Inflation rises 11.4% on hike in food, energy prices

Core inflation decelerates to 8.4% in urban areas, remains static at 8.8% in rural areas

A shopping cart is pushed down the aisle in this REUTERS photo illustration.

The pace of inflation, measured by the Consumer Price Index (CPI), increased to 11.4% in September over a year ago, stated the Pakistan Bureau of Statistics (PBS) on Wednesday. There was an increase of 0.9% as compared to the preceding month.

However, the core inflation - measured by excluding the impact of food and energy prices - slightly decelerated to 8.4% in urban areas and remained static at 8.8% in rural areas. State Bank of Pakistan Governor Dr Reza Baqir had recently changed the central bank’s target rate for determining the policy rate.

As against the earlier policy of setting the monetary policy rate while keeping in view the core inflation, the SBP has now shifted to the projection for headline inflation for determining the policy rate. It has projected the headline inflation in the range of 11-12% and set the interest rate at 13.25%.

Had the central bank not changed its policy, there would have been a strong case to cut the interest rate due to stable core inflation in the past three months.

The September inflation rate was in line with the central bank’s inflation projection.

The government had last month changed the inflation calculation methodology and the 11.4% rate has been calculated on the basis of the new methodology. When calculated with the old methodology and old base year of 2007-08, the rate of inflation in September would be 12.55%. However, on the basis of both the methodologies, the rate of inflation is increasing.

The inflation in urban areas recorded an increase of 11.6% while in rural areas, it rose 11.1% in September over a year ago.

The chief economist of the central bank said on Tuesday that inflation would start receding from the second half of the current fiscal year.

A special panel of the National Assembly, set up to suggest measures to contain inflation, has called for stability in the exchange rate, reduction in the monetary policy rate, the introduction of a meaningful cut in current expenditure, reduction in indirect taxes on basic consumption goods and reduction in utility prices.

The special panel has also discouraged the policy of attracting hot foreign money by keeping the interest rate “artificially high”.

There was some scope to bring down the policy rate from 13.25% since the core inflation remained at around 8.5%, according to the special panel headed by Pakistan Muslim League-Nawaz (PML-N) member of the National Assembly Dr Ayesha Ghaus Pasha.

Her views were reinforced on Wednesday when core inflation stood at only 8.4% compared to September 2018.

Now, the real interest rate, when worked out on the basis of core inflation, is positive by 4.9%. Bank spread increased significantly in the first half of the current calendar year due to the high-interest rate.

Average inflation in the first quarter of the current fiscal year stood at 10.08% compared to 6.1% in the same period of the previous year, according to PBS.

Causes of inflation

Food inflation in both urban and rural areas increased 15% from over a year ago while non-food inflation remained in single digit at 9.7% in urban areas and 8% in rural areas, according to the PBS.

Out of 19 major items that saw an increase in September over last year, 14 were related to food in the urban areas. The central bank’s tight monetary policy has had no effect on the prices of food items, which are increasing because of supply shocks, increase in sales tax and monopoly of a few businesses.

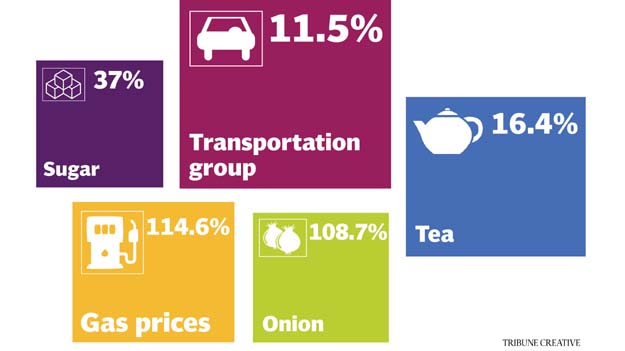

The maximum increase was recorded in gas prices, which surged 114.64% in urban areas followed by 108.7% surge in prices of onion, 79.4% in chicken, 46.8% in moong pulse, 38% in cigarettes, 37% in sugar, 36.2% in potato and 22% in petrol. The increase in sugar prices once again underlines the monopoly in the sector that the Pakistan Tehreek-e-Insaf government has failed to break due to its influence in power corridors.

Cooking oil prices increased 20.3%, construction inputs 19%, vegetable ghee 18.3%, tea prices 16.4%, doctors’ fee 15.8%, masoor pulse 13.4%, meat 12.7%, wheat flour 12.3% and transport services 11.5%.

Published in The Express Tribune, October 3rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ