cannot be controlled through interest rate hike or currency devaluation which have caused slowdown in the economy, which is indeed a bad strategy," he remarked.

The central bank has projected economic growth of 3.5% during the current fiscal year 2020. The International Monetary Fund (IMF), which is closely monitoring Pakistan's economic indicators under its loan programme worth $6 billion that started in July, anticipated the growth at 2.4% for the year. The GDP growth fell to a nine-year low of 3.3% in the previous fiscal year ended June 30, 2019.

Schehzad said that fiscal improvement through generating higher tax revenues and lower expenses may allow the government to invest in import substitutes and human resource capacity building. To recall, the central bank has increased the benchmark interest rate by 7.5% in the past two years to an eight-year high at 13.25% at present.

Besides, it let the rupee depreciate 52% in the previous two years to Rs160.05 to the US dollar as on June 30, 2019. However, it has recovered 2.59% to Rs155.90 since the beginning of the current fiscal year on July 1, 2019.

Traders oppose hike in municipal taxes, fees

The SBP reported the import of goods dropped 23% to $11.032 billion in the quarter ended September 30, 2019, compared to $14.27 billion in the same quarter of last year.

Exports inched up 2.37% to $6.03 billion in the quarter compared to $5.89 billion in the corresponding quarter. Experts said that exports have increased in volumetric terms, but remained low value-wise. An increase in export prices seems difficult due to economic slowdown across the world under the ongoing US-China trade tension.

Remittance inflows, however, slowed down 1.42% to $5.47 billion compared to $5.55 billion. Experts saw the slowdown as a temporary phenomenon and anticipated over 10% growth during the current fiscal year.

Published in The Express Tribune, October 19th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ