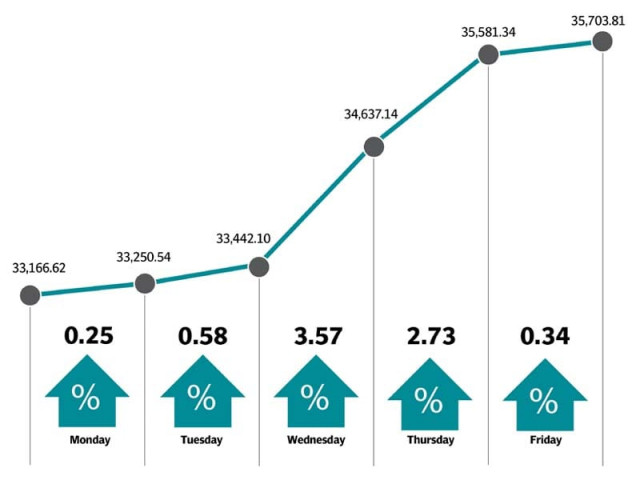

Weekly review: KSE-100 rises 7.65%, posts highest weekly gain in a decade

Investors resumed stock buying at attractive valuations following clarity on different issues

Weekly review: KSE-100 rises 7.65%, posts highest weekly gain in a decade

The last highest weekly gain in a decade came in the first week of April 2009, when the index surged 9.1%, according to Topline Securities.

Investors resumed buying with renewed vigour as clarity emerged on a variety of longstanding issues. The recent hike in policy rate by the central bank and creation of a support fund for the Pakistan Stock Exchange (PSX) fuelled the rally.

Monday witnessed an extremely volatile ride as the index oscillated sharply between red and green zones. However, despite a massive drop during intra-day trading, the index managed to make a decent recovery.

Investor confidence was bolstered following Adviser to PM on Finance Hafeez Shaikh’s meeting with PSX officials. The adviser assured brokers of creating a support fund for market stabilisation, which was largely responsible for the bullish trend.

The market expected a fund size of Rs17-20 billion, similar to the one launched in 2009, which may invest in government-owned companies in upcoming weeks.

Moreover, the approval of a deferred oil payment facility of $3.2 billion by Saudi Arabia, which will ease pressure on the balance of payments and foreign exchange reserves, added to the positive momentum. Resultantly, investors jumped in to buy stocks at attractive valuations, which pushed the benchmark index higher.

Investor participation jumped significantly as average daily volumes for the outgoing week went up 66% to 178 million shares while the average traded value surged 44% to $40 million.

Positive contribution to the index was led by fertiliser companies (up 524 points), commercial banks (494 points), cement manufacturers (314 points), oil and gas marketing companies (273 points) and oil and gas exploration companies (273 points).

Stock-wise major gainers were Engro (up 172 points), Lucky Cement (167 points), Fauji Fertiliser Company (157 points), PSO (136 points) and Pakistan Oilfields (120 points).

Foreign buying continued during the outgoing week as well, which came in at $0.02 million compared to net buying of $8.21 million last week. Major buying was witnessed in cement stocks ($2.19 million) and commercial banks ($1.44 million).

On the local front, selling was reported by insurance companies ($6.01 million) followed by mutual funds ($5.64 million).

Major news of the week included Hafeez Shaikh reaching out to brokers amid market turmoil, the State Bank jacking up interest rate by 150 basis points to 12.5%, current account deficit going down 27% to $11.5 billion in July-April FY19, fiscal deficit jumping to 5%, revenues remaining flat, Saudi Arabia giving Pakistan $3.2-billion deferred payment facility on oil supply from July, and foreign exchange reserves falling to $15.1 billion.

Published in The Express Tribune, May 26th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ