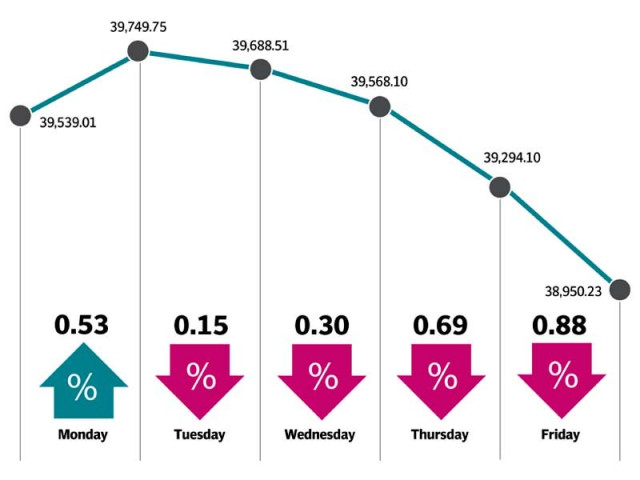

Border tensions, lack of triggers drag KSE-100 down by 589 points

Volumes decline 29% while trading value fall 35% in outgoing week

Despite the de-escalation of tensions between India and Pakistan, occasional ceasefire violations at the border continued to put the market under pressure as investors remained wary of accumulating stocks. Additionally, a lack of positive triggers also contributed to lacklustre trading during the week.

Even the approval of Finance Supplementary (Second Amendment) Bill 2019 by the National Assembly failed to lift sentiments of market participants.

Following relative calm at the weekend along the Pak-India border, the KSE-100 index traded in the green zone at the start of the week, continuing its winning streak from the preceding session. However, the tables quickly turned as bears returned to drag the index lower.

The news of an Indian submarine trying to enter Pakistani waters on Tuesday caused alarm among investors, who then resorted to stock selling.

The pressure mounted as weak cues from the domestic economic front, in addition to renewed tensions with India, resulted in the index continuing its journey south in the following two sessions. The market extended its losses on last trading day of the week and dropped below the 39,000 threshold despite foreign buying.

Investor participation weakened as average daily trading volumes during the week declined 29% to 114 million shares whereas average daily traded value fell 35% to $33 million.

In terms of sectors, negative contribution came from oil and gas exploration companies (down 230 points), commercial banks (127 points), power generation and distribution companies (78 points), fertiliser producers (63 points) and cement firms (63 points).

Sectors that contributed positively included automobile assemblers (up 91 points) following grant of permission to non-filers to purchase locally assembled new vehicles as per finance bill, and investment banks, investment companies and securities companies (30 points).

Stock-wise, major laggards were Oil and Gas Development Company (down 111 points), Pakistan Petroleum (92 points), MCB Bank (84 points), Hubco (83 points) and Engro (39 points).

Foreign selling continued this week as well, standing at $3.5 million compared to net selling of $1.3 million last week. Major selling was witnessed in commercial banks ($2.6 million) and exploration and production companies ($2.6 million).

On the domestic front, major buying was reported by individuals ($5.1 million) and companies ($3.5 million) while mutual funds offloaded stocks worth $10.6 million.

Among major highlights of the week were PSO receiving Rs60 billion from power-sector companies, Atlas Honda and Yamaha increasing bike prices, government likely to remove 4% super tax levied on banks, Chinese companies committing $2 billion to the PM housing project and issuance of orders for setting up a third LNG terminal on a fast track.

Published in The Express Tribune, March 10th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ