Jul-Apr FY19: Oil sales drop 24% to 15.3m tons

Fall comes due to slowdown in economic activity

Fall comes due to slowdown in economic activity. PHOTO: FILE

Declining reliance on furnace oil-fired power plants, especially during the winter season, also contributed massively in reducing the use of the petroleum oil nationwide during the period under review.

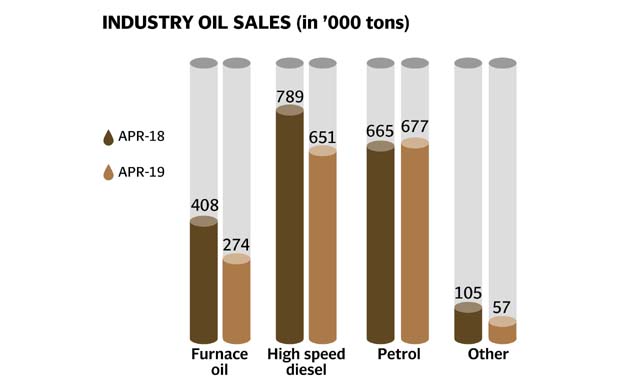

The breakup suggested that furnace oil sales dropped 57% to 2.5 million tons in the 10 months compared to 5.6 million tons in the same period last year. Similarly, sales of high speed diesel (HSD), which is mainly used in LSM sector, fell 19% to six million tons compared to 7.5 million tons.

However, the sales of petrol (motor gasoline) improved 3% to 6.2 million tons compared to six million tons in the same period last year. In April alone, the total oil sales declined 11% to 1.7 million tons compared to 1.9 million tons in the same month of last year.

On a month-on-month basis, the sales surged 14% mainly due to restarting of oil-fired plants during the current summer season and uptick in high speed diesel ahead of the fasting month of Ramazan as people prepare to celebrate one of the biggest Muslims’ festivals, Eidul Fitr.

“The upcoming holy month of Ramazan may have been a crucial factor in the 14% month-on-month uptick in sales,” JS Research said in a commentary.

Oil rally pauses with focus on supply direction

Company-wise sales

The country’s single largest oil marketing company (OMC), Pakistan State Oil (PSO), was ahead of the curve with a 17% month-on-month surge in total sales, “mostly on the back of a 69% increase in furnace oil (FO) sales,” it said.

The state-owned OMC also saw a 12% month-on-month boost in HSD sales - the largest in the industry - most likely because of its vast retail network.

Attock Petroleum Limited (APL) witnessed an 8% month-on-month increase in total sales as FO and petrol sales increased by 32% and 9%, respectively.

Hascol Petroleum Limited sales remained flat at 123,000 tons on month-on-month basis. Shell Pakistan Limited (Shell), the second largest OMC by retail network, managed to increase its sales by 7% month-on-month, it said. In April 2019, PSO continued to hold a significant 44% of the total POL market share while APL came in second place with 10% of the share. As Shell catered to 8% of total demand, Hascol cut its market share down to 7%.

Published in The Express Tribune, May 7th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ