Pakistan gets $1.5b worth of foreign loans in Jul-Aug

Disbursements picking up following signing of IMF loan programme

PHOTO: REUTERS

Foreign disbursements have started picking up following signing of the International Monetary Fund (IMF) loan programme, which seeks $38 billion in foreign funding over three years to keep Pakistan afloat.

Bilateral and multilateral creditors and commercial banks disbursed $1.49 billion in loans in the July-August period of the fiscal year 2019-20, according to statistics compiled by the Ministry of Economic Affairs.

The disbursements were higher by $774 million or 108% compared with loans of $714 million received in July-August FY19.

In addition to loans of $1.5 billion, Pakistan also obtained $132.3 million worth of foreign grants from the United Kingdom, the United States, and Japan.

The $1.5 billion in loans were equal to 11.5% of the projected $13-billion borrowing that the Pakistan Tehreek-e-Insaf (PTI) government targeted to secure in the current fiscal year in a bid to meet current account deficit and debt repayment requirements.

In its first year in power, the PTI government had acquired $16 billion worth of external loans.

The financing requirement for the current account deficit has started going down but still, the government will need roughly $8 billion in this fiscal year to fill the gap. Pakistan’s gross external financing needs have been assessed at a minimum of $25.6 billion by the IMF for the current fiscal year. The assessment is based on the projected current account deficit of $6.6 billion in the year.

However, State Bank of Pakistan (SBP) Deputy Governor Jameel Ahmad said on Friday that the current account deficit may remain around $8 billion.

During July-August FY20, Pakistan registered a $1.3-billion current account deficit, down 53% compared to the same period of the previous fiscal year. Owing to the $13.5-billion current account deficit and nearly $11 billion worth of loan repayments in the last fiscal year, Pakistan borrowed a whopping $16 billion through foreign loans in the year aimed at avoiding default on international debt obligations and financing imports.

The borrowing of $1.5 billion in July-August FY20 included $321.5 million in commercial loans and $500 million in first budgetary support from the Asian Development Bank (ADB) after the signing of IMF deal.

Disbursements by bilateral lenders stood at $272 million or 18% of total loans. Saudi Arabia gave $108 million for import of Saudi goods.

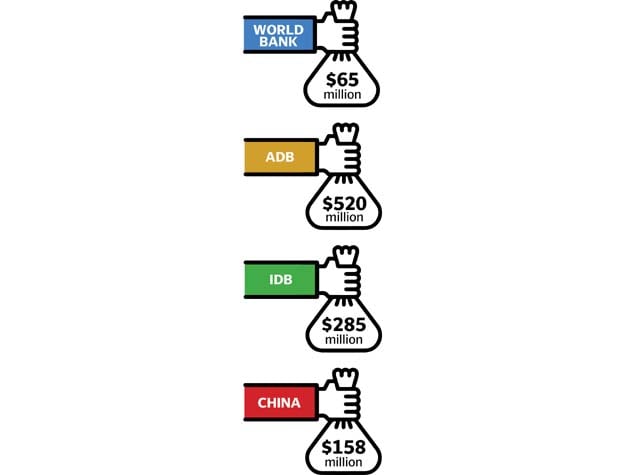

China disbursed $158.3 million in project financing in the first two months of FY20, nearly 47% less than the comparative period of last year. Chinese project financing has slowed down due to the completion of many China-Pakistan Economic Corridor (CPEC) schemes.

Beijing disbursed $27.2 million for the Havelian-Thakot road project and $68.2 million for the Sukkur-Multan motorway that has been completed and awaiting inauguration by Prime Minister Imran Khan.

CPEC was affected the most by the stringent conditions of the IMF loan programme. Owing to the tough loan terms, the roughly $9-billion Mainline-I railway project of CPEC is unlikely to be executed in the near future.

Pakistan received $321.5 million in relatively expensive commercial loans, which were over 21% of the total disbursements. There was almost fivefold increase in loan disbursements by commercial banks. Pakistan has estimated receiving $2 billion in commercial loans during the current fiscal year.

Citibank gave $148.2 million in short-term term finance facility to the government last month. Dubai Bank and a consortium led by Credit Suisse disbursed $173 million worth of loans in July at floating London Interbank Offered Rates.

SBP Governor Dr Reza Baqir is trying to lure risky hot money from Citibank into government securities.

The hot foreign money provides temporary cushion for the foreign exchange reserves but it creates more uncertainty when investors start pulling out their money due to a reduction in interest rate.

Sakib Sherani, the former economic adviser to the Pakistan Peoples Party government, stated on Friday that Baqir attended a Citibank-sponsored conference in London in order to secure hot foreign money.

Loan disbursements by multilateral creditors kept growing last month and the country received $896 million from them, which was 60% of the total disbursements.

The Islamic Development Bank disbursed $285 million under the oil credit facility out of the total of $551 million. The ADB disbursed $520 million during the first two months of FY20 mainly on account of the programme loan. Pakistan has budgeted $1.7 billion in ADB funding, although it expects to receive more than $2.2 billion.

The World Bank has released $65 million so far against the annual estimate of close to $1.2 billion.

The government has begun the process of hiring financial advisers for floating long-term security papers in the international debt market. It plans to raise $3 billion by floating Eurobonds and Sukuk.

Published in The Express Tribune, September 22nd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ