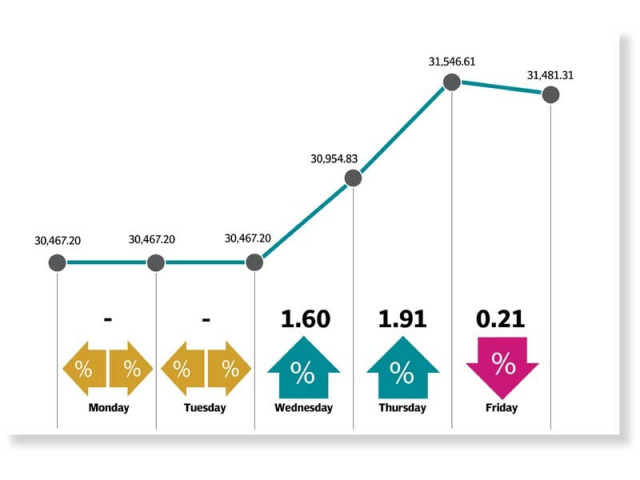

Weekly review: KSE-100 advances for second straight week

Benchmark index gains 3.3% largely due to expectations of monetary policy easing

“For the second consecutive week, the index provided positive weekly return of 3.3%, taking the return for two weeks to 6.1%,” stated a Topline Securities’ report.

The KSE-100 index soared on expectations of a rate cut in the monetary policy due to be announced on Monday and less-than-expected inflation among other economic developments.

The government had tightened the monetary policy in the past year to fix the external imbalance but with good, came the bad. This move also dampened domestic demand and added to the companies’ financial woes. The week kicked off on a positive note at the stock market on Wednesday as the bourse remained closed for the first two days of the week on account of Ashura.

The index extended gains from the preceding session and surged on positive expectations from the Financial Action Task Force (FATF) meeting in Bangkok. Moreover, increasing global crude prices in anticipation of further output cuts by major oil producers boosted investor sentiment. The rally continued in full swing as the index rose steadily in the following session as well. The spike was mainly due to signs of monetary easing as reflected in the fall in the treasury bills’ yield.

The development pushed the index up by nearly 900 points in intra-day trading but profit-booking partially wiped off earlier gains. Additionally, buying by certain provincial funds also lent support to the index.

Sadly, the winning streak did not last long and the index fell into the red zone amid range bound trading and an overall lack of positive triggers. Investors succumbed to the selling pressure and opted to book profits.

Investor participation surged as average daily trading volumes went up 39% week-on-week to settle at 130 million shares, while average daily traded value jumped 70% to $38 million.

In terms of sectors, positive contribution came from commercial banks (up 270 points), oil and gas exploration companies (213 points), fertiliser firms (196 points), power generation and distribution companies (95 points) and cement producers (86 points).

Stock-wise, positive contribution was led by Pakistan Petroleum Limited (up 122 points), Oil and Gas Development Company (89 points), Lucky Cement (84 points), UBL (75 points) and Fauji Fertiliser Company (72 points).

According to a report of Arif Habib Limited, foreign buying was recorded at $1.01 million during the week compared to net selling of $5.32 million last week. Buying was witnessed in exploration and production stocks ($1.4 million) and cement stocks ($1 million).

On the domestic front, major selling was reported by individuals ($4.8 million) and banks/DFIs ($4.5 million).

Other major news of the week included car sales plunging 41% in August, State Bank selling Rs467 billion worth of treasury bills with a fall in yields, top court deciding to take up the GIDC case on September 19, the SBP governor saying the economy was on the mend and foreign currency reserves held by the central bank reaching a 17-week high at $8.46 billion.

Published in The Express Tribune, September 15th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ