Accountability court summons Zardari, Talpur on April 8

Development comes after Karachi's banking court accepted NAB request to transfer case to Islamabad

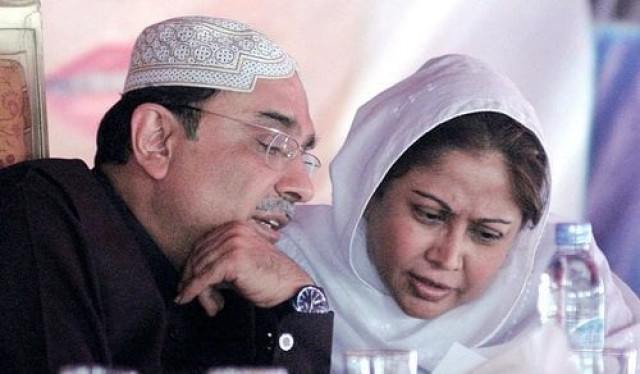

Former president Asif Ali Zardari and his sister Faryal Talpur. PHOTO: APP

PPP’s top leadership, Omni Group’s Anwar Majeed and his son Abdul Ghani Majeed, former Pakistan Stock Exchange chairperson Lawai, Summit Bank Senior Vice-President Taha Raza are among those being investigated by the Federal Investigation Agency (FIA) and the anti-graft watchdog separately. The matter is also being heard by the Supreme Court.

The development comes after a Karachi banking court accepted the National Accountability Bureau (NAB) request to transfer the fake accounts case to Islamabad.

The bureau filed the transfer appeal following the Supreme Court’s decision in the case wherein the joint investigation team (JIT) report and evidence collected was transmitted to the bureau for further investigations.

The case will be heard by accountability court Judge Muhammad Arshad Malik.

Money laundering case: Zardari, Talpur get 7th bail extension

The fake accounts saga

Information regarding the fake accounts came to the fore when an intelligence agency picked up a prominent money changer in an unrelated case. In December 2015, the Federal Investigation Agency (FIA) began a discreet investigation into certain bank accounts through which multi-billion rupee transactions have been made.

Investigators have so far identified 29 accounts which received payments, totalling at least Rs35 billion. The probe was initially shelved, but resumed almost a year and a half later with FIA’s State Bank circle initiating a formal inquiry in January, 2018. By June, the FIA had several high-profile names on its list but was unable to make headway–for several reasons.

It was at his point that the Supreme Court intervened and then chief justice Mian Saqib Nisar took suo motu notice of the ‘slow progress’ in the money-laundering case. In July, Zardari’s close aides Hussain Lawai, Taha Raza and two others were arrested. Subsequently, the first case was registered in the mega-corruption scandal.

The then chief justice ordered the formation of a joint investigation team to quicken the pace of the investigation. The JIT identified 11,500 bank accounts and 924 account holders at the start of their investigation. After the JIT report, the names of 172 individuals were placed on the no-fly list by the interior ministry.

Top court orders Bilawal, Shah’s names off ECL

The JIT report in a nutshell

According to the report, the JIT identified 11,500 bank accounts and 924 account holders at the start of their investigation.

Its experts generated 59 Suspected Transaction Reports (STR) and 24,500 Cash Transaction Reports. That means the transactions were flagged as suspicious.

Due to the high quantum of transactions, the JIT decided on a threshold of Rs10million “to track, follow and minutely investigate the flow of funds beyond the immediate counterparties and determine the source of funds and ultimate beneficiaries.”

It questioned 767 individuals, including Zardari and Talpur, while Bilawal submitted written responses.

It has since had the names of 147 individuals placed on the Provisional National Identification List, which would allow authorities to identify if those individuals try to enter or exit the country through an airport. After the report was submitted to the SC, the names of 172 individuals have been placed on the no-fly list by the interior ministry on the JIT’s request.

The investigations have focused on 32 accounts of 11 fake entities. The first account, belonging to M/S Lucky Enterprises, opened in January 2010 and remained active till January 2017. It was used for 13,809 transactions.

Damning JIT report indicts Zardari, Omni groups

The investigation uncovered that the 11 sole proprietorship entities were registered in the names of low-level employees of the Omni Group, as well as random individuals including a deceased person. All the accounts were operated by Omni Group executives.

A thorough review of the JIT report shows that representatives of State Bank and Securities and Exchange Commission of Pakistan (SECP) played a vital role in the investigation and preparation of the final report and recommendations.

Read the full text of the JIT report here

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ