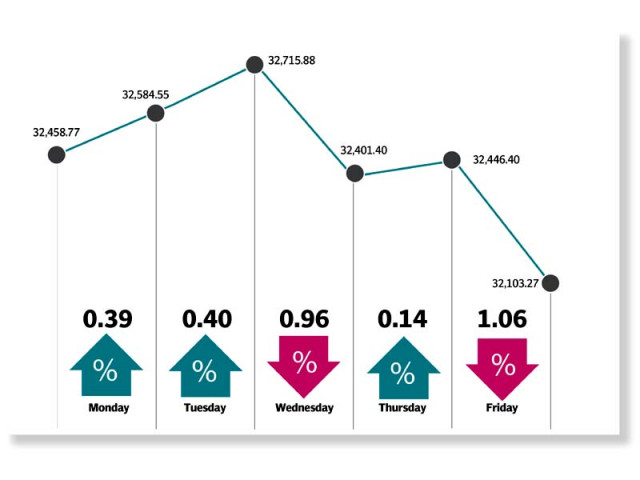

Bourse remains volatile, takes cue from political developments

KSE-100 index sheds 356 points or 1.1% to settle at 32,103

Earlier, the week started on a positive note as encouraging news continued to flow in from Prime Minister Imran Khan’s visit to the United States, where he held meetings with US President Donald Trump, key officials of the US Congress and delivered speech at a gathering of expatriate Pakistanis.

Talks covered various issues, most notably the promise of increased trade and improved relations in general between the two countries.

Market watch: Bourse recovers from hefty loss, closes little changed

As the week progressed, a downturn gripped the market. Opposition political parties staged protests on Thursday (July 25) - exactly one year after the last general elections - in most major cities of the country, denouncing recent reform measures of the government, among other issues. The protests sparked a reversal of market fortunes, leading to a decline in the index in the last trading session.

The World Bank’s draft report, which downgraded Pakistan’s ranking on almost all fiscal management-related indicators, also contributed to the market’s fall. Moreover, the commencement of corporate result season was seen as the key reason behind the KSE-100’s weak performance. Many investors opted to remain on the sidelines amid poor macroeconomic indicators and rapid political developments in the country.

Trading activity slowed down as average daily volumes dropped 29% week-on-week to 75 million shares, while average daily traded value decreased 13% to $21 million. In terms of sectors, negative contribution was led by power generation and distribution companies (down 71 points), food and personal care products (66 points), oil and gas marketing companies (49 points), cement (39 points) and tobacco (27 points).

Stock market gains 117 points in volatile week

Stock-wise, the negative contribution came mainly from Hubco (down 48 points), Engro (47 points), Nestle (31 points), Mari Petroleum (31 points) and Pakistan Tobacco (27 points). Foreign buying was recorded during the outgoing week as well, which was valued at $8.4 million compared to net buying of $6.4 million last week. Buying was witnessed in commercial banks ($5.6 million) and cement companies ($2.3 million).

On the domestic front, major selling was reported by mutual funds ($13.4 million) and companies ($1.2 million).

Other major news of the week included OGDC making a fresh oil and gas discovery in Sindh, the Asian Development Bank (ADB) approving $50 million in additional contribution to the Credit Guarantee and Investment Facility (CGIF), power tariff staying high on increase in capacity payments, no new tax on bike and rickshaw being imposed as announced by the Federal Board of Revenue and banks likely to pay higher tax on income from papers.

Published in The Express Tribune, July 28th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ