Foreign direct investment halved to $1.73b in FY19

It had been at $3.47 billion in preceding fiscal year 2017-18

DESIGN: CREATIVE COMMON

FDI stood at $3.47 billion in the preceding fiscal year 2017-18, the State Bank of Pakistan (SBP) reported on Monday.

“Uncertainty regarding the (rupee-dollar) exchange rate adjustment and finalisation of IMF (International Monetary Fund) programme, country’s vulnerable external and fiscal position, and downgrading of Pakistan’s credit rating by Fitch in December 2018 may have dented the investors’ confidence,” the central bank said in its third quarterly report on the state of Pakistan’s economy for fiscal year 2018-19.

Foreign investors’ confidence in Pakistan improves

Foreign investment in Pakistan failed to show an improved picture in Jul-Mar FY19 while FDI inflows remained substantially lower than last year and portfolio investment in shares at the Pakistan Stock Exchange (PSX) actually showed an accelerated outflow, it said.

The massive drop of 50% in FDI during FY19 came after a power-sector company paid off an inter-company loan of over half a billion dollars in October 2018. Moreover, telecommunication firms also paid off principal loans to parent companies abroad, according to the central bank.

“The power sector, which remained the single largest recipient of CPEC-related FDI over the last few years, witnessed an outflow of $293.7 million during Jul-Mar FY19. This was due to the repayment of an inter-company loan of around $530 million by a power entity to its parent company in October 2018,” the SBP report said.

“With regard to non-CPEC FDI, an outflow from telecommunications dragged down the overall investment during Jul-Mar FY19, as telecom firms operating in Pakistan made principal loan repayments to parent companies abroad.”

Selective investment up

On a positive note, some other sectors, including chemical, beverages and automobile were on the investors’ radar during the period under review.

“A few automakers have now started investing in Pakistan, following the incentives announced under the Automotive Industry Development Policy 2016-21,” the central bank said.

Sector-wise FDI

The oil and gas exploration sector attracted the largest net FDI worth $308.8 million in FY19 compared to $372 million in the previous fiscal year 2017-18.

The financial business sector drew the second largest net FDI of $286.5 million in FY19 compared to $400.3 million in FY18.

The coal-fired power sector, however, recorded divestment of $453.2 million during FY19 compared to investment of $769.8 million last year.

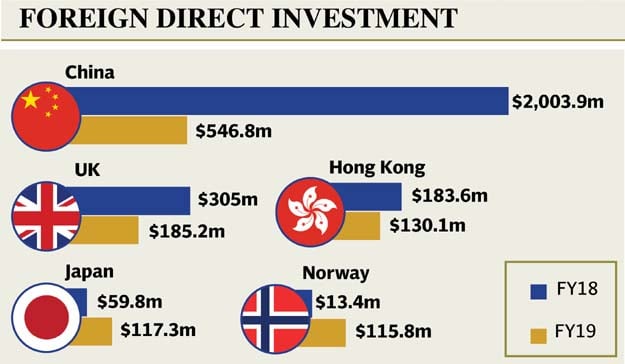

Country-wise FDI

China remained the largest foreign investor in Pakistan as it poured a net $546.8 million in the year ended June 30, 2019. This was, however, almost one-fourth of over $2 billion which the world’s second largest economy invested in the previous fiscal year.

The United Kingdom was the second largest investor with net FDI of $185.2 million in FY19 compared to $305 million in the previous year.

Chinese firms assure PM of $5bn investment in Pakistan

Portfolio investment down

Foreign portfolio investors accelerated divestment in shares listed at the Pakistan Stock Exchange (PSX) as they divested $415.2 million in FY19 compared to $240.7 million in FY18.

This was the fourth consecutive fiscal year in which foreign portfolio investors remained net sellers at the country’s bourse mainly due to an uncertain rupee-dollar exchange rate. They have cumulatively divested over $1 billion in four years.

Total foreign investment stood at a meagre $329.9 million in FY19 compared to $5.68 billion in FY18. The massive drop came after the country floated the Eurobond and Sukuk worth $2.45 billion in FY18 and retired debt worth $992 million against a maturing Eurobond in FY19.

Published in The Express Tribune, July 16th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ