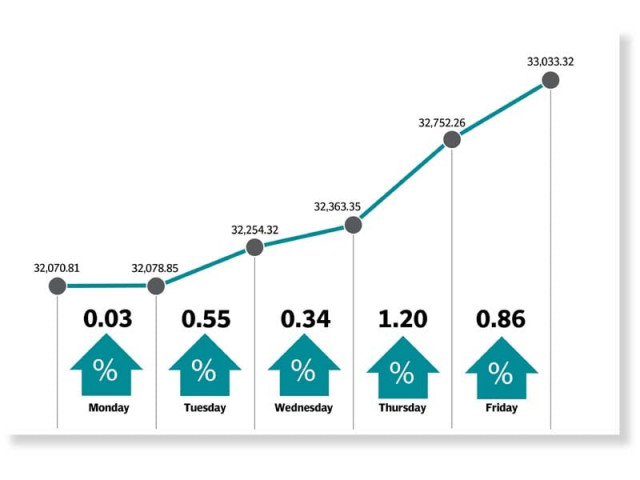

KSE-100 jumps 962 points as confidence rises

Volumes surge significantly; index finishes all five sessions in green

KSE-100 jumps 962 points as confidence rises

The buoyancy was in stark contrast to the trend seen in the preceding week and was largely led by improved investor confidence.

News regarding the increase in tax collection in 1QFY20 sparked buying interest. Moreover, the anticipation of an increase in cement prices in the northern region also acted as a catalyst for the cement sector and helped the index march upwards.

At a recent event, the central bank governor’s remarks about the current International Monetary Fund (IMF) loan programme being the last one also helped boost investor confidence. However, the investors remained cautious in terms of the country’s economic situation and the inflation reading for September.

Later in the week, a meeting of the business community with the army chief and separately with Prime Minister Imran Khan further helped the bourse to make a handsome recovery.

Sentiment improved markedly due to anticipation of remedial measures for addressing the outstanding economic issues, pushing volumes to a new high for the calendar year 2019. Despite a decline in international crude oil prices, the stocks of oil and gas exploration companies resisted the pressure.

The overall positivity in the investment climate was supported by higher volumes. Market activity jumped significantly during the week as average daily trading volumes went up 106% to 223 million shares while the average daily traded value surged 58% to $40 million.

In terms of sectors, positive contribution came from commercial banks (up 231 points), cement companies (189 points), power generation and distribution firms (96 points), oil and gas marketing companies (93 points) and fertiliser producers (68 points).

“Cement companies remained in the limelight after a hike in cement prices by Rs10-15 per bag coupled with the expectation of double-digit growth in cement sales for September 2019,” stated a Topline Securities’ report.

The stock-wise positive contribution was led by HBL (up 103 points), Hubco (52 points), Engro (51 points), DG Khan Cement (50 points) and NBP (50 points).

Foreign selling continued during the week, which came in at $4.7 million compared to net selling of $8.8 million last week. Selling was witnessed in commercial banks ($4.6 million) and food and personal care companies ($1.7 million). On the domestic front, major buying was reported by other organisations ($4.9 million) and individuals ($4.4 million) while banks and insurance firms were net sellers of $4.13 million and $4.75 million respectively.

Other major news of the week included petroleum product prices were left unchanged, Suzuki raising Alto 660 and bike prices, K-Electric signing a $50-million loan pact, the government making an Rs1.66-per-unit hike in power tariff and Chinese company setting up a ceramics unit.

Published in The Express Tribune, October 6th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ