Pakistan gets $440m worth of fresh loans in July

Financing source gradually shifts from China to multilateral creditors due to completion of CPEC projects

A US Dollar note is seen in this Reuters illustration photo.

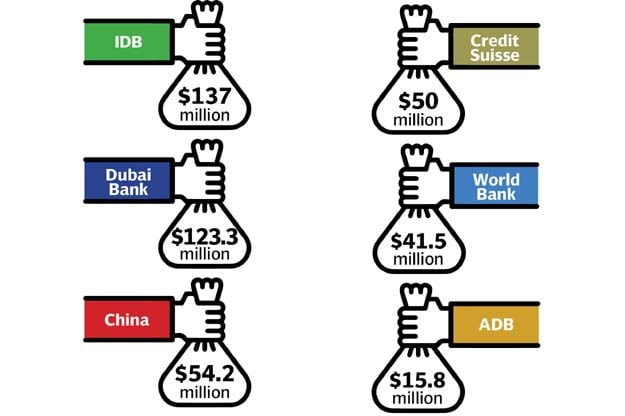

The borrowing of $440 million in July 2019 included $173.3 million in commercial loans from Dubai Bank and a consortium of Credit Suisse, said sources in the Ministry of Finance.

Unlike last fiscal year when the share of Chinese assistance was nearly half of the total disbursement, Chinese loans shrank to slightly over one-tenth of the total disbursement of $439.8 million in July, the sources said.

In the previous fiscal year, China bailed Pakistan out by placing $2 billion with the State Bank of Pakistan (SBP) and extending commercial loans of $2.6 billion.

Chinese project financing has slowed down due to completion of many CPEC schemes. Last month, China disbursed $4 million for the Orange Line Metro project and $49 million for the Havelian-Thakot Road project of CPEC. China’s total disbursement in July stood at $54.2 million.

The Mainline-I project of Pakistan Railways is the only mega scheme of CPEC that has remained unimplemented so far. Owing to the stringent conditions attached by the International Monetary Fund (IMF), the roughly $9-billion project is unlikely to be executed in the near future.

Pakistan received $173.3 million in two commercial loans from Dubai Bank and a consortium led by Credit Suisse. Both loans have been obtained at floating London Interbank Offered Rates.

Dubai Bank disbursed $123.3 million in July out of the total committed amount of $325 million. Credit Suisse disbursed $50 million out of its total commitment of $250 million.

Pakistan’s gross external financing needs are assessed at a minimum $25.6 billion by the IMF for the current fiscal year. The assessment is based on projected current account deficit of $6.6 billion in this fiscal year.

In July, Pakistan booked $579 million of current account deficit, down from $2.1 billion in the same month of previous fiscal year.

Owing to the $13.5-billion current account deficit and nearly $11 billion worth of loan repayments, Pakistan borrowed a whopping $16 billion through foreign loans in the last fiscal year aimed at avoiding default on international debt obligations and financing its imports.

As compared to the low loan disbursements by multilateral creditors in the past, last month the country received $212.2 million from them, which was nearly half of the total disbursement.

The Islamic Development Bank disbursed $137 million under the oil credit facility out of the total of $551 million.

The Asian Development Bank (ADB) disbursed $15.8 million last month. It has already approved $500 million in programme loan and the amount will be reflected in August data. The World Bank released $41.5 million last month.

World Bank official meets Shaikh

The World Bank country head on Thursday met with Adviser to Prime Minister on Finance and apprised him of the difficulties in approval of new project loans and delay in the award of contracts.

The World Bank has been raising the issue of delay in approval of projects by competent Pakistani forums. But the issue has remain unresolved that has delayed the approval of new projects besides affecting disbursements for ongoing projects.

Patchamuthu Illangovan, Country Director of the World Bank in Pakistan, also apprised the finance adviser of the visit of World Bank President David Malpass to Pakistan in the first week of November, according to a statement issued by the finance ministry after the meeting.

Illango conveyed a desire of the World Bank management to work with Pakistan to drive institutional reforms and support growth agenda of the government through any technical or financial assistance required from the bank, it added.

Illango said the World Bank could work on any financial arrangement looking at the objective need and assessment of the policy matrix as the bank was very supportive of the institutional reforms being undertaken by the government of Pakistan in different sectors of the economy.

He also briefed the adviser on ongoing discussions with the Ministry of Finance on two policy-based lending operations to provide budgetary support to Pakistan, which would be finalised by December 2019.

Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh said Pakistan was pursuing a growth-oriented programme by undertaking institutional reforms, and technical and financial assistance of the World Bank was vital for achieving various development goals in different sectors of Pakistan’s economy.

Published in The Express Tribune, August 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ