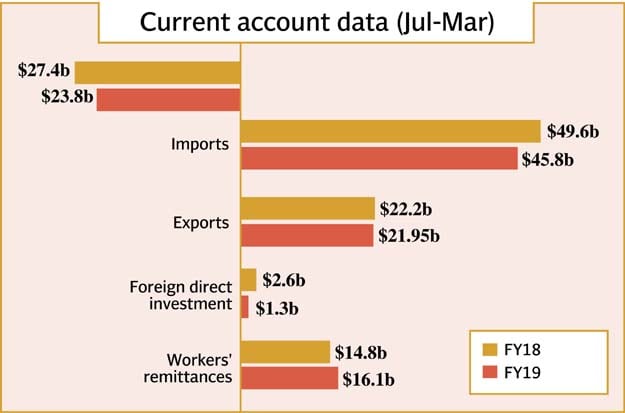

Pakistan's current account deficit contracts 29.5% to $9.6b

Drop comes on account of decrease in imports and rise in remittances

Representational image. PHOTO: REUTERS

The current account deficit stood at $13.6 billion in the same period of previous year, the State Bank of Pakistan (SBP) reported on Thursday.

On average, the deficit has dropped to $1.06 billion a month so far in the current fiscal year compared to $1.5 billion a month in the corresponding period of last year.

The central bank said import of goods shrank 5% to $39.3 billion in Jul-Mar FY19 compared to $41.4 billion in the same period of last year.

“Imposition of regulatory duty on the import of hundreds of goods and massive depreciation of the rupee against the US dollar and other major currencies made the imports expensive. Consequently, the aggregate demand for imports decreased,” Emerging Economics Managing Director Muzammil Aslam told The Express Tribune.

The central bank has let the rupee depreciate by 16.4% to Rs141.39 to the US dollar in the current fiscal year compared to Rs121.49 on June 29, 2018.

Moreover, a significant reduction in the government’s development budget - called the Public Sector Development Programme (PSDP) - and completion of Early Harvest projects under the China-Pakistan Economic Corridor (CPEC) also caused a drop in import of machinery and equipment, he said.

The drop in import of goods also caused a decrease in the import of services by 21.7% to $6.5 billion in Jul-Mar FY19 compared to $8.3 billion in the same period of last year. “Pakistan has paid less for insurance in line with the drop in import of goods. This has helped reduce the import of services,” he said.

Remittances from overseas Pakistani workers surged 9% to $16 billion in the first nine months of FY19 compared to $14.8 billion in the same period of last year, the central bank said. “The growth in remittances came after financial institutions and government officials stepped up efforts to give a push to inflows,” a banker said recently.

“The State Bank of Pakistan (SBP) and National Bank of Pakistan (NBP) have taken several measures, including the offer of cash reward on receipt of remittances through legal channels. Apart from this, a crackdown has been launched on illegal hawala/hundi operators and action taken against dollar hoarders…these all are positive steps to attract higher remittances,” a state-owned bank official dealing in worker remittances said.

However, the foreign direct investment (FDI) dipped 51.5% to $1.3 billion in first nine months of FY19 compared to $2.6 billion in the same period of previous year.

“The drop in foreign investment comes as the local currency (rupee) remains in an adjustment phase against the US dollar, which does not suit foreign investors,” he said.

Month-on-month deficit soars

Contrary to the notable drop in current account in the first nine months, the current account deficit soared 195% to $822 million in March compared to $278 million in February.

Aslam said likely interest payments against the huge accumulated foreign debt would have pushed the current account deficit sharply higher in March.

“Pakistan was to pay interest at the end of Jan-Mar 2019 quarter. Pakistan’s foreign debt has surged to $90 billion as of now,” he said.

The central bank said the balance of trade in goods and services rose 32.8% to $2.3 billion in March compared to $1.8 billion in February.

Published in The Express Tribune, April 19th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ