Current account deficit contracts 48% in Jan over Dec

Gap shrinks to $809m following a notable rise in exports

Representational image. PHOTO: REUTERS

The deficit fell by half to $809 million in January compared to $1.54 billion in the previous month of December 2018, the State Bank of Pakistan (SBP) reported on Thursday.

The decline, which came largely in line with expectations, has eased the pressure on the country’s dwindling foreign currency reserves and has improved its import payment and debt repayment capacity.

“The market was expecting a drop of around $1 billion in the current account deficit in January,” remarked Arif Habib Limited Head of Research Samiullah Tariq while talking to The Express Tribune. “The larger drop was anticipated after the deficit unexpectedly surged in the previous month of December 2018.”

Exports of goods from Pakistan increased 15% to $2.3 billion in January 2019 compared to $2 billion in December 2018.

“Exports, especially of textiles, have improved with the drop in temperature in trading partners in the West and with support of the government, which has provided a number of incentives to revive exports in recent months,” commented Taurus Securities’ analyst Mustafa Mustansir. “Exports may increase further with more chilly weather in the West.”

Mustansir recalled that the government gave a subsidy of Rs44 billion on imported liquefied natural gas (LNG) supply to export-focused industries in Punjab in a bid to keep uniform fuel prices across the country. It also provided subsidised loans and let the rupee depreciate by a significant 32% against the US dollar since December 2017.

“Industries have significantly increased borrowing from banks to run their day-to-day operations smoothly. The trend also suggests exports will improve further going forward,” he said.

Besides, the fall in current account deficit was also supported by a slowdown in the import of goods in January. Imports decreased 3.4% to $4.42 billion in the month compared to $4.57 billion in December 2018, according to the SBP.

Worker remittances, which have been extending much-needed support to restricting the deficit in previous months, remained flat at $1.74 billion in January.

Mustansir said the ongoing financial difficulties in Middle Eastern countries, like Saudi Arabia and the UAE, where majority of the overseas Pakistanis live, may have been a reason behind the flat remittances in the month.

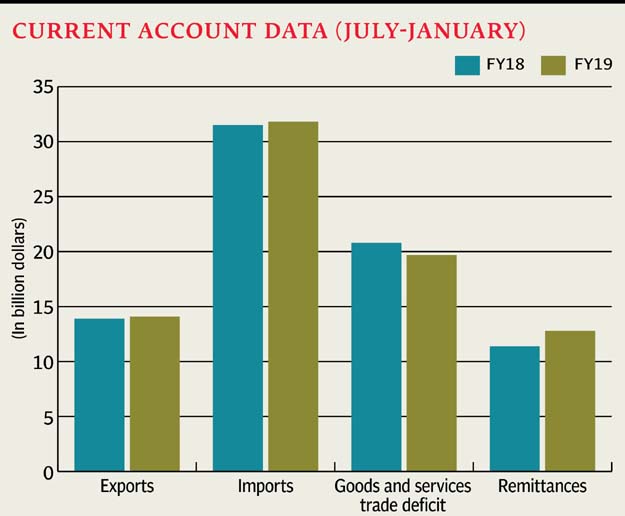

Seven-month data

Cumulatively, in first seven months (July-January) of the current fiscal year, the current account deficit declined 17% to $8.42 billion compared to $10.12 billion in the same period of previous year, according to the SBP.

The drop came mainly due to a notable growth in worker remittances and a significant drop in import of services.

“The import of services has gone down due to a drastic reduction in international traveling expenses,” Tariq said.

The import of services fell 18% to $5.16 billion in Jul-Jan FY19 compared to $6.31 billion in the same period of previous year, the central bank reported.

Worker remittances increased 12% to $12.77 billion in Jul-Jan FY19 compared to $11.38 billion in the same period of previous year.

Published in The Express Tribune, February 22nd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ