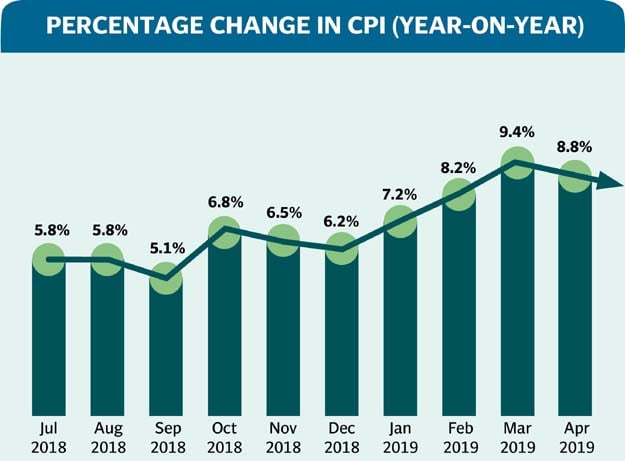

Inflation slows down to 8.8% in April

Two closely watched indices slip, could weaken IMF’s case for discount rate hike

A shopping cart is pushed down the aisle in this REUTERS photo illustration.

The headline inflation also slowed down to 8.8% in April, the Pakistan Bureau of Statistics (PBS) reported on Thursday. The pace of increase in prices of goods and services had been recorded at 9.41% in March over a year ago, which raised the spectre of stagflation in the country.

Core inflation - non-food and non-energy index - that in March stood at 8.5% receded to 7% - declining for the second consecutive month, albeit at a faster pace this time.

The April reading of headline inflation as well as core inflation was largely in line with government’s expectations. However, it was more because of a high base effect than any easing of inflationary pressures. This was reflected in the core inflation, which increased 1% month-on-month - double the pace than a month ago.

The State Bank of Pakistan (SBP) takes monetary policy decisions keeping in view the year-on-year core inflation. It last raised the key discount rate by 50 basis points to 10.75% with effect from April 1. However, some called the decision untimely and said it was apparently taken under IMF influence.

The central bank has cumulatively increased the interest rate by five percentage points since January last year aimed at curtailing aggregate demand in the economy.

The IMF has long been pressing Pakistan to increase the interest rate to near 14% in order to curb inflation, which the Fund believes will be in double digits due to hefty currency depreciation and the possibility of imposition of more taxes.

Pakistan has expressed its willingness to keep the inflation-adjusted interest rate positive. In March, the real interest rate was positive by 2.25%. But after the deceleration last month, the real interest rate became positive by 3.75%. The development came at a time when the IMF again sought a further hike in interest rate keeping in mind the implications of further currency depreciation and slapping of new taxes.

The next monetary policy announcement is expected by the end of current month, which will indicate whether the central bank is toeing the IMF line or not.

During a staff-level IMF visit that ended inconclusively in November, the lender predicted that inflation in Pakistan would hit 14%. The IMF has long been advocating tight monetary and fiscal policies to slash aggregate demand in a bid to restore macroeconomic stability in Pakistan.

Presumably, the positive gains of the increase in interest rate have been nullified by currency depreciation and expansionary fiscal policies.

Average inflation in first 10 months (Jul-Apr) of the current fiscal year rose 7% over the same period of last year. The average inflation is above the government’s annual target, but is close to the range given by the central bank.

In the CPI, prices of the housing, water, electricity and gas group increased 10.1% in April over a year ago. The group has 29.4% weight in the overall inflation basket - the second largest group after food.

The perishable food group recorded a surge of 23.6%, transport fares increased 14.5% on average on the back of a hike in fuel prices.

Tomato prices remained elevated and there was on average 124% increase in its rates in April over a year ago. Onion rates jumped over 36%, followed by 26% increase in prices of moong pulse. Vegetable prices jumped nearly one-fourth while fruits became expensive by 16% in April.

Motor fuel rates surged nearly one-fifth last month, which led to a 13.3% increase in transport services. House rent increased 6.4% in April over a year ago.

Published in The Express Tribune, May 3rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ